As we see consumer-grade devices becoming increasingly more ruggedised with many high-end devices now being IP68 certified is there any need for field service companies to continue to invest in more expensive equivalents offered by specialist rugged...

ARCHIVE FOR THE ‘features’ CATEGORY

Apr 10, 2018 • Features • Hardware • Jackson White • Xplore • Getac • hardware • janam • Robert Hurt • rugged • Tom Kost

As we see consumer-grade devices becoming increasingly more ruggedised with many high-end devices now being IP68 certified is there any need for field service companies to continue to invest in more expensive equivalents offered by specialist rugged manufacturers?

As high-end consumer units become better rated (for example high-end Samsung phones have been IP68 for some time now) the question arises will rugged eventually die out as a category of mobile devices?

Tom Kost, Director of Product Marketing at Xplore Technologies is someone that firmly believes this won’t be the case.

As high-end consumer units become better rated the question arises will rugged eventually die out as a category of mobile devices?“Absolutely not,” he states. “There are dozens of companies offering what they call “rugged” devices and hope that those 6 letters will win the sale. Yet, a mobile device that claims to offer rugged protection via the addition of a Gorilla Glass screen or external rubber casing will never come close to offering the protection, power and performance of a device that’s engineered to be rugged to the core.”

“Simply making an otherwise fragile consumer device waterproof or dustproof (IP68-rated) does not make it a viable option for heavy field use, as “consumer rugged” brands want you to believe. Water and dust are not the only hazards threatening device reliability, data security or even worker safety, all of which matter to field service organizations. Deeming a tablet, laptop or handheld PC that will be used in professional environments as “rugged” using a single spec is not just risky, but irresponsible,” he asserts.

Jackson White, Business Development Director at Getac takes a slightly more measured approach to the relationship between consumer and rugged devices.

“Consumer and rugged device manufacturers are learning from each other and the categories certainly are converging,” he argues.

Consumer devices are becoming thinner, lighter and faster and industry is now demanding a more consumer-like experience with the aim of achieving better communication and productivity in the field.“Consumer devices are becoming thinner, lighter and faster and industry is now demanding a more consumer-like experience with the aim of achieving better communication and productivity in the field.”

However, he to feels that when it comes to professional use in the field rugged manufacturers still provide the better solutions.

“While everyday consumers would undoubtedly benefit from their devices being waterproof, off the shelf consumer devices would not survive the rigours of an eight hour plus shift for a three year period for field service professionals,” he comments.

“We’re seeing rapid innovation from rugged manufacturers where they’re focused on reducing size, weight (through the use of composite materials, for example) and power consumption, all while retaining rugged characteristics.”

“Rugged devices used by field workers not only have to withstand drops, shocks, vibrations, spillages and in some instances, chemicals, but they also need to provide data security and the power and battery life needed to ensure a reliable experience, allowing organizations who have digitized their processes to benefit from gains in efficiency and productivity.”

“Devices designed for mobile workers use batteries which are more powerful and can last eight to 10 hours. Connectivity is better with optimized antennas, so field service personnel can access and input data quicker, and more efficiently.

Touchscreen technology has dramatically improved, for example, Getac’s proprietary Lumibond® technology allows screens to be easily read in both very bright and dull environments, and used with finger, gloves and protective clothing, or stylus, even in the rain.”

Rugged accounts for 28% of enterprise device access, according to ‘CCS Insights IT Decision Maker Mobile Technology Survey, 2016’, and this number rises to 50% in industries such as construction, transportation and utilities.

These thoughts are also echoed by Robert Hurt, General Manager, EMEA with Janam.

Rugged on its own, is not enough in a real-world field service environment. True ruggedness is not just about IP ratings or rigorous testing “Rugged on its own, is not enough in a real-world field service environment. True ruggedness is not just about IP ratings or rigorous testing to ensure it can withstand frequent drops, tumbles and shocks across a wide temperature range. Rugged mobile computers offer features that enable the device to optimally perform well beyond the life expectancy of a consumer-grade device,” he adds.

“Features like reinforced displays to prevent breakages, large capacity and/or removable batteries and robust radios to provide secure and reliable connectivity and seamless roaming, have a positive impact on productivity and the bottom line.”

“If an organization requires data capture, a consumer device will not provide true barcode scanning technology. While a smartphone camera can scan a barcode, it doesn’t provide the same performance you receive from a scan engine, and certainly will disappoint when it comes to reading damaged or poorly printed barcodes.”

“Rugged smartphones have a short lifecycle and are not designed to last several years in a business environment. Purpose-built rugged mobile computers offer longer-term investment protection, backed-up by multi-year service plans to get you back up and running quickly if a unit does get damaged. At the end of the day, a rugged smartphone cannot replace a rugged mobile computer that was specially designed to run line-of-business applications in the enterprise.”

The point around device life expectancy is, of course, a valid one, especially when we consider the mission-critical importance of field service operations. However, with the price of consumer units, especially from regions like China, becoming so much lower than a rugged device – could a case be made for adopting an approach whereby organizations simply stock up on additional cheaper units as back up rather than fewer more reliable, but more expensive rugged units?

“First off, a “rugged” tablet that is far less expensive that its competition is most likely far less rugged,” comments Kost.

“Consider the resources it will require to replace knock-off “consumer rugged” devices when they fail (and they will) along with the downtime losses that will occur while that worker is offline. This isn’t just about the sticker price of the replacement device, either. You have to factor the cost of labour required to re-order, re-configure, re-secure and redeploy the new device, all while your field worker is “down” and customers aren’t serviced.”

“Multiply that by 100 or 10,000 employees and you’ll see how hard it is to justify the few hundred dollars you may save per device up front on a “cheaper” device. Then factor the costs related to deploying the right workflow software, compatible accessories, and ultimately the security and maintenance of the entire mobility/IT solution for 3-5 years.”

It’s risky to do an upfront cost comparison for consumer and rugged mobile devices; rather businesses need to take a long-term view of total cost of ownership for a deviceWhite also concurs with this premise.

“It’s risky to do an upfront cost comparison for consumer and rugged mobile devices; rather businesses need to take a long-term view of total cost of ownership for a device,” he says.

“Despite generally being cheaper at the offset, consumer devices will quickly fail in environments outside of the office, which not only leads to higher replacement and service costs, but also to inefficiencies, disruptions in productivity, penalties from missed service level agreements but most importantly end-user frustration and loss of confidence in systems and process. While consumer devices tend to have a usable life of around 18 to 24 months, in testing field environments, this could be as short as a few weeks.”

“Rugged devices are built to last. For example, Getac devices are built from the ground up and components are assured for up to five years. In the unlikely event of damage, it offers a ‘bumper-to-bumper’ accidental damage warranty free of charge.”

“VDC recently reported that consumer devices are 3x more likely to fail within the first year,” adds Hurt.

“We’ve worked with many customers that initially deployed consumer-grade devices. After 6-12 months they came to us because the devices couldn’t survive – and the downtime and repair costs of the consumer device quickly ate up the initial savings associated with deploying a smartphone. Not only did these customers experience crippling downtime, but they couldn’t get the same level of service and support that comes with purchasing and deploying a rugged mobile computer.”

“Cheaper devices don’t offer all the features and functionality enterprises require, nor do consumer manufacturers offer the same range of optional accessories workers need to support various applications,” he adds.

You may pay a bit more in the short term for a purpose-built device, but you save in the long term when you take into consideration the costs associated with device downtime and frequent replacement costs“You may pay a bit more in the short term for a purpose-built device, but you save in the long term when you take into consideration the costs associated with device downtime and frequent replacement costs when the consumer device simply can’t survive the rigours of the enterprise.”

With this in mind, it would appear that whilst having hardware that is fit-for-purpose is an important factor in why field service organizations continue to turn to rugged manufacturers, the true value in working with an enterprise level hardware provider is as much about their understanding of your workflows and needs as it is about their hardware.

“Many technology resellers and OEMs are simply going to deliver a package to your door and walk away, leaving you to figure out the “solution”. That’s why you must partner with a true enterprise-level mobile solution provider that understands the specialized needs of your industry and business and knows how to overcome common pain points,” Kost comments.

“They can expertly identify which mobile components are compatible with your current IT environment. And, they are best-equipped to integrate the entire mobility solution in a way that bridges legacy and future systems without disrupting workers and workflows. For example, at Xplore, we think beyond the platform to ensure every component of our rugged mobility solutions – from the core of the rugged computer to the mounting hardware, connectivity, security, software and accessories – is compatible with customers’ other tech systems and complementary to workers’ existing business processes and the physical work environment.”

It is this ability to understand workflows that White believes is the key differentiator between consumer and specialist providers also.

“Rugged manufactures can add value by having a deep understanding of specific industry workflows practices and process. It’s also important for them to work closely with customers to understand individual requirements so devices can be customized accordingly,” he comments.

Hurt is also on the same page here as well. “Companies like Janam work closely with a broad range of customers, resellers and ISVs and understand the requirements to support workflows across industries. We specially design our devices to survive all day, everyday use in tough environments. We work closely with our customers to deliver a device that meets the specific needs of their organization, as we understand that the consumer “one size fits all” model doesn’t work for companies running demanding line-of-business applications.”

However, making the decision to opt for rugged devices over consumer is only the first step in identifying the devices right for your field engineers. The rugged sector, though niche, remains highly competitive. So what should a company look for in a rugged hardware provider?

“You need to choose a solution provider that not only has the technology, but the resources, agility and know-how to quickly solve your complex business problems,” explains Kost.

You need to choose a solution provider that not only has the technology, but the resources, agility and know-how to quickly solve your complex business problems“You should never feel as though the hardware provider is trying to shoehorn in a device, and be wary of those that push ‘one-size-fits-all’ mobile computers or mobility bundles. Also, confirm platform expandability. Ensure the device can support OS, storage and memory upgrades. This provides operational flexibility and extends the life of the current software, security, and back-office systems, lowering the cost of IT training/support.”

“Businesses should consider a number of factors when choosing a hardware provider to work with,” comments White.

“Sector knowledge and experience with the ecosystem associated with the device are key as is the ability to customize and tailor devices. Warranties and after sales care are also extremely important,” he explains.

“It’s also important to find a hardware provider that is interested in a long-term partnership – not a quick sale,” Hurt adds. “We find customers want to work with someone that picks up the phone and is there to help resolve issues in real-time. Downtime equals frustration and loss of revenue – so look for a supplier who will be on hand, with local service, for the quickest turnaround.”

“Lastly, look for a hardware provider that works exclusively with best-of-breed partners that share a commitment to integrity, flexibility and responsiveness, especially when so many providers have lost sight of these vital attributes,” he concludes.

Be social and share

Apr 10, 2018 • Features • Darren Halliwell • FLS • FLS Mobile • FLS VISITOUR • microsoft dynamics • Case Studies • Chris Welsh • fast lean smart • Software and Apps

Key Retirement Group (KR Group) have implemented FLS VISITOUR optimised appointment booking and scheduling software from Fast Lean Smart for their field-based advisors.

Key Retirement Group (KR Group) have implemented FLS VISITOUR optimised appointment booking and scheduling software from Fast Lean Smart for their field-based advisors.

Results achieved have included attending appointments sooner, reducing mileage and travel, and increased capacity to attend more appointments per Advisor.

Darren Halliwell, Chief Technology Officer at KR Group explains “Our process for arranging customer visits was laborious and often made poor utilisation of Advisors time. Our key focus is to attend appointments in a timely manner that supports our customer needs via a two-stage face-to-face process; a first meeting and then follow-ups. For this to be achieved with the same Advisor often caused ineffective use of resources and delays to other potential customer visits.”

Selection of FLS and No-Commitment Trial

Darren continues “We chose to work with FLS as we had confidence in their offering and approach to proving the benefits with relatively low investment of both time and resource. They were initially recommended by a Microsoft Dynamics partner due to their expertise working with CRM and we were impressed with the feedback from reference customers they provided.”

The results were compelling and KR quickly decided to take advantage of the FLS offer of a SaaS “try before you buy” live system trial.Working together, KR Group and FLS completed an initial scheduling test using FLS VISITOUR and historical data to compare with their current process. The results were compelling and KR quickly decided to take advantage of the FLS offer of a SaaS “try before you buy” live system trial.

The agile implementation approach meant the trial could be live within 2 weeks. The trial immediately showed positive results and was extended from the North-West region to include London which had different travel challenges.

“Though the trial was not a fully integrated system, we quickly began to realise the advantages that FLS VISITOUR offered for cost and efficiency savings and, most importantly, in terms of customer convenience and satisfaction. The benefits achieved, including quicker response times, higher appointment availability and reduced travel costs, led to the whole business wanting to positively embrace FLS VISITOUR for our face-to-face Equity Release Advisors and with real potential for other areas of the business”.

FLS VISITOUR and Microsoft Dynamics Integration

Through the successful trial, KR Group had the reassurance of knowing their ROI and end results were as expected and the decision was made to deploy as soon as possible.

FLS worked with KR Group’s Microsoft Dynamics partner and within a few weeks the integration between FLS VISITOUR and Microsoft Dynamics was live and the solution rapidly rolled out to all users. The Call Centre was consequently able to operate purely with Dynamics to manage appointments while allowing team managers to use FLS VISITOUR’s advanced scheduling and route optimisation features.

Field-based follow-up appointment booking with FLS MOBILE

As a second phase of the rollout, FLS VISITOUR’s mobile app was put in place for field-based advisors meaning they could offer the follow-on appointment at the conclusion of the first, confident in the knowledge that their time would still be used efficiently with the least possible travel and cost, while meeting the needs of the customer they are with at the time.

The Results!

Darren concludes “The integration and implementation project was an excellent success and has delivered our objectives.

We have a more efficient team delivering lower cost appointments with increased flexibility for customer convenience and satisfactionWe have a more efficient team delivering lower cost appointments with increased flexibility for customer convenience and satisfaction. The VISITOUR technology does exactly what was proposed to us and we have built an excellent working relationship with FLS. I would not hesitate to choose the same solution if starting again.”

Chris Welsh, UK Sales Director for FLS comments “It has been very pleasing to work with Key Retirement and hear such positive feedback from management, call centre and field users alike. Optimised appointment booking and real-time scheduling is not just for engineers and this is a great case in point.”

Be social and share

Apr 09, 2018 • Features • copperberg • Field Service Summit • service supply chain • Thomas Igou • Parts Pricing and Logistics

Ahead of the forthcoming inaugural Spare Parts Summit being held in Warwick, UK on April 12th, Field Service News Editor-in-Chief, Kris Oldland talks to Thomas Igou, Content Director, Copperberg about the impact the growing trend of servitization...

Ahead of the forthcoming inaugural Spare Parts Summit being held in Warwick, UK on April 12th, Field Service News Editor-in-Chief, Kris Oldland talks to Thomas Igou, Content Director, Copperberg about the impact the growing trend of servitization will have upon the spare parts sector...

In his role as Content Director with conference producer Copperberg, Thomas Igou has been at the heart of conversations in both the Field Service and Spare Parts sectors for many years now. So who better to assess how the continued trend of servitization is impacting on both sectors?

With Copperberg launching a new UK focused version of their highly respected European Spare Parts Forum I was keen to get his view of what the key issues facing those working in the Spare Parts sector were and if the introduction of outcome-based contracts would require a rethink of how manufacturers align there field service and spare parts operations.

“There are three main themes on the macro level looking at how digital transformation is impacting organisations and more importantly the service business,” explains Igou.

Most manufacturers today are going through some form of servitization process moving from a purely transactional business to a more servitized model“Most manufacturers today are going through some form of servitization process moving from a purely transactional business to a more servitized model. That creates both great opportunities but also some sizeable challenges from a spare parts perspective and then to add to those challenges there are a number of other disruptive factors in the market at the moment as well.”

“eCommerce, AI, 3D printing and so on are all necessitating transformation in the spare parts sector, which has tended to be the cash cow within a service businesses because of the purely transactional nature of the business - the customer needs the spare part, he orders it, pays for it, gets it delivered.”

“Whereas on the flip side, when you look at field service it’s actually the opposite - field service directors are looking at how to move from being a cost centre to being a profit centre, and servitization plays a role in facilitating that shift. “

“However, the impact that is being seen in spare parts operations as companies move towards an outcome-based model, is that companies actually, start to cannibalise some of their spare parts revenue - because instead of being purely transactional, spare parts orders and deliveries start being included in SLAs, so actually, you will make less money from the sale of spare parts.”

“Essentially, it is something of a contradictory development because companies have to take away from one side to add value to the other.”

As Igou mentions for the spare parts executive there are additional external challenges to be contended with as well as the internal questions being raised by outcome-based contracts. Not least of these is eCommerce.

“eCommerce is another very significant topic of conversation at the moment, especially regarding competition from China where quality is getting better and better but as Chinese organisations have access to much cheaper raw materials they are able to be far more price competitive compared to European or North American organisations,” Igou explains.

“And that is before we even get to challenges centred around pirated parts - there are even growing fears around how companies like Amazon or Google could enter the sector and take a large share of the market revenue quite easily as they have done in other industries and sectors.”

Indeed, the Spare Parts sector is perhaps facing some of its most testing times ahead, but there remain plenty of opportunities also - many of which lie in tightening up efficiencies in two of the sectors mainstay topics - pricing and logistics.

The main aim with the spare parts sector is tackling how to deliver the right part, at the right time and at the right price“The main aim with the spare parts sector is tackling how to deliver the right part, at the right time and at the right price,” Igou explains.

“Most companies are now trying to move away from the cost plus model (i.e. how much does it cost to produce the part and then adding the profit on top) towards a more value-based approach, or if a company is entering a new market, they may prefer a market-based pricing strategy. Here, of course, eCommerce is again having an impact because prices are becoming more transparent - anyone can go on eBay or the internet and see on your website how much it costs to buy a part from China compared to say Egypt and then compared to the US or Europe.”

“If you have price differences it can be awfully bad for businesses so companies are facing a need to standardise prices across the board.” “In terms of logistics, the big discussion remains centred around whether companies should have a centralised warehouse management solution (where you have one big warehouse holding all of the stock and service all of Europe) or whether they opt for a decentralised strategy, operating multiple smaller warehouses which are closer to their customers, but which cannot stock as much inventory per warehouse.”

“In addition to that, there is a new consideration emerging,” Igou adds.

”We had a great session at this year’s European Spare Parts Forum from Schneider Electric about segmenting logistics depending on customer segments. Schneider found that customers in each of the differing sectors they service have different behaviours and expectations. For example, in one industry it may be that their customers need a very rapid solution and the key issue for that industry may be availability, so their logistics channel needs to be very good and very flexible and agile.”

“Whereas, another customer segment might be more demanding of uptime or more price sensitive etc, so segmenting your service supply chain based on your customer segment and the specific needs of that sector is another consideration that is beginning to enter the conversation.”

Of course, as Igou mentions, as companies move towards outcome-based solutions there is a danger of spare parts revenue being cannibalised as part of the wider service offering.

So where does he see the future of Spare Parts Management - will it ultimately become swallowed up as a subdivision of field service operations perhaps?

“It’s a great question and one I’ve been giving quite a bit of thought to,” replies Igou when I put this to him.

Whilst yes, servitization will mean some cannibalisation of the spare parts revenue, I don’t see that it’s going to destroy the spare parts business“With some of the larger organisations that were involved at our Aftermarket Conference at the end of October last year, we saw that even with companies such as SKF and GE Healthcare, i.e. major multi-national companies who have been working towards outcome-based services for some time now, still only about a third of their customers are on outcome based contracts and these are the organisations that are really at the forefront of this shift.”

“So whilst yes, servitization will mean some cannibalisation of the spare parts revenue, I don’t see that it’s going to destroy the spare parts business. There are always going to be some customers who won’t want these long term contracts and who will be happy to continue on a more transactional type of arrangement.”

“So I think the Spare Parts business will always have that transactional element and it will always be a profit centre. There will however, perhaps be a need for establishing some different internal relationships and some different processes may need to be considered moving forwards.”

The inaugural UK Spare Parts Summit will run on the 11th of April and will mirror the highly interactive peer-to-peer format of Copperberg’s UK focused field service event The Field Service Summit.

For more information on this event visit and last minute for registration opportunities visit: www.sparepartssummit.co.uk

Be social and share

Apr 09, 2018 • Features • Industrial Cleaning Equipment Ltd • Liz Osborne • Mike Bresnihan • case study • ICE • Software and Apps • Asolvi

Industrial Cleaning Equipment Ltd (ICE) is the UK’s largest independent provider of industrial cleaning machines and associated services. Five years ago, it began using Tesseract, Asolvi's longest-standing service management product. It was a move...

Industrial Cleaning Equipment Ltd (ICE) is the UK’s largest independent provider of industrial cleaning machines and associated services. Five years ago, it began using Tesseract, Asolvi's longest-standing service management product. It was a move that caused ICE to undergo a complete operational transformation.

ICE specialises in the supply and maintenance of efficient, forward-thinking cleaning solutions and protecting clients from unplanned equipment downtime. It partners with leading manufacturers of industrial vacuum cleaners, scrubber driers, road sweepers, steam and pressure washers and combination machines to bring the latest in cleaning technology to the retail, leisure, transport and commercial sectors. An enduring commitment to service and innovation has won the company multiple awards.

A big contributor to its success is the elite company-wide service management system that underpins it: Tesseract. A big contributor to its success is the elite company-wide service management system that underpins it: Tesseract. “It’s the one database we use for everything,” says Mike Bresnihan, chief operating officer at ICE. “Our admin staff, field-based engineers, product specialists and finance teams all use Tesseract. And our customers can access it via the web or our new mobile app.”

ICE has in place the latest iteration of the Tesseract product: Service Centre 5.1. Customers notify ICE of any problems with their cleaning equipment by logging in to Tesseract’s Remote Customer Access portal. Remote Engineer Access lets field engineers generate live reports, order parts, close down maintenance jobs and raise same-day invoices from their tablets. Call Control is used to schedule drivers and engineers to collect, deliver and maintain equipment, and Parts Centre automatically manages stock levels.

A huge step up from the old system

Pre-Tesseract, ICE used a custom-built application to manage its planned and reactive maintenance work. However, the software’s functionality was extremely limited. The company couldn’t use it for invoicing, ordering parts or maintaining stock levels. Customers could log a call and write notes, but they couldn’t see how their call was being dealt with, so it did little to manage their expectations. ICE’s drivers and engineers had no access to the software; they had to fill in paper delivery notes and worksheets and post them to the office. This meant, after each job was complete, ICE had to wait a few days to update their records.

We had piles of paperwork to get through, an abundance of spreadsheets to fill in, and we often had to enter the same data multiple times“It was very chaotic,” says Liz Osborne, ICE’s HR manager and former service manager. “We had piles of paperwork to get through, an abundance of spreadsheets to fill in, and we often had to enter the same data multiple times in order to keep different departments within the company up to date.”

So ICE selected Tesseract to operationally transform the company. Today, thanks to Tesseract, ICE is virtually paperless. Its drivers and engineers use tablets, allowing Head Office to receive job updates and information in real time. Deployment is faster, manual stock-checking is a thing of the past, and accuracy of information along the service chain is vastly improved. Mike Bresnihan explains, “We’re all on one system, which means data can flow freely between each department and we have full visibility of everything that’s going on. By automating and optimising our service operation, Tesseract has given us the capacity to focus on our customers, rather than managing a system that is supposed to be managing us.”

No downtime

Tesseract is a cloud-based product that is maintained and continually honed and developed in-house by Asolvi. The biggest benefit of this for ICE is the in-built disaster recovery; if any part of the system goes down, Tesseract will seamlessly and automatically switch to another cloud environment.

Unlike the server-based system we had before, which could go down at any moment, there’s no chance of downtime with Tesseract,“Unlike the server-based system we had before, which could go down at any moment, there’s no chance of downtime with Tesseract,” says Mike. “We’re able to depend 100% on the resilience of Tesseract’s cloud and not worry about our office, our field engineers or our customers losing access to the system.”

Easier to grow

In the last two years, ICE has experienced a growth spurt. It’s acquired three previously competing companies, each of which had its own service management system. But these systems were old, driven by paper and disparate bits of software, with too many places their teams had to go to get information. As a result, all of their data was extracted and inputted into the Tesseract system, and Tesseract was rolled out across all of them.

Tesseract actually facilitated the acquisition process. Mike explains, “Tesseract gave us visibility of the new organisations really quickly, and expedited our integration with them. Inputting these companies’ data into the Tesseract system was easy, as was adding new users. Now every company in our group uses it as we do. In effect, Tesseract has made growing ICE into a leading player in the industry possible, and a far less daunting prospect than it could’ve been.”

The future: fewer silos, more integration

ICE is currently looking at breaking down remaining silos within its organisation and fully integrating Tesseract with its existing systems. There is already an interface between Tesseract and ICE’s financial software, removing the need for double entry accounting. Now the plan is to integrate Tesseract with its customers’ workflow management systems.

ICE is currently looking at breaking down remaining silos within its organisation and fully integrating Tesseract with its existing systemsAt the moment ICE updates a number of its customers’ systems with progress on repairs and service jobs. This is something it also does in Tesseract, so an interface between the two databases will save ICE from having to do it twice.

Also on the agenda is an interface with ICE’s asset tracking system, which allows them to monitor where, when and how equipment and company vehicles are being used.

“Our relationship with Asolvi grows stronger all the time,” says Mike. “At the moment we are looking at further automation and integration and we are working closely with Asolvi to achieve this. We know that with the system’s inherent flexibility and adaptability, virtually anything’s possible — and we look forward to what the future has in store.”

Be social and share

Mar 29, 2018 • Features • Augmented Reality • Daniele Pe • Future of FIeld Service • Virtual Reality • Delta Partners • Gunish Chawla • Irish Monipis • technology

Gunish Chawla and Daniele Pe, Senior Principals and Irish Manipis, Senior Business Analyst at Delta Partners have published a deep and far-reaching exploration of exactly how Augmented Reality and Virtual Reality are set to become key platforms in...

Gunish Chawla and Daniele Pe, Senior Principals and Irish Manipis, Senior Business Analyst at Delta Partners have published a deep and far-reaching exploration of exactly how Augmented Reality and Virtual Reality are set to become key platforms in the future.

We are already seeing an increasing number of forward-thinking field service organisations adopting such platforms so this detailed report provides some excellent, well-resourced context about the future of a technology set to play a very big part in the future of field service management...

The relevance of AR and VR in re-shaping user experiences and the implications on the telecom industry.

Augmented reality (AR) and virtual reality (VR) have the potential to become the next big platforms after PC, web, and mobile. Isolated applications of AR and VR have been around for a while, but the technologies to unlock their potential have only recently become available. We expect AR and VR to fundamentally transform how consumers interact in the physical world and how enterprises run their operations.

Augmented and Virtual Reality: Distinct but complementary technologies

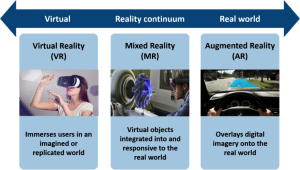

In a nutshell, AR overlays digital imagery onto the real world, while VR immerses a user in an imagined or replicated world (see figure 1 below).

Figure 1: AR and VR overview

Figure 1: AR and VR overviewFundamentally, AR and VR create a new way of interaction using gestures and graphics that are highly intuitive to humans. VR creates an illusory “sense of presence” in an imaginary world created through a computer-generated simulation. For instance, this allows users to experience travelling, shopping, creating, talking or interacting with people remotely in a completely different way. In contrast, AR allows people to access digital information in their real-world environments, thereby allowing “simultaneous existence” in both physical and digital worlds. Both AR and VR are transformative in nature and likely to co-exist as immersive platforms.

A whole new realm of opportunities

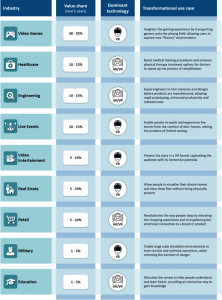

We are still at the beginning of the AR and VR revolution, but there is no doubt that they have the potential to revolutionise multiple industries over the next five to ten years, transforming the way we interact with the surrounding world, unlocking new experiences, increasing productivity and efficiency (see figure 2.)

Figure 2: Selected AR and VR transformational use cases

Figure 2: Selected AR and VR transformational use casesFrom the use cases, one can infer that AR and VR will create a shift that is comparable, if not greater, than that of the smartphone and underlying platforms.

This potential has been recognised by major technology giants and OEMs (Original Equipment Manufacturer).

Facebook made an early bet in 2014 when it acquired Oculus for $2.1bn and since then it has acquired over ten other AR/VR players. Other technology giants have followed suitFacebook made an early bet in 2014 when it acquired Oculus for $2.1bn and since then it has acquired over ten other AR/VR players. Other technology giants have followed suit – Google launched Google Cardboard, Google Glass and backed Magic Leap; Microsoft launched HoloLens and Apple acquired AR software maker Metaio. Samsung has multiple projects coming from its in-house C-lab incubator such as Monitorless (PC-viewing glasses), Vuildus (VR home furnishing), Relúmῐno (smart aid for the visually impaired) and TraVRer (360-degree travel video platform).

While technology giants and OEMs have been leading the charge, telecom operators have been slow to react, but, in recent years, we see operators in developed markets beginning to dip their toes in the water. For example, Telefonica launched start-up incubator Wayra currently supporting eight VR and four AR start-ups. SK telecom has developed 360-degree VR live broadcasting capabilities and BT is trying to revolutionise the sports experience through VR enabled football match telecast.

For AR and VR to become the next big platforms, challenges must be overcome

While significant progress has been made in this space over the past few years and the ecosystem today has hundreds of companies, thousands of employees and over $4.5 billion invested, with expectations to become an $80-100 billion industry by 2025, AR and VR today are still emerging technologies.

For AR and VR to fully materialise and provide the impact described above, significant hurdles need to be overcome.

These can be grouped into four main categories:

- Bulky and expensive devices: Despite the emergence of lower cost hardware options such as Google Cardboard ($15) and Google Daydream ($99), the majority of AR and VR equipment is very costly, e.g. HTC Vibe ($799), Oculus Rift ($600) and Google Glass ($1,500). In addition to the hefty price tags, the current AR and VR equipment is bulky and cumbersome (e.g. presence of wires). Though it may be suitable for static experiences (e.g. watching a movie), it will be a challenge in an immersive environment that requires freedom of movement and authenticity as functionality (e.g. employees in the manufacturing industry, who deal with dangerous machinery, and cannot be exposed to potential hazards).

- Scarcity of “killer” content and applications: Without a wide variety of popular applications, it will be hard for AR and VR to reach mainstream success. Although there are many applications on the gaming and video front, AR and VR have yet to find their “superstar app” – i.e. the use case that makes the technology fundamental for both consumers and enterprises.

- Limited penetration of technically ready smartphones and devices: Technical issues such as smartphone battery life and graphical capabilities hinder the adoption of AR and VR. To have the best AR and VR experience, devices need to have superior image display and audio capabilities (at least 2560x1440 resolutions), powerful processors (e.g. 820 Snapdragon), large memory space and adequate battery life. Today less than 10% of 2.8+ billion smartphones worldwide are compatible with Samsung Gear and Google Daydream.

- Insufficient network speed and latency: Fully immersive 360-degree experiences require at least 25Mbit/s for streaming and can go up to 80-100Mbit/s for HD TV. With a global average of 7.2 Mbit/s, only about 12% of global connections satisfy these requirements. In addition, low latency is critical to delivering the best AR and VR experience because even small delays can have a disorientating effect. For instance, when a user turns and the landscape does not move simultaneously, the user may experience motion sickness. VR requires less than 1ms latency and currently, the global average latency is 36ms on fixed and 81ms on mobile.

The case of Pokémon Go (free-to-play, location-based AR game) clearly illustrates the situation. When Pokémon Go was released in July 2016, it exceeded 100m downloads within a month of its release, becoming the most downloaded mobile gaming app of 2016. It single-handedly proved how profitable and widespread AR could be, generating over a billion dollars in revenue for developer Niantic.

This was achieved with a game that was “simple” enough to work with smartphones without the need of any additional device and the content was a “killer hit” as demonstrated by the take-up. Despite the success, key issues emerged in terms of device capabilities and network. Pokémon Go requires the smartphone device to have long battery life, GPS sensor and compass.

Users without these functionalities would drain their batteries within a few hours or have to settle for a pared down version of the game which detracted from their enjoyment and experience. On top of device capability issues, Pokémon Go also experienced issues on mobile networks. Despite only taking up roughly 0.1% of the overall traffic, the game accounted for >1% of all sessions on the network.

This ten times differential was the result of communication sessions opening with Niantic servers every time an event happened in the game. Driven by the massive uptake, the cumulative effect from both bandwidth and sessions negatively impacted networks, especially when the game drove large groups of players towards specific geographical areas.

What role can telecom operators play in the AR and VR ecosystem?

As mentioned, telecom operators are yet to make a credible play in this space. However, we believe that they can play a fundamental role in helping overcome some of the challenges illustrated and thereby enable earlier materialisation of the AR and VR promise. This is where operators’ typical strengths such as network infrastructure deployment or devices distribution capabilities come into play. But beyond helping drive these new technologies, we believe AR and VR have the power to transform the role of operators in the ecosystem.

If we believe that AR and VR will be the next big platforms, we should be able to imagine a world where we no longer look at our phones, but rather look up to visualise the content in front of our eyesIf we believe that AR and VR will be the next big platforms, we should be able to imagine a world where we no longer look at our phones, but rather look up to visualise the content in front of our eyes, and interact with the device through machine-learning enabled voice or visual recognition. In this scenario, the role of the smartphone would be significantly diminished.

This would provide a fresh opportunity for operators. Operators have missed the opportunity to play a significant role in the smartphone ecosystem - in terms of capturing a share of a customer’s mind and interaction time, and therefore monetising it. However, if the role of the smartphone diminishes, and new platforms take over, then opportunities arise for operators to play a pivotal role in the digital ecosystem beyond connectivity. This is where the roles of ‘open enablement platform’ and ‘application and content provider’ become relevant for operators.

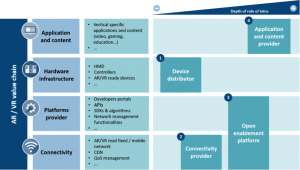

Pragmatically, we have categorised the role of operators in the AR / VR ecosystem in four groups based on the level of involvement of the operator and the expected transformational results: 1) Device distributor, 2) Connectivity provider, 3) Open enablement platform, and 4) Application and content provider.

Figure 3: Telecom operators’ role in the AR and VR ecosystem

Figure 3: Telecom operators’ role in the AR and VR ecosystem- As a ‘Device distributor’, operators would resell devices to end-users, and make them more accessible by subsidising, leasing or financing them as operators have been doing for smartphones.

- As a ‘Connectivity provider’, operators would need to ensure that last mile networks have intelligent traffic management solutions, high quality compression algorithms, low-latency and high bandwidth capabilities to offer users immersive experiences that are realistic, engaging and entertaining. As such, 5G technology will be critical in helping overcome network limitations. Similarly, the Telecom Infra Project (TIP), an initiative launched by Facebook in collaboration with operators, infrastructure providers and system integrators, focused on tackling the engineering challenges of delivering high-resolution video and virtual reality, will play a key role in enabling AR and VR take-up. However, driving these network transformation projects will require large investments on top of ongoing CAPEX requirements. Operators need to determine whether they can successfully and sustainably monetise this investment, which poses the following key questions:

- Will the surge in data usage from AR and VR applications be enough to justify the effort? Could operators monetise the quality of service demanded by AR and VR through specific tariffs or network boost add-ons?

- Can an AR and VR ready network be leveraged as a tool to boost differentiation, hence customer acquisition and retention, therefore driving the operators’ revenue share in the market?

- In an ‘Open enablement platform’ role, operators position themselves as the ‘glue’ that brings together different players in the AR/VR ecosystem: end-users, developers, devices manufacturers and content creators, effectively allowing different players within the ecosystem to develop solutions, ensuring interoperability and widespread adoption. This enablement platform will not only have typical network functionalities such as QoS management (deploying bandwidth intelligently based on pre-defined rules and parameters), robust content delivery network, and compression algorithms (to reduce network strain), but also a developer portal with tools such as APIs (to connect the different ecosystem providers and enable the longer tail of developers), dedicated SDKs, ready-to-use ‘basic’ AR/VR algorithms, billing capabilities and an analytics layer.

- As an ‘Application and content provider’, operators would collaborate with industry players to deliver AR and VR specific applications and content (e.g. video, gaming, shopping, manufacturing, etc.), where AR and VR will support specific use cases. This will help operators explore new revenue streams directly through app/content-based revenue models, and revenue sharing with app/content developers but also indirectly through improved positioning (meaning better customer acquisition and retention), and higher customer engagement (translating in a share of wallet and data usage boost). Korea Telecom (KT) is an example of an operator that is going down this path. For the 2018 PyeongChang Winter Olympic Games, KT plans to release a whole suite of AR and VR applications. These include Sync View (viewers watch the games through athlete’s lens), Interactive Time Slice (100 camera angles and screens), 360 VR Live (panoramic view of the games) and Omni Point View (all around view of the games). Along similar lines, BT is planning to drive its ambition to revolutionise sports watching to a new level by delivering fully-immersive, interactive VR content, which will place people right at the heart of the action.

In summary

While AR and VR are still emerging technologies, their mainstream adoption will increase dramatically as hardware costs fall, device functionality gets more sophisticated, more ‘killer’ content is developed, and network speed and latency improve. While it’s true that in the short-term, AR and VR will remain relatively niche, the mid to long-term potential could be transformational.

Operators can adopt a passive approach, where no specific step is taken in the advancement of the AR and VR industry beyond the ongoing modernisation of the network (e.g. 5G deployment), which naturally supports the materialisation of the AR and VR promise. This is unlikely to result in significant monetisation potential, and could further decrease operator relevance in the ecosystem, pushing operators further towards being pure connectivity providers.

Digitally-minded ambitious operators can champion and drive the AR/VR space by positioning themselves deeper in the value chain as a ‘platform enabler’ and/or ‘application and content provider’ Alternatively, digitally-minded ambitious operators can champion and drive the AR/VR space by positioning themselves deeper in the value chain as a ‘platform enabler’ and/or ‘application and content provider’. This implies early investment in the required network capabilities, a build-up of additional competencies on top of the connectivity layer and collaboration with technology players that are pushing the boundaries of the industry to develop end-user solutions. Operators that choose this path and do it right can leverage the novelty factor to reposition themselves within the ecosystem of tech and device players and in the eyes of the end user.

The telecom industry track record suggests this is a long shot for operators. Over the last decade, they have generally been poor at innovation and have time and again missed the opportunity to leverage their unique assets to position themselves strongly in the digital space. Nevertheless, there is intention from many leading operators to make a serious play within the digital space – AR and VR could well be the foundation to spearhead this transformation.

Be social and share

Mar 28, 2018 • video • Features • Video • Dan Sewell • Espresso Service • Software and Apps • Asolvi

Kris Oldland, Editor-in-Chief, Field Service News talks exclusively to Dan Sewell, COO of Espresso Service about the improvements to their service delivery that they have seen come to the fore since the implementation of a dedicated field service...

Kris Oldland, Editor-in-Chief, Field Service News talks exclusively to Dan Sewell, COO of Espresso Service about the improvements to their service delivery that they have seen come to the fore since the implementation of a dedicated field service management solution, in this instance Tesseract Service Centre, an Asolvi product.

Be social and share

Mar 27, 2018 • Features • Management • Artificial intelligence • Augmented Reality • Jan Van Veen • Machine Learning • Michael Blumberg • Reactive Maintenance • Bill Pollock • Blockchain • Deep Learning • SLA Management • Parts Pricing and Logistics

Field Service News' Big Discussion has a simple premise - we take one key topic, bring together three leading experts on that topic and then put three core questions to them to help us better understand its potential impact on the field service...

Field Service News' Big Discussion has a simple premise - we take one key topic, bring together three leading experts on that topic and then put three core questions to them to help us better understand its potential impact on the field service sector...

This issue our topic is the what to expect in 2018 and our experts are Michael Blumberg, Blumberg Advisory, Bill Pollock, Strategies for GrowthSM and Jan Van Veen, moreMomentum

The first question we tackled was What is the biggest challenge facing field service companies in the next 12 months?

Our second big question in the series was What is the biggest opportunity facing field service companies in the next 12 months?

And now onto the final question in this instalment of the Big Discussion...

What one technology do you think will have the biggest impact in the next 12 months?

Bill Pollock:  Clearly, Artificial Intelligence (AI) and Machine Learning (ML) will have the biggest impact on field service in the next 12 months. In fact, while some field service companies are still debating whether or not to implement Augmented Reality (AR), the more progressive – and aggressive – services organisations are already embarking on their respective AI and ML implementation programs.

Clearly, Artificial Intelligence (AI) and Machine Learning (ML) will have the biggest impact on field service in the next 12 months. In fact, while some field service companies are still debating whether or not to implement Augmented Reality (AR), the more progressive – and aggressive – services organisations are already embarking on their respective AI and ML implementation programs.

The application of AI for positively impacting key services-related areas such as customer experience and workforce productivity, while also allowing companies to move from a preventive maintenance to a predictive maintenance service model will be stunning! In addition, many organisations are already beginning to realise the benefits of using AI and ML for improving their overall service parts management activities, as well as for supporting data-driven decisions by allowing them to process, understand and share information that they didn’t even know they could cultivate as recently as just a year or two ago.

One caveat, though: services managers will need to closely align with their companies’ CTO and CIO before embarking on an AI/ML program, as their respective knowledge of the technical aspects of these “new” technologies will certainly help throughout both the decision-making and implementation processes.

AI and ML are not a fad – they are here to stay, and now is the time for field service companies to embark on that journey.

Jan Van Veen: I try to think of one technology that will impact on all companies. This depends on the industry and where the field service is on the continuum from reactive maintenance to advanced services. Also, the impact of new technologies will always be over a longer period of time.

Jan Van Veen: I try to think of one technology that will impact on all companies. This depends on the industry and where the field service is on the continuum from reactive maintenance to advanced services. Also, the impact of new technologies will always be over a longer period of time.

I do observe that most field service organisations have little view on the impact of Augmented Intelligence and Deep Learning systems which can process and learn from unstructured information in writing and speech. These systems are now having practical applications in various sectors, including technical services.

We have already seen Doctor Watson of IBM massively beating the smartest people in the game ‘Jeopardy’ (search for it on YouTube). Dr Watson is already providing quite accessible web services to use the functionality and have their first field service solutions.

This technology will not only completely reshape our knowledge systems and the scarce skill sets we need for remote diagnostics, it will also be a crucial vehicle for developing advanced data-driven value propositions.

I hope to see more and more manufacturers engaging with a few trusted clients and the right data-driven partners to explore the opportunities from this technology.

Michael Blumberg: I think blockchain technology will have the biggest impact on the Field Service Industry in the next 12 months. A brief definition of the blockchain is that it is a decentralized and distributed digital ledger used to permanently record transactions across data, text, video, or audio files. It is extremely secure and scalable.

Michael Blumberg: I think blockchain technology will have the biggest impact on the Field Service Industry in the next 12 months. A brief definition of the blockchain is that it is a decentralized and distributed digital ledger used to permanently record transactions across data, text, video, or audio files. It is extremely secure and scalable.

The blockchain includes within it the concept of a “smart contract”, a series of if-then statements related to a transaction.

This makes it the ideal technology for building an IoT platform. The blockchain can be used to record sensor data and then trigger service events (i.e., field service dispatch, parts shipment, corrective actions, etc.) based on smart contracts. These transactions can also be monetized in real-time; like a virtual cash register. Any disputes can be resolved by verifying the blockchain transaction itself.

This is just one of many use cases for block chain technology in the Field Service Industry. Other use cases include asset tracking, spare parts authentication, knowledge content sharing, and SLA management. 2018 will be the year where these use cases are implemented in field service and produce measurable results which eventually lead to large-scale adoption within the field service industry.

Be social and share

Mar 26, 2018 • Features • Hardware • LabelMate • Lorien LIghtfoot • Mike Pullon • Zebra • Gen2Wave • hardware • Honeywell • IntelliTrack • janam • Jonathan Brown • Robert Hurt • rugged • Rugged Mobile • SBV • Varlink

Varlink, the specialist Mobile Computing, Auto ID and EPOS Distributor, held its 2018 Meet the Manufacturer (MTM) event on 15th March at Whittlebury Hall, Northamptonshire, where partners had the opportunity to meet resellers and to demonstrate and...

Varlink, the specialist Mobile Computing, Auto ID and EPOS Distributor, held its 2018 Meet the Manufacturer (MTM) event on 15th March at Whittlebury Hall, Northamptonshire, where partners had the opportunity to meet resellers and to demonstrate and display their latest products and services. Now in its 13th year, MTM has become a key date in the diary for resellers and suppliers alike.

This year the event was sponsored by Janam, a leading provider of rugged mobile computers. Janam unveiled two new products at MTM, including the XT100. The XT100 rugged touch computer eliminates the pitfalls associated with deploying consumer-grade devices and packs the power and performance of a rugged mobile computer in a slim smartphone design to meet the diverse needs of mobile workers across field service. This device provides more features and functionality than any other device in its field.

Robert Hurt, Janam General Manager EMEA, said of the event: “This year’s MTM was especially successful for us. The event presented us with an excellent platform to debut two new rugged mobile computers to the reseller/ISV community. We value our partnership with Varlink and are thrilled with the opportunities MTM delivers each year.”

Gen2wave also showcased their new UHF RFID and Barcode Readers – the RPT50 and RPT100, which are now available from Varlink. Both products are compatible with various host devices, with a long-lasting battery and slim and lightweight feel. The RPT100 is an ultra-rugged device with an IP68 rating and reading distance of up to 9m. With a stand-alone batch mode, up to 1000 RFID/barcode tags can be collected while off the network.

In addition to leading hardware vendors, MTM2018 also featured Varlink’s Alliance Partners who offer complementary products and services giving resellers the chance to enhance their overall solution.Also on show was the Zebra TC25 rugged smartphone, featuring a point-and-shoot scanner and all-day power with the snap on PowePack. This device is built for work with a 4.3in Gorilla Glass display and an IP65 rating.

In addition to leading hardware vendors, MTM2018 also featured Varlink’s Alliance Partners who offer complementary products and services giving resellers the chance to enhance their overall solution.

It was a bumper year, featuring 25 exhibitors and a record number of delegates in attendance. Honeywell’s UKI Distribution Manager, Erin Townsend, commented: “MTM is always a successful and well-run event. MTM presents great opportunities to meet new partners, catch up with existing partners, and showcase our latest exciting devices to the channel.”

While Datalogic’s Channel Manager, Johnathan Brown said: “We thought it was a great event that everyone at Varlink should be very proud of. We had an excellent experience and thought it was most worthwhile.”

This year’s event was organised by Varlink’s newly established marketing team, led by Head of Marketing, Lorien Lightfoot. The team is uniquely structured; each member of the team has a wealth of experience in graphic design, email marketing and digital marketing, allowing them to focus their efforts on specific verticals, and develop expert knowledge of each industry’s needs.

Customers are at the heart of Varlink’s Marketing operations and the development of industry specialists within the team allows them to better support their resellers in their own marketing efforts, providing branded materials, email campaign support and even advice on social media marketing, not to mention the comprehensive Product Reference Guide, which has just been released for 2018.

All in all, MTM18 was a huge success with exhibitors from long-standing Varlink brands, such as Zebra and Honeywell, to newcomers who made their MTM debut, like Labelmate, SBV and IntelliTrack. The business outlook for 2018 looks rosy for all Varlink’s partners, says CEO Mike Pullon:

“MTM is a testament to how much we value our relationship with both manufacturers and resellers and is always an indicator of how well Varlink will perform across the year. 2018 is set to be a record year for Varlink. With significantly increased stock holding and new products launching from some of our key brands, the company is making huge strides towards a year of significant growth.

Are you a Reseller?

To join Varlink’s reseller community please click here.

Are you a Field Service Executive?

If you are interested in any of the products mentioned in this article for your own business, please click here to be put in touch with a Varlink solutions provider.

Be social and share

Mar 23, 2018 • video • Features • Management • Artificial intelligence • Augmented Reality • GE Digital • IoT • servicemax

Kris Oldland, Editor-in-Chief, Field Service News and Kieran Notter, Director, Global Customer Transformation, ServiceMax from GE Digital explore the findings of an exclusive independent research conducted by Field Service News and sponsored by ...

Kris Oldland, Editor-in-Chief, Field Service News and Kieran Notter, Director, Global Customer Transformation, ServiceMax from GE Digital explore the findings of an exclusive independent research conducted by Field Service News and sponsored by ServiceMax from GE Digital.

In this, the third and final excerpt from the full one-hour long webcast, Oldland and Notter discuss how field service organisations can and are turning to the latest technologies including Augmented Reality, Artificial Intelligence and the Internet of Things to ensure they keep attrition rates for their field service engineers low

Want to know more? The full webcast PLUS an exclusive report based on the findings of this research is available for Field Service News subscribers.

If you are a field service practitioner you may qualify for a complimentary 'industry practitioner' subscription. Click here to apply now!

Be social and share

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Leave a Reply