A new reality awaits: are AR and VR the next big platforms?

Mar 29, 2018 • Features • Augmented Reality • Daniele Pe • Future of FIeld Service • Virtual Reality • Delta Partners • Gunish Chawla • Irish Monipis • technology

Gunish Chawla and Daniele Pe, Senior Principals and Irish Manipis, Senior Business Analyst at Delta Partners have published a deep and far-reaching exploration of exactly how Augmented Reality and Virtual Reality are set to become key platforms in the future.

We are already seeing an increasing number of forward-thinking field service organisations adopting such platforms so this detailed report provides some excellent, well-resourced context about the future of a technology set to play a very big part in the future of field service management...

The relevance of AR and VR in re-shaping user experiences and the implications on the telecom industry.

Augmented reality (AR) and virtual reality (VR) have the potential to become the next big platforms after PC, web, and mobile. Isolated applications of AR and VR have been around for a while, but the technologies to unlock their potential have only recently become available. We expect AR and VR to fundamentally transform how consumers interact in the physical world and how enterprises run their operations.

Augmented and Virtual Reality: Distinct but complementary technologies

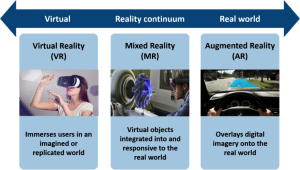

In a nutshell, AR overlays digital imagery onto the real world, while VR immerses a user in an imagined or replicated world (see figure 1 below).

Figure 1: AR and VR overview

Figure 1: AR and VR overviewFundamentally, AR and VR create a new way of interaction using gestures and graphics that are highly intuitive to humans. VR creates an illusory “sense of presence” in an imaginary world created through a computer-generated simulation. For instance, this allows users to experience travelling, shopping, creating, talking or interacting with people remotely in a completely different way. In contrast, AR allows people to access digital information in their real-world environments, thereby allowing “simultaneous existence” in both physical and digital worlds. Both AR and VR are transformative in nature and likely to co-exist as immersive platforms.

A whole new realm of opportunities

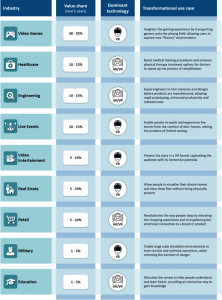

We are still at the beginning of the AR and VR revolution, but there is no doubt that they have the potential to revolutionise multiple industries over the next five to ten years, transforming the way we interact with the surrounding world, unlocking new experiences, increasing productivity and efficiency (see figure 2.)

Figure 2: Selected AR and VR transformational use cases

Figure 2: Selected AR and VR transformational use casesFrom the use cases, one can infer that AR and VR will create a shift that is comparable, if not greater, than that of the smartphone and underlying platforms.

This potential has been recognised by major technology giants and OEMs (Original Equipment Manufacturer).

Facebook made an early bet in 2014 when it acquired Oculus for $2.1bn and since then it has acquired over ten other AR/VR players. Other technology giants have followed suitFacebook made an early bet in 2014 when it acquired Oculus for $2.1bn and since then it has acquired over ten other AR/VR players. Other technology giants have followed suit – Google launched Google Cardboard, Google Glass and backed Magic Leap; Microsoft launched HoloLens and Apple acquired AR software maker Metaio. Samsung has multiple projects coming from its in-house C-lab incubator such as Monitorless (PC-viewing glasses), Vuildus (VR home furnishing), Relúmῐno (smart aid for the visually impaired) and TraVRer (360-degree travel video platform).

While technology giants and OEMs have been leading the charge, telecom operators have been slow to react, but, in recent years, we see operators in developed markets beginning to dip their toes in the water. For example, Telefonica launched start-up incubator Wayra currently supporting eight VR and four AR start-ups. SK telecom has developed 360-degree VR live broadcasting capabilities and BT is trying to revolutionise the sports experience through VR enabled football match telecast.

For AR and VR to become the next big platforms, challenges must be overcome

While significant progress has been made in this space over the past few years and the ecosystem today has hundreds of companies, thousands of employees and over $4.5 billion invested, with expectations to become an $80-100 billion industry by 2025, AR and VR today are still emerging technologies.

For AR and VR to fully materialise and provide the impact described above, significant hurdles need to be overcome.

These can be grouped into four main categories:

- Bulky and expensive devices: Despite the emergence of lower cost hardware options such as Google Cardboard ($15) and Google Daydream ($99), the majority of AR and VR equipment is very costly, e.g. HTC Vibe ($799), Oculus Rift ($600) and Google Glass ($1,500). In addition to the hefty price tags, the current AR and VR equipment is bulky and cumbersome (e.g. presence of wires). Though it may be suitable for static experiences (e.g. watching a movie), it will be a challenge in an immersive environment that requires freedom of movement and authenticity as functionality (e.g. employees in the manufacturing industry, who deal with dangerous machinery, and cannot be exposed to potential hazards).

- Scarcity of “killer” content and applications: Without a wide variety of popular applications, it will be hard for AR and VR to reach mainstream success. Although there are many applications on the gaming and video front, AR and VR have yet to find their “superstar app” – i.e. the use case that makes the technology fundamental for both consumers and enterprises.

- Limited penetration of technically ready smartphones and devices: Technical issues such as smartphone battery life and graphical capabilities hinder the adoption of AR and VR. To have the best AR and VR experience, devices need to have superior image display and audio capabilities (at least 2560x1440 resolutions), powerful processors (e.g. 820 Snapdragon), large memory space and adequate battery life. Today less than 10% of 2.8+ billion smartphones worldwide are compatible with Samsung Gear and Google Daydream.

- Insufficient network speed and latency: Fully immersive 360-degree experiences require at least 25Mbit/s for streaming and can go up to 80-100Mbit/s for HD TV. With a global average of 7.2 Mbit/s, only about 12% of global connections satisfy these requirements. In addition, low latency is critical to delivering the best AR and VR experience because even small delays can have a disorientating effect. For instance, when a user turns and the landscape does not move simultaneously, the user may experience motion sickness. VR requires less than 1ms latency and currently, the global average latency is 36ms on fixed and 81ms on mobile.

The case of Pokémon Go (free-to-play, location-based AR game) clearly illustrates the situation. When Pokémon Go was released in July 2016, it exceeded 100m downloads within a month of its release, becoming the most downloaded mobile gaming app of 2016. It single-handedly proved how profitable and widespread AR could be, generating over a billion dollars in revenue for developer Niantic.

This was achieved with a game that was “simple” enough to work with smartphones without the need of any additional device and the content was a “killer hit” as demonstrated by the take-up. Despite the success, key issues emerged in terms of device capabilities and network. Pokémon Go requires the smartphone device to have long battery life, GPS sensor and compass.

Users without these functionalities would drain their batteries within a few hours or have to settle for a pared down version of the game which detracted from their enjoyment and experience. On top of device capability issues, Pokémon Go also experienced issues on mobile networks. Despite only taking up roughly 0.1% of the overall traffic, the game accounted for >1% of all sessions on the network.

This ten times differential was the result of communication sessions opening with Niantic servers every time an event happened in the game. Driven by the massive uptake, the cumulative effect from both bandwidth and sessions negatively impacted networks, especially when the game drove large groups of players towards specific geographical areas.

What role can telecom operators play in the AR and VR ecosystem?

As mentioned, telecom operators are yet to make a credible play in this space. However, we believe that they can play a fundamental role in helping overcome some of the challenges illustrated and thereby enable earlier materialisation of the AR and VR promise. This is where operators’ typical strengths such as network infrastructure deployment or devices distribution capabilities come into play. But beyond helping drive these new technologies, we believe AR and VR have the power to transform the role of operators in the ecosystem.

If we believe that AR and VR will be the next big platforms, we should be able to imagine a world where we no longer look at our phones, but rather look up to visualise the content in front of our eyesIf we believe that AR and VR will be the next big platforms, we should be able to imagine a world where we no longer look at our phones, but rather look up to visualise the content in front of our eyes, and interact with the device through machine-learning enabled voice or visual recognition. In this scenario, the role of the smartphone would be significantly diminished.

This would provide a fresh opportunity for operators. Operators have missed the opportunity to play a significant role in the smartphone ecosystem - in terms of capturing a share of a customer’s mind and interaction time, and therefore monetising it. However, if the role of the smartphone diminishes, and new platforms take over, then opportunities arise for operators to play a pivotal role in the digital ecosystem beyond connectivity. This is where the roles of ‘open enablement platform’ and ‘application and content provider’ become relevant for operators.

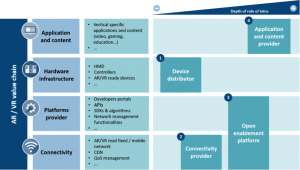

Pragmatically, we have categorised the role of operators in the AR / VR ecosystem in four groups based on the level of involvement of the operator and the expected transformational results: 1) Device distributor, 2) Connectivity provider, 3) Open enablement platform, and 4) Application and content provider.

Figure 3: Telecom operators’ role in the AR and VR ecosystem

Figure 3: Telecom operators’ role in the AR and VR ecosystem- As a ‘Device distributor’, operators would resell devices to end-users, and make them more accessible by subsidising, leasing or financing them as operators have been doing for smartphones.

- As a ‘Connectivity provider’, operators would need to ensure that last mile networks have intelligent traffic management solutions, high quality compression algorithms, low-latency and high bandwidth capabilities to offer users immersive experiences that are realistic, engaging and entertaining. As such, 5G technology will be critical in helping overcome network limitations. Similarly, the Telecom Infra Project (TIP), an initiative launched by Facebook in collaboration with operators, infrastructure providers and system integrators, focused on tackling the engineering challenges of delivering high-resolution video and virtual reality, will play a key role in enabling AR and VR take-up. However, driving these network transformation projects will require large investments on top of ongoing CAPEX requirements. Operators need to determine whether they can successfully and sustainably monetise this investment, which poses the following key questions:

- Will the surge in data usage from AR and VR applications be enough to justify the effort? Could operators monetise the quality of service demanded by AR and VR through specific tariffs or network boost add-ons?

- Can an AR and VR ready network be leveraged as a tool to boost differentiation, hence customer acquisition and retention, therefore driving the operators’ revenue share in the market?

- In an ‘Open enablement platform’ role, operators position themselves as the ‘glue’ that brings together different players in the AR/VR ecosystem: end-users, developers, devices manufacturers and content creators, effectively allowing different players within the ecosystem to develop solutions, ensuring interoperability and widespread adoption. This enablement platform will not only have typical network functionalities such as QoS management (deploying bandwidth intelligently based on pre-defined rules and parameters), robust content delivery network, and compression algorithms (to reduce network strain), but also a developer portal with tools such as APIs (to connect the different ecosystem providers and enable the longer tail of developers), dedicated SDKs, ready-to-use ‘basic’ AR/VR algorithms, billing capabilities and an analytics layer.

- As an ‘Application and content provider’, operators would collaborate with industry players to deliver AR and VR specific applications and content (e.g. video, gaming, shopping, manufacturing, etc.), where AR and VR will support specific use cases. This will help operators explore new revenue streams directly through app/content-based revenue models, and revenue sharing with app/content developers but also indirectly through improved positioning (meaning better customer acquisition and retention), and higher customer engagement (translating in a share of wallet and data usage boost). Korea Telecom (KT) is an example of an operator that is going down this path. For the 2018 PyeongChang Winter Olympic Games, KT plans to release a whole suite of AR and VR applications. These include Sync View (viewers watch the games through athlete’s lens), Interactive Time Slice (100 camera angles and screens), 360 VR Live (panoramic view of the games) and Omni Point View (all around view of the games). Along similar lines, BT is planning to drive its ambition to revolutionise sports watching to a new level by delivering fully-immersive, interactive VR content, which will place people right at the heart of the action.

In summary

While AR and VR are still emerging technologies, their mainstream adoption will increase dramatically as hardware costs fall, device functionality gets more sophisticated, more ‘killer’ content is developed, and network speed and latency improve. While it’s true that in the short-term, AR and VR will remain relatively niche, the mid to long-term potential could be transformational.

Operators can adopt a passive approach, where no specific step is taken in the advancement of the AR and VR industry beyond the ongoing modernisation of the network (e.g. 5G deployment), which naturally supports the materialisation of the AR and VR promise. This is unlikely to result in significant monetisation potential, and could further decrease operator relevance in the ecosystem, pushing operators further towards being pure connectivity providers.

Digitally-minded ambitious operators can champion and drive the AR/VR space by positioning themselves deeper in the value chain as a ‘platform enabler’ and/or ‘application and content provider’ Alternatively, digitally-minded ambitious operators can champion and drive the AR/VR space by positioning themselves deeper in the value chain as a ‘platform enabler’ and/or ‘application and content provider’. This implies early investment in the required network capabilities, a build-up of additional competencies on top of the connectivity layer and collaboration with technology players that are pushing the boundaries of the industry to develop end-user solutions. Operators that choose this path and do it right can leverage the novelty factor to reposition themselves within the ecosystem of tech and device players and in the eyes of the end user.

The telecom industry track record suggests this is a long shot for operators. Over the last decade, they have generally been poor at innovation and have time and again missed the opportunity to leverage their unique assets to position themselves strongly in the digital space. Nevertheless, there is intention from many leading operators to make a serious play within the digital space – AR and VR could well be the foundation to spearhead this transformation.

Be social and share

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Leave a Reply