GPS Insight, a leading provider of SaaS-based fleet management software and complementary solutions in the United States and Canada, today announced the acquisition of FieldAware, the leader in made-for-mobile, cloud-based field service solutions.

AUTHOR ARCHIVES: Field Service News

About the Author:

Field Service News is the world's leading publication for dedicated to the field service read by over field service professionals across the globe. If you are a field service practitioner you may qualify for a complimentary industry subscription - visit fieldservicenews.com/subscribe now!

Dec 02, 2021 • News • Digital Transformation • field service technology • FieldAware • fleet management • GLOBAL • GPS Insight

GPS Insight, a leading provider of SaaS-based fleet management software and complementary solutions in the United States and Canada, today announced the acquisition of FieldAware, the leader in made-for-mobile, cloud-based field service solutions.

The acquisition advances field services and fleet tracking capabilities for GPS Insight, allowing them to better serve customers of all sizes through a more robust and comprehensive digital platform with capabilities to achieve operational insights and cost savings.

THIS PARTNERSHIP MOVES FIELDAWARE CLOSER TO FULLY DIGITIZING AND AUTOMATING A MADE-FOR-MOBILE FIELD OPERATIONS EXPERIENCE

"GPS Insight is thrilled to provide even better solutions for our customers through this partnership with FieldAware, while at the same time extending our competitive advantage across the field service and fleet management landscape," said Gary Fitzgerald, CEO at GPS Insight. "We're committed to creating tools for businesses to operate with more efficiency," Fitzgerald adds, "and bringing together these two platforms will provide an unparalleled synergy to guarantee high-quality, reliable service that drives bottom-line profitability, while enabling our customers to deliver a superior end-to-end service experience for their customers."

The acquisition will better position GPS Insight to expand its field service solutions to meet the unique digital field service challenges of mid-market and enterprise service organizations across core industries, such as industrial and commercial equipment, solar and renewable energy, facility and property management, waste management, construction, HVAC, electrical, and plumbing, while ensuring fleet performance—along with driver safety and compliance—to a customer base of more than 250,000 vehicles combined.

"This is an exciting time for FieldAware to join forces with GPS Insight. This partnership moves FieldAware closer to realizing our vision of fully digitizing and automating a comprehensive, made-for-mobile field operations experience," said Steve Mason, COO at FieldAware. "Existing and new customers can expect to see benefits immediately as we take our solutions and innovation to a new level to expand the impact of all types of assets in the field."

"FieldAware's history of digital innovation has been transforming field service organizations since 2011," continued Fitzgerald. "By integrating their field-first service suite with the industry-leading telematics, video telematics, and field service management solutions from GPS Insight, we'll be able to complement each other's unique strengths and market positioning—expanding our go-to-market channels and cross-selling opportunities. This acquisition not only grows the GPS Insight product portfolio, but also reinforces our commitment to helping companies realize the promise of fully digital field operation transformation."

For more information, please visit gpsinsight.com

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about Service Innovation @ www.fieldservicenews.com/service-innovation

- Read more about FieldAware on Field Service News @ www.fieldservicenews.com/fieldaware

- Learn more about FieldAware @ www.fieldaware.com

- Find out more about GPS Insights @ gpsinsight.com

- Follow FieldAware on Twitter @ twitter.com/fieldaware

Dec 01, 2021 • Features • connectivity • Digital Transformation • GLOBAL • TELENOR CONNEXION • LTE-M • NB-IOT

In this final feature of a series of excerpts from a recent white paper published by Telenor Connexion, we look in detail at the difference between LTE-M and NB-IOT, as a guide to make the optimal choice for your business.

In this final feature of a series of excerpts from a recent white paper published by Telenor Connexion, we look in detail at the difference between LTE-M and NB-IOT, as a guide to make the optimal choice for your business.

This feature is just one short excerpt from a white paper published by Telenor Connexion.

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content Telenor Connexion who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Adaptability to New Use Cases

When choosing a connectivity technology, the complete lifecycle of the connected product must be taken into consideration. Enterprises need to choose a technology that can grow with new use cases.

Imagine a product called “The connected door”. Initially it should just be possible to open and close the door and the door should send usage statistics every night to the cloud. The typical door has a lifecycle of 10 years. After just looking at the initial use case, the data amount is very low, so the focus is on technology with the lowest bandwidth and the door is mass produced and successfully launched. After three years the enterprise wants to monitise this success and add new value - the door should not just connect, but also interact with a parcel delivery service. For use cases where the application can be expected to evolve over time it is thus important that the whole solution has potential to develop. LTE-M provides greater potential to grow over time.

Due to its wider bandwidth LTE-M provides more adaptability to new use cases where the use cases of the IoT solution will develop over time. NB-IoT is an alternative when the requirements are more static and known from start.

Due to the shutdown of 2G and 3G networks in many parts of the world many legacy use cases need to be transferred to new connectivity technology.

We believe that 2G technologies will continue to be available in many parts of the world and outlive 3G. In Europe we anticipate 2G will be available until 2025, due to the legally required emergency services in the EU which depend on 2G technology.

As the coverage of LTE-M and NB-IoT deployments may not, as of today, be good enough everywhere, we recommend enterprises verify coverage in more detail and/or ensure devices are compatible with existing technologies as a backup.

IoT use cases will eventually move from old to new technology. As LTE-M meets or exceeds the technical characteristics of 2G/3G services, it appears to be a natural, evolutionary step. NB- IoT has lower responsiveness and limitations in mobility and may be relevant for use cases with lower requirements.

Global Availability

We believe that LTE-M will be the first to become a globally available technology as it has technically been designed for roaming from the start, like all other 2G, 3G, 4G and 5G technologies. NB-IoT was initially designed for static devices only, and roaming has been added later as afterthought.

Operators will be more reluctant to support incoming roaming NB-IoT devices that use network resources, but hardly generate revenue. Roaming on NB-IoT will most likely be limited to the business units within an operator group. We expect that LTE-M roaming will be available globally in the coming years, similarly to normal 4G roaming, and it is indeed already available today as a best effort offering on existing 4G roaming contracts.

LTE-M has been designed for roaming from the start and can leverage existing roaming and wholesale business models between operators. NB-IoT will require new business models to be a good alternative for global connectivity. Therefore we expect that LTE-M will be relevant for international IoT solutions earlier than NB- IoT.

Software Updates and Security

IoT devices can have a typical life span of 10 to 15 years. For many use cases it is desirable to update the software in the device several times over its lifecycle. Therefore, enterprises must choose a technology that can handle updates to work with modern software development practices - and to keep devices secure.

Enterprises typically use agile software development (small and frequent increments) to decrease time to market. This makes the waterfall approach to software development – where large software are deployed that are never touched again - a practice of the past.

The characteristics of NB-IoT mean it is not suitable for upgrading large fleets of IoT devices. This is expected to be addressed in a future version of NB- IoT, called NB2. In this variety software upgrades can be managed using multi-cast.

This means that there will be two varieties of NB-IoT available - NB1 and NB2 (also sometimes called LTE-cat NB1 and LTE Cat NB2). The current status is however that today most networks only support NB1, and it may take years before NB2 is widely available.

Increased security improvements and the agile software development methods used today, will continue to drive software updates. This has a large impact on the bandwidth consumption during the lifecycle of devices which is often underestimated. LTE-M is considerably better at handling device updates as its higher bandwidth can handle more data.

Moving Devices

Previous mobile technologies all support devices that can move around without connectivity being interrupted. Devices constantly measure radio signals of nearby radio towers (cells) in the network and dynamically and seamlessly adjust their signaling to different towers (cells). Here we see significant differences between NB-IoT and LTE-M.

NB-IoT is designed for static devices. It is designed to increase battery life by reducing measurement of signals to nearby radio towers (cells). When NB-IoT devices are moved, sessions may get dropped, or devices may need to reconnect. This can lead to interruptions and reduces battery life. This makes NB-IoT less suitable for moving devices.

LTE-M on the other hand is designed for moving devices, just like 2G, 3G, 4G and 5G. LTE-M can support moving devices without losing data sessions, at speeds of up to 200km/hr.

LTE-M is the better choice for moving devices as it has been designed for this from the start. As NB-IoT is designed for static devices it can lead to interruptions if devices are moved.

Remote Control Devices

If devices need to be remotely controlled, responsiveness is important.

Devices controlled by people need a fast and consistent response. LTE-M provides the same consistent response time as regular 4G, so it can be used by people to remotely control devices. NB- IoT is designed to send small amounts of data and is not designed for a fast response. With NB-IoT it may sometimes take up to 10 seconds to receive a response from a device.

Not all use cases need a fast response and it may for example be perfectly acceptable to wait 10 seconds for sensor readings.

When there is human interaction a slow response risk being perceived as poor usability, which could harm the brand perception of enterprises.

LTE-M is needed for a fast and consistent response, while NB-IoT can handle use cases where a delay of minutes is acceptable.

Voice Readiness

LTE-M is designed for voice and the specification includes Voice over LTE (VoLTE) - which is deployed by 194 operators in 91 countries.

Today however, VoLTE is not globally available in LTE-M networks and there are not many hardware modules that can support VoLTE over LTE-M. We expect that VoLTE will grow in importance in the coming years in LTE-M, just as it did in the consumer market for LTE.

The bandwidth and especially the responsiveness of LTE-M can also be used as an alternative to Voice over IP solutions. Devices need to respond quickly to calls and must be able to send and receive data at the same time (full duplex). Only LTE-M can support full duplex communication.

NB2 adds push to talk technology to NB-IoT, only one party can talk at any one time because the technology is half duplex, like walkie-talkies used to be.

LTE-M is designed for voice with Voice over LTE and can also be used for Voice over IP with full duplex. NB2 adds push to talk technology to NB-IoT but only at half duplex.

SIM Localisation - EUICC

Physically swapping the SIM card of deployed devices can be a costly and complicated process, especially in an IoT environment. SIM cards with eUICC technology allows switching of identity over the air, without the need for physical replacement of SIM cards.

When the life cycle of connected devices is longer than the commercial agreement with an operator, the eUICC technology makes a change of operator possible. eUICC can also be used for devices deployed in locations where roaming is not possible. While eUICC is still in an early stage today it will become a vital technology for large and international deployments of IoT devices.

Not all operators support the combination of NB-IoT and SMS which means that eUICC cannot be initiated in many networks. The bandwidth of LTE-M is also more suitable for transmission of SIM profiles, just like software updates. Enterprises considering eUICC should therefore also consider LTE-M.

Time to Market - Internet Competence

Time to market is essential when launching new products. Connectivity technology is only one aspect of the product. Access to people with the right competence is vital to ensure time to market which is why many enterprises choose common technologies over specialized technologies. Common technologies make product development faster, and product maintenance more cost efficient, because it is easier to get access to developers and other specialists.

The internet is built on technologies like IP, TCP, UDP and TLS. These protocols are familiar and easy to use for developers, as they hide much network complexity and are easy to scale without central control.

NB-IoT is designed to perform in local deployments, for example connecting streetlights in a city. Here it is not necessary to use standard internet technologies, such as IP.

Enterprises can access their devices through the Service Capability Exposure Function (SCEF) provided by the network operator. SCEF simplifies the access to devices by hiding the complexity of the operator’s network making device access familiar to application developers.

Today SCEF is available in some networks for local deployments. Enterprises that would like to use NB- IoT without IP would need to connect to all individual NB-IoT operators that support SCEF.

The roaming and interworking of SCEF is standardized, but it will take several years before SCEF are widely deployed and roaming is available.

LTE-M is using standard IP protocols which makes it straightforward to develop applications. NB-IoT is using tailormade protocols requiring specific application development and competence.

CONCLUSION AND RECOMMENDATIONS

Deciding between the new mobile connectivity technologies, LTE-M and NB-IoT, requires an understanding of the key differences between them.

LTE-M and NB-IoT are both globally available, vendor independent technologies, based on open standards. With the introduction of eUICC enterprises can take a commercial decision based on the most suitable technology and irrespective of operator.

Both LTE-M and NB-IoT enable relevant use cases and are telecom grade, which means they operate on dedicated radio frequencies in telecom networks with a proven capability to scale, and with committed support through the whole life cycle from the operator.

Both technologies also support improved battery life and substantial coverage enhancements, when compared to older mobile technologies.

For Most International Use Cases LTE-M is the Preferred Alternative

- LTE-M is the better alternative with respect to handling firmware and software updates that are expected during the lifecycle of the devices. LTE-M is built for roaming and has the best support for international deployments using a single point of contact and subscription for enterprises.

- Both LTE-M and NB-IoT have significantly improved indoor coverage compared with LTE.

- LTE-M is a better alternative for moving devices as it will not lose ongoing data transfers.

- LTE-M is prepared for voice technology and Voice over LTE.

- With LTE-M, devices can react in milliseconds if required, enabling use cases where a fast response is needed which is relevant for the usability of human-machine interactions.

Recommendations

Choosing the right connectivity technology is one of the critical decisions when implementing an IoT solution. The right choice is essential for deploying a well working solution in a cost efficient way and that can develop over time. New mobile IoT connectivity standards, LTE-M and NB-IoT, opens up for new and evolved use case by offering better coverage, longer lasting batteries and/or lower device cost. In addition they offer a future-proof path as 2G and 3G networks are gradually sunset across the world.

For most international IoT solutions LTE-M will be the preferred connectivity standard as it is expected to become globally available faster and to be more straightforward when developing and maintaining applications. NB-IoT may still be the better choice for some applications, -for example for very large scale sensor networks where the requirements are known at deployment and the best possible indoor coverage is absolutely essential.

As of today neither LTE-M nor NB-IoT are deployed widely enough to be solely relied on for international fleets of devices. For now it is recommended to use hardware that is able to use LTE-M or NB-IoT as well as networks with mature footprints, for example,

2G and/or 4G. The deployment status of mobile IoT network is developing rapidly and therefore the right setup will vary over time.

Independent on the choice of technology standard, Telenor Connexion can help you with all your connectivity needs. Get in touch to find out more about the first steps to take for your low-power, wide-area IoT application.

This feature is just one short excerpt from a white paper published by Telenor Connexion.

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content Telenor Connexion who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content Telenor Connexion who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about Mobile Connectivity @ www.fieldservicenews.com/connectivity

- Read more about Telenor on Field Service News @ www.fieldservicenews.com/telenor

- Learn more about Telenor Connexion @ www.telenorconnexion.com

- Follow Telenor Connexion on Twitter @ twitter.com/t_connexion

- Connect with Telenor Connexion on LinkedIn @ www.linkedin.com/telenor-connexion-ab/

Nov 29, 2021 • News • Field Service Management Software • SimPRO • Leadership and Strategy • GLOBAL

simPRO, the global leader in field service management software, announced that it has secured an investment of over $350 million from K1 Investment Management, with participation from existing investor Level Equity.

simPRO, the global leader in field service management software, announced that it has secured an investment of over $350 million from K1 Investment Management, with participation from existing investor Level Equity.Additionally, simPRO announced the acquisitions of ClockShark, a US-based time-sheeting and scheduling platform, as well as AroFlo, an Australia-based job management software provider. Together, the companies support the full lifecycle of a field service organization from sole operator or small business to larger, more complex businesses and franchises.

ACQUISITIONS ACCELERATE GLOBAL EXPANSION AND PRODUCT DEVELOPMENT EFFORTS

simPRO helps field service business owners grow revenue and profitability by reducing their reliance on paper-based workflows. With dedication to continuous product innovation, the company has experienced rapid growth as customers around the globe seek to future-proof their businesses with cloud-based, end-to-end software.

"This investment marks the next stage of simPRO's exciting growth journey," said Sean Diljore, simPRO CEO. "Our mission is to build a world where field service businesses can thrive. That mission will continue to be our focus as we accelerate our expansion and product development efforts. We'll continue adding to our suite of features and build further capabilities to support even more business owners within the global trade and construction industries."

In addition to supporting the recent acquisitions, the funding will be used to accelerate product investment and scale global operations across the business.The leadership teams of simPRO, ClockShark, and AroFlo will operate independently, including continued service on existing products.

"We're thrilled to welcome ClockShark and AroFlo to the simPRO family," said Diljore. "Both companies are leaders in their spaces and have incredibly valuable product offerings that will benefit our combined customer bases and help our customers increase revenue. We look forward to growing together and building a range of solutions for the field service and construction industries."

"We're excited to start this path with simPRO and K1," said Cliff Mitchell, ClockShark CEO. "It opens up many opportunities for ClockShark as a company, and for the customers we serve. We chose to move forward with simPRO because of its global footprint which will provide us access to additional markets, customers, and resources relevant to ClockShark customers."

AroFlo CEO Guy Arrowsmith echoed this sentiment. "This opportunity with simPRO and K1 allows AroFlo to continue on its growth trajectory while providing the same great product and service to its customers. We're excited to see what the future holds for all of our brands and what we can do together for the field service and construction industries."

Combined, the platforms are trusted by more than 17,000 businesses, 320,000 users and have over 500 staff in offices throughout Australia, New Zealand, the United Kingdom and the United States, with continued expansion anticipated in all geographies.

"K1 sought to invest in a global category leader that is transforming the way field service operators do business," said Simon Yu, senior vice president at K1. "simPRO's global growth momentum will only accelerate with the complementary acquisitions of ClockShark and AroFlo. K1 is thrilled to partner with Sean and his team in creating a platform that can support the broadest range of customers with best-of-breed solutions, globally."

Further Reading:

- Read more about Leadership & Strategy @ www.fieldservicenews.com/leadership-and-strategy

- Read more about simPRO on Field Service News @ www.fieldservicenews.com/simPRO

- Find out more about simPRO @ www.simprogroup.com

- Learb more about K1 Capital @ k1capital.com

- Follow simPRO on Twitter @ twitter.com/simprosoftware

- Connect simPRO on LinkedIn @ www.linkedin.com/simpro-software/

Nov 26, 2021 • Features • White Paper • FieldAware • Leadership and Strategy • customer experience • customer success

In this final feature from a recent white paper we published in partnership with FieldAware, we discuss if customer satisfaction metrics are suitable to identify a measure of success in a servitized or customer success-based service model.

In this final feature from a recent white paper we published in partnership with FieldAware, we discuss if customer satisfaction metrics are suitable to identify a measure of success in a servitized or customer success-based service model.

This feature is just one short excerpt from a recent white paper we published in partnership with FieldAware.

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Do we need to rethink how we measure success within our organization if we move towards a servitized or customer success focused model? This is something of a complex question, and in many ways, the answer is both yes and no.

From an operational perspective, as we put forward earlier in this paper, broadly what defines operational success in a transactional break-fix service offering largely remains the same definition of success that we would see in a servitized model.

To reiterate, in the traditional break-fix setup, metrics like mean-time-to-repair, first-time-fix-rate, and technician utilization are all indicators of how efficiently the service organization can meet the customer’s external demands and expectations.

In a servitized offering, those same metrics remain vital for ensuring that the field service operation is running at a level of efficiency that makes it both feasible and financially rewarding for the service provider to offer such as solution.

Yet as the Field Service News Research study from late 2019, Understanding the metrics that matter in a rapidly changing field service sector, revealed, of those organizations that had introduced some level of servitization into their service portfolio, over 80% of them had made changes to the KPIs they measure.

Also, remember the statistic we referenced earlier in this paper from that same report- over half (51%) of all field service organizations now placed equal importance on CSAT metrics as they did operational metrics – a statistic that has steadily risen year on year since Field Service News Research began hosting benchmarking studies in this area back in 2013.

Yet, when we think of customer satisfaction metrics, are these suitable to identify a measure of success in a servitized or customer success-based service design model?

Rudimentary statistics such as Net Promoter Score can offer a broad overview of service standards. More detailed tools like customer surveys allow more specific insights to come to the fore, and modern tools such as sentiment analysis can fill in the gaps between the two.

However, all CSAT metrics are the equivalent of driving while looking in the rearview mirror and while valuable indicators, are perhaps not focused enough for the end-goal of defining customer success.

“CSAT metrics are the equivalentof driving while looking in the rearview mirror and while valuable indicators are perhaps not focused enough for the end-goal of defining customer success...”

In earlier sections of this paper, we have touched on how co-creation often lies at the heart of many successful servitization case studies and the potential importance of an onboarding team.

When it comes to defining the core metrics for a customer success-based service model, a critical role of the onboarding team (and also of pre-sales and/or account management) should be to work with the customer to identify a shared set of metrics that will shape how success is defined.

This may require data sets from both organizations to combine a new set of KPIs that allow the service provider to ensure they meet the requirements. Should these KPIs indicate an issue, then traditional operational KPIs can provide an insight as to why. Meanwhile, broader CSAT metrics can offer an indication of the overall temperature of the service organisations success.

This more complex understanding not only of what success looks like for each customer but also leveraging existing KPIs to ensure that is happening at the macro and granular level, serves once more to re-enforce the importance of not only having the tools to empower effective service delivery but also the critical importance of reporting tools that allow the service provider to quickly and easily keep their finger on the pulse of how the service operation is performing.

In addition, such reporting tools allow the service provider to offer a layer of transparency that is crucial in communicating with the customer. This transparency leads to a relationship founded on trust. In summary, new metrics will evolve, but the old metrics remain vital and access to data is key in all areas.

This feature is just one short excerpt from a recent white paper we published in partnership with FieldAware..

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about Data Management @ www.fieldservicenews.com/data-management

- Read more about FieldAware on Field Service News @ www.fieldservicenews.com/exel

- Learn more about FieldAware @ www.fieldaware.com

- Follow FieldAware on Twitter @ twitter.com/fieldaware

Nov 25, 2021 • Features • Digital Transformation • Aquant • Covid-19 • customer experience

Aquant, has recently published the 2022 Service Intelligence Benchmark Report, now available at Field Service News, which offers an in-depth analysis of field service performance and customer satisfaction in a year of talent shortage, COVID service...

Aquant, has recently published the 2022 Service Intelligence Benchmark Report, now available at Field Service News, which offers an in-depth analysis of field service performance and customer satisfaction in a year of talent shortage, COVID service pivots, and shifting customer demands. In this final excerpt from the report, we discuss how companies can look beyond KPIs.

This feature is just one short excerpt from a report published by Aquant

www.fieldservicenews.com subscribers can read the full report now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content Aquant who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content Aquant who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

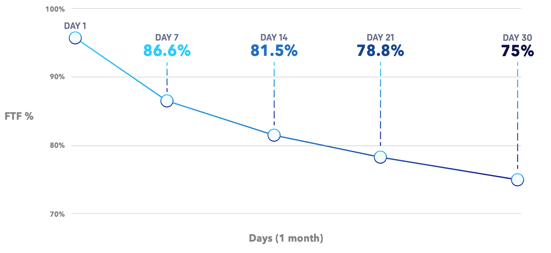

The Customer Experience Gap

The Customer Experience Gap shows the difference between what customers expect and what your organization delivers.

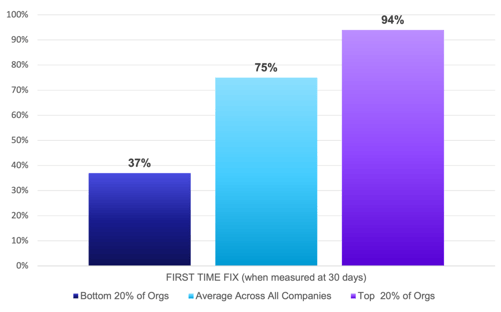

Our analysis shows that companies who measure FTF rates in 7-day or 14-day windows are setting the stage for a wide experience gap—which leads to frustrating customer experiences. The moral of the story: a few metrics can’t provide the entire picture. It’s time to look at experience as a whole.

Instead of defining FTF in arbitrary time increments (7 days, 14 days, or 21 days), think about it in terms of the natural service cycle. Our research shows that measuring in 30-day windows strips out false-positive FTF rates.

Understand where your organization falls on the Customer Experience Gap chart.

- If your FTF rate is similar when measured at 7 days and 30 days, you have a small gap.

- If your FTF rate has a wide variation (usually a high rate at 7 days and a low rate at 30 days), you have a large gap.

- If you have a large gap, your team is focused on hitting their numbers instead of focusing on great customer experiences.

Why FTF Rates Vary by Time

When measured in short windows (like 7-day increments), jobs where a technician made an incorrect fix—but got the machine to work temporarily—will be marked as complete. But an incorrect fix is only a temporary measure, and the machine will continue to break down until properly repaired. For instance, a customer may call for service two or three times in a 30-day window. If you only measure in 7-day increments, your dashboard may show you successfully completed three jobs for one customer. In reality, these were three failed visits. This environment also leads to customer escalations and customer complaints that management may deem as “surprise complaints” that they didn’t see coming.

When it comes to service, it’s just as important to maximize the time between events and failures as it is to fix things correctly the first time. The less a customer needs a technician on-site, the better. This means the customer’s needs are being met.

Two Examples of Poor Customer Experiences

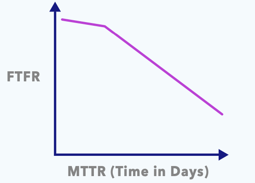

Company A: KPIs are not aligned to customer outcomes

When FTF curves start out flat, it means that the company likely incentivizes high FTF rates over deep problem-solving. That’s shown by the curve getting steeper at the end of a 30-day cycle, indicating that the FTF rate is plummeting.

The key takeaway: Company A is not closely monitoring FTF rate—or there is no incentive to maintain a high rate over a long period of time—leading to poor customer experiences.

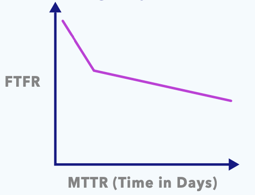

Company B: KPIs are not aligned to customer outcomes

Here, the FTF rate starts out high and eventually flattens out. This may indicate that more preparation, information, or triage was needed before visiting a job site. A return visit would most likely be required to successfully solve the problem. Unlike Company A, Company B eventually solves root problems, but it requires several visits.

The key takeaway: Company B is trying to provide great customer service, but has some limitations that hinder quick and accurate outcomes, such as a lack of prep or an employee knowledge gap.

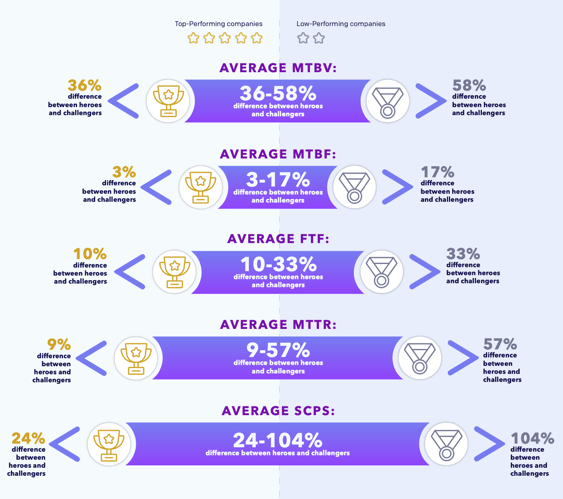

The Skills Gap - A Profile of the Top and Lowest Performing Organisations

What does the knowledge gap have to do with hitting KPIs?

If there is a large knowledge gap between team members, performance will vary—and so will customers’ experiences. That’s why it’s crucial to make sure that your technicians are equally knowledgeable about the equipment that they service and up-to-date on specific customer preferences.

Determine your team’s skills gap.

To increase your team’s knowledge and success, you must first identify how much of a gap exists between your star technicians (heroes) and underperformers (challengers).

For this report, we calculated the percentage difference between heroes and challengers across all organizations on the following page. We divided it into:

- Above average organizations

- Above performing organizations

- Below average organizations

A Snapshot of high performing and low performing organizations

The top 20% of organizations have a smaller workforce skills gap. A workforce with a more equal knowledge distribution results in more consistent customer experiences.

Why the Skills Gap Matters

A bigger distance between heroes and challengers leads to:

- Decrease in customer satisfaction

- Increased workload on your already overburned experts

- Increase in service costs

- Less capacity for organizational resilience

- Negative impact on growth

What's Next?

The service industry is facing unprecedented workforce shortages and increasing customer demands. A better way to overcome these challenges is to understand your business on a much deeper level than you do today so you can tailor service for every customer. Here’s where to start.

This feature is just one short excerpt from a report published by Aquant.

www.fieldservicenews.com subscribers can read the full report now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content Aquant who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content Aquant who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Further Reading:

- Read more about Aquant on Field Service News @ www.fieldservicenews.com/aquant

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about Leadership & Strategy @ www.fieldservicenews.com//leadership-and-strategy

- Learn more about Aquant @ www.aquant.io

- Follow Aquant on Twitter @ twitter.com/Aquant_io

Nov 24, 2021 • News • Artificial intelligence • Automation • Ericsson • Telecommunications • EMEA

Ericsson (NASDAQ: ERIC) is launching its Intelligent Automation Platform, a service management and orchestration product which enables any mobile network to be intelligently automated.

Ericsson (NASDAQ: ERIC) is launching its Intelligent Automation Platform, a service management and orchestration product which enables any mobile network to be intelligently automated.

Building on existing offerings, including cloud native dual-mode 5G Core and the Cloud RAN portfolio, the company is adding the Ericsson Intelligent Automation Platform and a suite of rApps as a natural next step to build the networks of the future.

The solution facilitates AI and automation, which improves network performance, operational efficiency and customer experience to help create smarter networks.

ERICSSON INTELLIGENT AUTOMATION PLATFORM IS AN OPEN SERVICE MANAGEMENT PRODUCT THAT WILL HELP COMMUNICATIONS SERVICE PROVIDERS OPTIMIZE NETWORK PERFORMANCE AND DELIVER ENHANCED CUSTOMER EXPERIENCE.

The cloud-native solution will work across new and existing 4G and 5G radio access networks (RAN) and will support diverse vendors and RAN technologies, including purpose-built and Open RAN.

This will create greater choice for communications service providers (CSPs) as they evolve their networks. Ericsson’s investment in this platform is reflective of the company’s contributions to industry development of Open RAN technologies.

Ericsson Intelligent Automation Platform automates the radio access network using AI and radio network applications (rApps) with different functionalities. In a similar way to an operating system that automates operations, resources and identifies improvements to be made across the network, Ericsson Intelligent Automation Platform includes a non-real-time RAN intelligent controller (Non-RT-RIC) that operates rApps.

The platform supports ecosystem innovation by enabling software developers to build products through a software-development toolkit (SDK). A suite of Ericsson rApps with field-proven capabilities will be made available on the platform across four domains: efficient automated deployment; network healing; network evolution; and network optimization. The suite will continue to grow in collaboration with customers.

Jan Karlsson, Senior Vice President and Head of Business Area Digital Services, Ericsson, says: “We embrace the principle of openness and the evolution to open network architectures. Building upon our Cloud RAN offering, we are taking another major step towards building the network for the digital future with the launch of Ericsson Intelligent Automation Platform, which fundamentally enables smarter mobile networks. We look forward to providing our customers with an open platform that enables operational efficiency, enhances customer experience and drives service innovation. I am happy to hear the reactions from our customers already being positive towards our new product and we look forward to future development and innovation.”

Neil McRae, MD Architecture & Strategy, BT Group Chief Architect, says: “At BT we connect for good and continuously innovate to provide the best services for our customers. As we expand and modernize building more reliable networks in more places, managing network complexity via automation is critical to ensure our customers best quality of experience. I’m pleased to see that Ericsson is launching the Intelligent Automation Platform for automating networks, based on the O-RAN Alliance Service Management and Orchestration (SMO) concept. Ericsson’s vision to extend that SMO concept to support both Open RAN and existing 4G and 5G networks, using a single operational pane-of-glass is an innovative approach.”

Toshikazu Yokai, Executive Officer, Chief Director of Mobile Technology, KDDI, says: “KDDI recognizes the importance of Service Management and Orchestration (SMO) and automation to achieve optimal network operations across multi-vendor, purpose-built RAN and Open RAN environments. SMO combined with an open software-development toolkit (SDK) has the potential to drive application (rApps) innovation and diversity, unleashing CSP, telecommunications vendor and third-party software provider innovation to optimize network performance, improve operational efficiency and drive superior customer experiences. KDDI expects SMO and the Non-Real-Time RAN Intelligent Controller (Non-RT-RIC) to fine-tune RAN behavior and to assure SLAs dynamically based on slice specific service requirements. KDDI looks forward to collaborating with Ericsson to explore the potential of these solutions.”

Sue Rudd, Director Networks and Service Platforms, Strategy Analytics, says: “Ericsson Intelligent Automation Platform brings scalability, performance and operations simplicity to the increasingly complex environment of mobile networks, including purpose-built and Open RAN. Ericsson’s long-demonstrated expertise in radio networking and end-to-end network slicing, in parallel with its active participation in the O-RAN Alliance and leadership in ONAP network automation, have enabled it to create this powerful platform to assist customers to maximize their ROI through smart delivery of high-quality services to their end-customers. Ericsson’s proven record of multi-vendor service orchestration and open operations automation make it an excellent partner for rApps developers and systems integrators who can leverage this unique toolkit and development environment.”

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Learn more about Ericsson Automation Platform @ www.ericsson.com/intelligent-automation-platform

- Read more about Ericsson on Field Service News @ www.fieldservicenews.com/ericsson

- Find out more about Ericsson @ www.ericsson.com/

- Follow Ericsson on Twitter @ twitter.com/Ericsson

Nov 24, 2021 • Features • connectivity • Digital Transformation • GLOBAL • TELENOR CONNEXION • LTE-M • NB-IOT

In this second feature of a series of excerpts from a recent white paper published by Telenor Connexion, we look in-depth at the characteristics of LTE-M and NB-IoT technologies and how they will affect the market.

In this second feature of a series of excerpts from a recent white paper published by Telenor Connexion, we look in-depth at the characteristics of LTE-M and NB-IoT technologies and how they will affect the market.

This feature is just one short excerpt from a white paper published by Telenor Connexion.

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content Telenor Connexion who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

LTE-M AND NB-IOT TECHNOLOGIES - INCREASED BATTERY LIFE, ENHANCED COVERAGE AND SIMPLIFIED HARDWARE

LTE-M and NB-IoT are designed to support IoT devices that need a long battery life or are used at locations that are difficult to reach with normal 4G technology, such as deep indoor locations.

So how are they different and how will they affect the market?

Battery Life and Increased Coverage

Battery life is increased by reducing the radio communications between device and network, and devices can go into sleep mode or listen less often to the network. LTE-M and NB-IoT both offer better coverage than 4G in, for example, deep indoor or remote areas.

There is however a trade-off between battery life, coverage and responsiveness. To leverage this requires access to new types of functionality in the network- for example PSM and EDRX use cases that need a fast response are less suitable for battery saving and enhanced coverage.

Likewise, devices that need a life cycle of 10 years need to be deployed in areas with good coverage. To support a balanced approach, battery saving and enhanced coverage are applied in step with each other. Significant improvement in battery life and coverage can be achieved by sleep mode and applying the right level of repetitions.

New Pricing Models Likely to Emerge

Pricing models for LTE-M and NB-IoT will likely be different to traditional telecom pricing because of the different traffic profile involved with IoT connectivity. There will be a vast number of connected LTE-M and NB-IoT devices but they will send low amounts of data. Rather than the data consumption per device price model, network providers will most likely consider charging access fees for devices on a per device basis for LTE-M and NB-IoT, or a combination of both, to better match the network resources consumed by these devices.

Hardware Simplification

LTE-M and NB-IoT both use simplified versions of regular 4G which reduces hardware complexity and cost once the technology is operating at scale.

GSMA maintains a list of modules that are commercially available at: https://www.gsma.com/ iot/mobile-iot-modules/ showing that the market for modules is fragmented into three main categories: modules supporting either LTE-M or NB-IoT and modules that support both LTE-M and NB-IoT.

LTE-M AND NB-IOT - GLOBAL AVAILABILITY AND OUTLOOK

Moving towards local availability in all countries

For global deployments of devices, enterprises need to take the life cycle of technology in consideration.

Global deployments need global availability, but new technologies are first locally available, typically in urban areas or with nationwide deployments. So when can we expect global availability for LTE-M and NB-IOT?

Today, the status for LTE-M and NB-IoT is that they are both locally available and on their way to becoming globally available.

We see that sometimes one operator in a region starts focusing on either LTE-M or NB-IoT, after which their competitors in the same region often offers the alternative.

We expect that in a few years both LTE-M and NB-IoT will be locally available in all countries.

Nationwide deployments are a good start but for global availability, commercial global roaming agreements between operators must be in place, so enterprises can deploy their devices using only one contract and one point of contact.

With 4G widely available and 5G around the corner, 2G and 3G are slowly being phased out. 2G technology is today still widely used in IoT solutions. 2G voice technology is used for voice calling, including emergency calls such as eCall - a European initiative for rapid assistance to motorists involved in a collision anywhere in the European Union. eCall was made mandatory in all new type-approved cars sold in the European Union from April 2018. As eCall mandates 2G voice, operators in the European Union cannot simply phase out 2G.

We expect that most European operators will support 2G until 2025. In North America, 2G is less widely available and certain countries in Asia and the Pacific have already phased out 2G.

LTE-M and NB-IoT are starting to become globally available, starting with LTE-M. We expect LTE-M and NB-IoT to be available during the complete lifecycle of 5G.

This feature is just one short excerpt from a white paper published by Telenor Connexion.

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content Telenor Connexion who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content Telenor Connexion who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about Mobile Connectivity @ www.fieldservicenews.com/connectivity

- Read more about Telenor on Field Service News @ www.fieldservicenews.com/telenor

- Learn more about Telenor Connexion @ www.telenorconnexion.com

- Follow Telenor Connexion on Twitter @ twitter.com/t_connexion

- Connect with Telenor Connexion on LinkedIn @ www.linkedin.com/telenor-connexion-ab/

Nov 23, 2021 • News • Future of field servcice • servicemax • Leadership and Strategy • GLOBAL

ServiceMax, Inc., a leader in asset-centric, Field Service Management software provides the following preliminary results for its fiscal Q3 2022 that ended on October 31, 2021.

ServiceMax, Inc., a leader in asset-centric, Field Service Management software provides the following preliminary results for its fiscal Q3 2022 that ended on October 31, 2021.

Preliminary Third Quarter Fiscal Year 2022 Financial Highlights

- Total Revenue: Total revenue was $33.2 million during the third quarter of fiscal 2022, representing an increase of 20% year-over-year. Excluding the impact of purchase accounting for the third quarter of fiscal 2021, total revenue increased 19% year-over-year.

- Subscription Revenue: Subscription revenue was $28.7 million during the third quarter of fiscal 2022, representing an increase of 23% year-over-year. Excluding the impact of purchase accounting for the third quarter of fiscal 2021, subscription revenue increased 21% year-over-year.

- Operating Results: Loss from operations was ($14.0) million during the third quarter of fiscal 2022, compared to ($15.8) million during the third quarter of fiscal 2021. Non-GAAP loss from operations was ($3.0) million during the third quarter of fiscal 2022, compared to ($5.6) million during the third quarter of fiscal 2021.

Business Highlights

- Closed acquisition of LiquidFrameworks on November 1, 2021, which advances ServiceMax's Field Service Management capabilities in the energy sector ("LiquidFrameworks Acquisition"). The acquisition was financed with cash on hand and a new $100 million term loan.

- Announced that the U.S. Securities and Exchange Commission (the "SEC") has declared effective Pathfinder Acquisition Corporation's ("Pathfinder") registration statement on Form S-4 (File No. 333-258769) relating to the previously announced proposed business combination of Pathfinder and ServiceMax (the "Business Combination"). The Extraordinary General Meeting of Pathfinder shareholders to approve the pending Business Combination between Pathfinder and ServiceMax, among other items, is scheduled for December 7, 2021, at 10:00 am ET.

The foregoing financial information for the quarter ended October 31, 2021 is unaudited and subject to quarter-end adjustments in connection with the completion of our customary financial closing procedures. Such changes could be material. ServiceMax will release full financial results for the three and nine months ended October 31, 2021, on December 9, 2021.

Financial Outlook

ServiceMax is providing financial guidance for its fourth quarter ending January 31, 2022, inclusive of the LiquidFrameworks Acquisition, as follows:

- Total revenue between $38.5 million and $39.5 million, representing an increase of 37% year-over-year at midpoint of the range.

- Subscription revenue between $34.0 million and $35.0 million, representing an increase of 42% year-over-year at midpoint of the range.

- Non-GAAP operating loss between $(7) million and $(6) million.

ServiceMax is providing financial guidance for its fiscal year 2022 ending January 31, 2022, inclusive of the LiquidFrameworks Acquisition, as follows:

- Total revenue between $134 million and $135 million, representing an increase of 23% year-over-year at midpoint of the range.

- Subscription revenue between $116 and $117 million, representing an increase of 28% year-over-year at midpoint of the range.

- Non-GAAP operating loss between ($18) million and ($17) million.

Financial Outlook

On July 15, 2021, ServiceMax entered into a business combination agreement with Pathfinder, a publicly traded special purpose acquisition company co-sponsored by affiliates of HGGC and Industry Ventures, which was amended and restated on August 12, 2021. The Business Combination is expected to close in the fourth quarter of calendar year 2021. The transaction is expected to deliver as much as $335 million of gross proceeds to the combined company, assuming no redemptions by Pathfinder shareholders, and including proceeds from a strategic common equity investment immediately prior to closing by leading software companies (PTC Inc. and Salesforce Ventures) at the same per share valuation as the Business Combination transaction. The closing of the Business Combination is expected to result in ServiceMax becoming a Nasdaq listed company under the ticker symbol "SMAX".

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about ServiceMax on Field Service News @ www.fieldservicenews.com/servicemax

- Find out more about ServiceMax @ www.servicemax.com

- Connect with ServiceMax on LinkedIn @ www.linkedin.com/company/servicemax/

- Follow ServiceMax on Twitter @ twitter.com/ServiceMax

Nov 22, 2021 • News • Augmented Reality • Remote Assistance • Digital Transformation • FieldBit • Help Lightning • EMEA

Help Lightning, the leading provider of remote visual assistance software, announced today the acquisition of Fieldbit, an augmented reality-enabled platform known for its innovative knowledge sharing, remote collaboration and workflow automation...

Help Lightning, the leading provider of remote visual assistance software, announced today the acquisition of Fieldbit, an augmented reality-enabled platform known for its innovative knowledge sharing, remote collaboration and workflow automation capabilities supporting both expert led and self-help solutioning.

Help Lightning is a leading innovator in the application of augmented reality for use cases that deliver positive outcomes in industries such as complex medical equipment and telecommunications. According to Gartner®, “by 2026, 75% of capital-equipment-intensive industries will use AR as a key component for cost reduction/avoidance among frontline workers”. With significant category growth expected over the next 3 years, the acquisition of Fieldbit will provide the broadest and deepest value creation for its growing list of global enterprise customers.

THE ACQUISITION SIGNIFICANTLY ENHANCES HELP LIGHTNING'S INDUSTRY-LEADING REMOTE ASSISTANCE SOLUTION WITH NEW, EXPANSIVE CAPABILITIES TO DEEPEN CUSTOMER VALUE

“Today’s announcement represents another exciting milestone for Help Lightning and more good news for our more than 200 customers who benefit every day from our AR-enabled solution,” said Gary York, CEO of Help Lightning. “The acquisition of Fieldbit is an important step in fulfilling our vision to provide instant access to expertise, delivering dramatic improvements in first time fix rates, resolution times, and customer satisfaction.”With Fieldbit, Help Lightning customers will benefit from access to additional capabilities to enable real-time, expert-led problem solving while also supporting a variety of self-help scenarios. The combined solution will include an industry-leading set of capabilities such as:

- Remote video collaboration and technical support

- 3D annotation

- The industry’s only Merged Reality feature

- Knowledge capture and share

- Work instructions including operational & safety procedures

- Augmenting real time data from IIoT platforms

With this acquisition, Help Lightning improves support for the ever-expanding needs of enterprise customers who depend on its services, including leading brands like Ricoh, Bunn and Becton Dickinson. Fieldbit brings depth and breadth in comparison to other solutions on the market, allowing the combined power of these two industry leaders to successfully meet the needs of today’s global enterprises. Fieldbit has a strong roster of successful customers including large enterprises such as BP, Emerson, and Veolia.

“From the beginning, our vision at Fieldbit has been to be at the forefront of technology so we can provide the most advanced AR solutions for our customers,” said Evyatar Meiron, CEO of Fieldbit. “With our strong footprint in the energy, utilities and manufacturing industries, and together with Help Lightning’s ability to create and expand customer value, we are now able to bring unparalleled expertise and powerful capabilities to create positive outcomes for our customers.”For more information about how Help Lightning enables business experts to virtually work side-by-side with anyone needing help, anywhere in the world, visit helplightning.com.

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about Help Lightning on Field Service News @ www.fieldservicenews.com/helplightning

- Read more about Remote Assistance on Field Service News @ www.fieldservicenews.com/remote-assistance

- Find out more about Help Lightning @ helplightning.com

- Learn more about Fieldbit @ www.fieldbit.net

- Connect with Help Lightning on LinkedIn@ www.linkedin.com/company/helplightning/

- Follow Help Lightning on Twitter @ twitter.com/helplightning

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Leave a Reply