ServiceMax, Inc., a leader in asset-centric field service management, announces the launch of Spark 360, a fixed-scope, low-risk professional services implementation package that drives a prescriptive approach and condensed timeline for ServiceMax...

ARCHIVE FOR THE ‘leadership-and-strategy’ CATEGORY

Dec 23, 2021 • News • Future of field servcice • servicemax • Leadership and Strategy • GLOBAL

ServiceMax, Inc., a leader in asset-centric field service management, announces the launch of Spark 360, a fixed-scope, low-risk professional services implementation package that drives a prescriptive approach and condensed timeline for ServiceMax Asset 360 deployments.

Utilizing Asset 360's best practices and core business functions, Spark 360 is designed for fast implementation and rapid time to value so customers can quickly achieve increased service profitability, asset visibility, and agility as they transform their field service operations. Spark 360 also leverages the MaxApproach, an implementation methodology developed through hundreds of successful customer implementations, that delivers maximum efficiency throughout the rollout.

“With global conditions rapidly changing on an almost daily basis due to COVID-19, supply chain disruptions, ‘the great resignation,’ and other factors, keeping infrastructure running and doing so efficiently and cost-effectively is now more paramount than ever,” said Dave Kahley, Senior Vice President, Customer Solutions, ServiceMax. “Spark 360 enables new clients to quickly implement our Asset 360 product and start seeing the benefits of their transformation right away.”

As 2021 draws to a close, ServiceMax’s Asset 360 continues to attract new customers, including Lowry Solutions who completed a significant new implementation in Q3. The company has also seen existing customers like Boston Scientific, Rite-Hite and Technogym expand the scope of their field service offerings, as well as customers like Smiths Detection complete successful multi-region and multi-functional rollouts.

Looking forward, the addition of Spark 360 and its fixed scope furthers the company’s ability to help customers to go live faster with Asset 360. Spark 360’s exclusive business capabilities include:

- Asset Hierarchy Management (move, swap, clone, update)

- Location Management

- Asset Uptime & Downtime Capabilities & Reporting

- Automated Maintenance Work from Asset or Contract

- Work Order Assignment Management

Other capabilities of the package enable customers to:

- Manage, track, and enforce warranty and service contract entitlements against your installed base

- Effectively create and apply new maintenance plans and service contracts with a templatized approach

- Utilize end-to-end business process flows using Asset 360’s best-practice approach

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about ServiceMax on Field Service News @ www.fieldservicenews.com/servicemax

- Find out more about ServiceMax @ www.servicemax.com

- Learn more about Spark 360 @ www.servicemax.com/spark360

- Connect with ServiceMax on LinkedIn @ www.linkedin.com/company/servicemax/

- Follow ServiceMax on Twitter @ twitter.com/ServiceMax

Dec 22, 2021 • News • UK • Small Medium Businesses • SMB • Covid-19 • Leadership and Strategy • EMEA • Fintech

Despite lingering anxieties about the pandemic and a variety of economic and commercial issues, the majority of SMEs believe it is now imperative to begin building back from the crisis.

Despite lingering anxieties about the pandemic and a variety of economic and commercial issues, the majority of SMEs believe it is now imperative to begin building back from the crisis.

They are ready to step up their business investment, with ambitious plans for recruitment, renewal of equipment and machinery, and both domestic and international expansion. Fintech business lender MarketFinance asked 2,000 SME owners across the UK about their outlook for 2022 and beyond, gauging their short and long-term plans for business investment and growth. MarketFinance has today released a comprehensive research report of its findings, which are summarised here.

Confidence

Analysis of the survey results has shown that business confidence amongst SMEs is improving, with many firms now focused on recovery and growth. With pandemic disruptions now largely settled, half of SMEs (48%) expect their turnover to stabilise or to increase over the next 12 months. Similarly, 50% of SMEs expect demand for their products or services to stabilise or to increase over the next six months. MarketFinance’s research has found that the majority of SMEs (63%) expect their business to grow over the next three years

Investment

With survival mode no longer a necessity and cash flow pressures beginning to ease, the vast majority of SMEs (70%) now feel confident enough to increase business investment over the next 12 months. A quarter of SMEs plan to hire new staff, while 24% expect to purchase new equipment and machinery. When asked how they were factoring borrowing into their investment plans, 23% of SMEs said access to a broader range of borrowing options could enable them to increase investment even further.

Borrowing

The research findings demonstrate that borrowing will play a key role in recovery and growth with 62% of SMEs saying that prudent borrowing could help them fund growth. However, three quarters (71%) of SMEs do not believe traditional banking products are the most obvious and convenient way to borrow for investment. Despite this lack of alignment between current finance needs and the options available through traditional routes, more than a third of SMEs (37%) are looking to take on new borrowing facilities.

Growth

With confidence high and a sense of having moved beyond recovery and into a new stage of growth, many businesses are looking forward to seizing a host of opportunities in 2022. Almost all SMEs surveyed (81%) plan to invest in sustainability, while 30% say they are considering merger and acquisition (M&A) activity in the year ahead – more than twice as many as those primarily focusing on organic growth (14%). Over a third of businesses (34%) say they already sell overseas, or have plans to begin doing so. That figure is highest amongst the largest businesses surveyed (turnover between £5m and £6.5m) but even amongst smaller enterprises significant numbers are focused on export.

Anil Stocker, CEO at MarketFinance, commented: “It’s clear that the business environment has shifted and SMEs are looking ahead with a quietly confident and cautiously optimistic view. UK businesses intend to ramp up growth through domestic and international expansion, digital transformation and even M&A activity. But as they reset their post-pandemic goals for a post-pandemic, they’ll need to be confident of their funding base.

Given that so many SMEs are looking outside of traditional routes in their search for finance, we’re particularly proud to have been accredited by the British Business Bank as one of the few alternative providers under The Recovery Loan Scheme. Schemes like the RLS are a golden opportunity for SMEs looking to gear up for growth, providing easily accessible funding at a lower cost across a wide range of products. We expect to see a large number of SMEs taking advantage of the scheme over the next 6 months as their growth and expansion efforts gain momentum and they invest in ambitious plans for 2022 and beyond.”

Further Reading:

- Read more about Leadership and Strategy @ www.fieldservicenews.com/leadership-and-strategy

- Read more about the impact of COVID-19 @ www.fieldservicenews.com/COVID-19

- Read more about Fintech on Field Service News @

- Learn more about Market Finance @ marketfinance.com

- Follow Market Finance on Twitter @ twitter.com/marketfinance

Dec 16, 2021 • Features • CEO • Dave Hart • Service Leadership • Leadership and Strategy

Dave Hart, Managing Partner of Field Service Associates, highlights the importance of benchmarking your business against your competitors to fully understand if your strategy and plans are working.

Dave Hart, Managing Partner of Field Service Associates, highlights the importance of benchmarking your business against your competitors to fully understand if your strategy and plans are working.

I have to say for almost 18 months now I have been an avid watcher of the news with particular interest in seeing the daily coronavirus cases and deaths figures for the UK. Do I have some morbid fascination with seeing the numbers whilst being thankful I am not one of the statistics? Well, yes; yes, I do. Why may you ask? Well, I am one of those people who are classed as clinically extremely vulnerable, and I must be very careful where I go and who I meet. Even my friends don’t come around to my house unless they have taken a lateral flow test. (I must confess its rather embarrassing ‘parking’ them in the garage and watching them force large swabs up their noses before we allow them in!)What fascinates me more, is that statistically I am a person far more likely to have serious ramifications to my health if I caught coronavirus and therefore, I watch with great interest in how the UK government tackles this awful virus. Now I am not going to debate the rights and wrongs of if the UK government should have locked down earlier, the wearing of masks, COVID passports and the vaccine roll out versus the anti vax brigade (don’t get me started!). No, I am fascinated how the stats stack up country to country, now we have enough data we can see trends emerging and that is truly enlightening. You see for me, any governments first duty is to protect the lives and well-being of its citizens and now we can measure the ‘performance’ of each country’s government strategy and benchmark them appropriately. I will let you be the judge as to how well each government is performing…

Thus, my title for this article. Always light a candle to show your performance. You see I fundamentally believe that any business, like any government, should be benchmarked against its peer group so that it has an indicator that its strategy and plans are delivering for its key stakeholders, namely the employees, customers, and shareholders

I love the phrase used in the US which is often banded about ‘I had my ass handed to me’ as it resonates with me so much. You see in a previous role, as my quarterly business reviews took place in the board room of our corporate headquarters in Connecticut, I often had my ass handed to me in my reviews because when challenged by the CEO or CFO it was almost impossible for me to defend my team’s performance. You see the problem I had was there were no external benchmarks available that I could use to determine if it was warranted that my ass should be handed to me (even on a silver platter as my old CEO would often attest to doing!). As much as I tried, I could not find a way of proving that my team were performing very well especially with the constraints I faced as a service leader at the time. Often, I would be asked why I couldn’t get more productivity, achieve higher first-time fix rates, increase revenue per head, better profitability by product, reduced inventory (working capital) levels. I could go on – you get the picture. In cases like these arbitrary performance levels are set that can often be extremely difficult to attain purely because no one knows if anyone has achieved these levels of performance historically. It was only much later in my career that purely by chance I met my counterpart from our biggest competitor at the time. It was intriguing to find out that he had the same challenges from his CEO.

It strikes me that these days understanding your businesses performance becomes even more complex with transformational journeys service companies are embarking on. Artificial intelligence, Augmented reality, AIoT, Remote visual assistance, blended workforce approaches and many other developments. Service leader’s needs to benchmark themselves against their peer groups to truly understand if the progress they are making is keeping pace with their competitors. To take this approach would quickly evidence to any service leader whether they needed to really start to take affirmative action in areas where they were falling behind their peer group, or indeed, walk into any boardroom with the full confidence of knowing their service team’s performance sets the benchmark and that is a completely different conversation with the CEO!

So, don’t curse the darkness of not knowing how you stack up, light a candle on your business and benchmark your performance and do so every year so you can evidence your progress. At the end of the day, it makes perfect sense to know whether your ass is ever going to be handed back to you.Further Reading:

- Read more about Leadership and Strategy @ www.fieldservicenews.com/leadership-and-strategy

- Read more exclusive FSN articles from Dave Hart @ www.fieldservicenews.com/dave-hart

- Learn more about Field Service Associates @ fieldserviceassociates.com

- Connect with Dave Hart on LinkedIn @ linkedin.com/david-hart

- Follow Dave Hart on Twitter @ twitter.com/DaveHartProfit

Nov 29, 2021 • News • Field Service Management Software • SimPRO • Leadership and Strategy • GLOBAL

simPRO, the global leader in field service management software, announced that it has secured an investment of over $350 million from K1 Investment Management, with participation from existing investor Level Equity.

simPRO, the global leader in field service management software, announced that it has secured an investment of over $350 million from K1 Investment Management, with participation from existing investor Level Equity.Additionally, simPRO announced the acquisitions of ClockShark, a US-based time-sheeting and scheduling platform, as well as AroFlo, an Australia-based job management software provider. Together, the companies support the full lifecycle of a field service organization from sole operator or small business to larger, more complex businesses and franchises.

ACQUISITIONS ACCELERATE GLOBAL EXPANSION AND PRODUCT DEVELOPMENT EFFORTS

simPRO helps field service business owners grow revenue and profitability by reducing their reliance on paper-based workflows. With dedication to continuous product innovation, the company has experienced rapid growth as customers around the globe seek to future-proof their businesses with cloud-based, end-to-end software.

"This investment marks the next stage of simPRO's exciting growth journey," said Sean Diljore, simPRO CEO. "Our mission is to build a world where field service businesses can thrive. That mission will continue to be our focus as we accelerate our expansion and product development efforts. We'll continue adding to our suite of features and build further capabilities to support even more business owners within the global trade and construction industries."

In addition to supporting the recent acquisitions, the funding will be used to accelerate product investment and scale global operations across the business.The leadership teams of simPRO, ClockShark, and AroFlo will operate independently, including continued service on existing products.

"We're thrilled to welcome ClockShark and AroFlo to the simPRO family," said Diljore. "Both companies are leaders in their spaces and have incredibly valuable product offerings that will benefit our combined customer bases and help our customers increase revenue. We look forward to growing together and building a range of solutions for the field service and construction industries."

"We're excited to start this path with simPRO and K1," said Cliff Mitchell, ClockShark CEO. "It opens up many opportunities for ClockShark as a company, and for the customers we serve. We chose to move forward with simPRO because of its global footprint which will provide us access to additional markets, customers, and resources relevant to ClockShark customers."

AroFlo CEO Guy Arrowsmith echoed this sentiment. "This opportunity with simPRO and K1 allows AroFlo to continue on its growth trajectory while providing the same great product and service to its customers. We're excited to see what the future holds for all of our brands and what we can do together for the field service and construction industries."

Combined, the platforms are trusted by more than 17,000 businesses, 320,000 users and have over 500 staff in offices throughout Australia, New Zealand, the United Kingdom and the United States, with continued expansion anticipated in all geographies.

"K1 sought to invest in a global category leader that is transforming the way field service operators do business," said Simon Yu, senior vice president at K1. "simPRO's global growth momentum will only accelerate with the complementary acquisitions of ClockShark and AroFlo. K1 is thrilled to partner with Sean and his team in creating a platform that can support the broadest range of customers with best-of-breed solutions, globally."

Further Reading:

- Read more about Leadership & Strategy @ www.fieldservicenews.com/leadership-and-strategy

- Read more about simPRO on Field Service News @ www.fieldservicenews.com/simPRO

- Find out more about simPRO @ www.simprogroup.com

- Learb more about K1 Capital @ k1capital.com

- Follow simPRO on Twitter @ twitter.com/simprosoftware

- Connect simPRO on LinkedIn @ www.linkedin.com/simpro-software/

Nov 26, 2021 • Features • White Paper • FieldAware • Leadership and Strategy • customer experience • customer success

In this final feature from a recent white paper we published in partnership with FieldAware, we discuss if customer satisfaction metrics are suitable to identify a measure of success in a servitized or customer success-based service model.

In this final feature from a recent white paper we published in partnership with FieldAware, we discuss if customer satisfaction metrics are suitable to identify a measure of success in a servitized or customer success-based service model.

This feature is just one short excerpt from a recent white paper we published in partnership with FieldAware.

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Do we need to rethink how we measure success within our organization if we move towards a servitized or customer success focused model? This is something of a complex question, and in many ways, the answer is both yes and no.

From an operational perspective, as we put forward earlier in this paper, broadly what defines operational success in a transactional break-fix service offering largely remains the same definition of success that we would see in a servitized model.

To reiterate, in the traditional break-fix setup, metrics like mean-time-to-repair, first-time-fix-rate, and technician utilization are all indicators of how efficiently the service organization can meet the customer’s external demands and expectations.

In a servitized offering, those same metrics remain vital for ensuring that the field service operation is running at a level of efficiency that makes it both feasible and financially rewarding for the service provider to offer such as solution.

Yet as the Field Service News Research study from late 2019, Understanding the metrics that matter in a rapidly changing field service sector, revealed, of those organizations that had introduced some level of servitization into their service portfolio, over 80% of them had made changes to the KPIs they measure.

Also, remember the statistic we referenced earlier in this paper from that same report- over half (51%) of all field service organizations now placed equal importance on CSAT metrics as they did operational metrics – a statistic that has steadily risen year on year since Field Service News Research began hosting benchmarking studies in this area back in 2013.

Yet, when we think of customer satisfaction metrics, are these suitable to identify a measure of success in a servitized or customer success-based service design model?

Rudimentary statistics such as Net Promoter Score can offer a broad overview of service standards. More detailed tools like customer surveys allow more specific insights to come to the fore, and modern tools such as sentiment analysis can fill in the gaps between the two.

However, all CSAT metrics are the equivalent of driving while looking in the rearview mirror and while valuable indicators, are perhaps not focused enough for the end-goal of defining customer success.

“CSAT metrics are the equivalentof driving while looking in the rearview mirror and while valuable indicators are perhaps not focused enough for the end-goal of defining customer success...”

In earlier sections of this paper, we have touched on how co-creation often lies at the heart of many successful servitization case studies and the potential importance of an onboarding team.

When it comes to defining the core metrics for a customer success-based service model, a critical role of the onboarding team (and also of pre-sales and/or account management) should be to work with the customer to identify a shared set of metrics that will shape how success is defined.

This may require data sets from both organizations to combine a new set of KPIs that allow the service provider to ensure they meet the requirements. Should these KPIs indicate an issue, then traditional operational KPIs can provide an insight as to why. Meanwhile, broader CSAT metrics can offer an indication of the overall temperature of the service organisations success.

This more complex understanding not only of what success looks like for each customer but also leveraging existing KPIs to ensure that is happening at the macro and granular level, serves once more to re-enforce the importance of not only having the tools to empower effective service delivery but also the critical importance of reporting tools that allow the service provider to quickly and easily keep their finger on the pulse of how the service operation is performing.

In addition, such reporting tools allow the service provider to offer a layer of transparency that is crucial in communicating with the customer. This transparency leads to a relationship founded on trust. In summary, new metrics will evolve, but the old metrics remain vital and access to data is key in all areas.

This feature is just one short excerpt from a recent white paper we published in partnership with FieldAware..

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about Data Management @ www.fieldservicenews.com/data-management

- Read more about FieldAware on Field Service News @ www.fieldservicenews.com/exel

- Learn more about FieldAware @ www.fieldaware.com

- Follow FieldAware on Twitter @ twitter.com/fieldaware

Nov 23, 2021 • News • Future of field servcice • servicemax • Leadership and Strategy • GLOBAL

ServiceMax, Inc., a leader in asset-centric, Field Service Management software provides the following preliminary results for its fiscal Q3 2022 that ended on October 31, 2021.

ServiceMax, Inc., a leader in asset-centric, Field Service Management software provides the following preliminary results for its fiscal Q3 2022 that ended on October 31, 2021.

Preliminary Third Quarter Fiscal Year 2022 Financial Highlights

- Total Revenue: Total revenue was $33.2 million during the third quarter of fiscal 2022, representing an increase of 20% year-over-year. Excluding the impact of purchase accounting for the third quarter of fiscal 2021, total revenue increased 19% year-over-year.

- Subscription Revenue: Subscription revenue was $28.7 million during the third quarter of fiscal 2022, representing an increase of 23% year-over-year. Excluding the impact of purchase accounting for the third quarter of fiscal 2021, subscription revenue increased 21% year-over-year.

- Operating Results: Loss from operations was ($14.0) million during the third quarter of fiscal 2022, compared to ($15.8) million during the third quarter of fiscal 2021. Non-GAAP loss from operations was ($3.0) million during the third quarter of fiscal 2022, compared to ($5.6) million during the third quarter of fiscal 2021.

Business Highlights

- Closed acquisition of LiquidFrameworks on November 1, 2021, which advances ServiceMax's Field Service Management capabilities in the energy sector ("LiquidFrameworks Acquisition"). The acquisition was financed with cash on hand and a new $100 million term loan.

- Announced that the U.S. Securities and Exchange Commission (the "SEC") has declared effective Pathfinder Acquisition Corporation's ("Pathfinder") registration statement on Form S-4 (File No. 333-258769) relating to the previously announced proposed business combination of Pathfinder and ServiceMax (the "Business Combination"). The Extraordinary General Meeting of Pathfinder shareholders to approve the pending Business Combination between Pathfinder and ServiceMax, among other items, is scheduled for December 7, 2021, at 10:00 am ET.

The foregoing financial information for the quarter ended October 31, 2021 is unaudited and subject to quarter-end adjustments in connection with the completion of our customary financial closing procedures. Such changes could be material. ServiceMax will release full financial results for the three and nine months ended October 31, 2021, on December 9, 2021.

Financial Outlook

ServiceMax is providing financial guidance for its fourth quarter ending January 31, 2022, inclusive of the LiquidFrameworks Acquisition, as follows:

- Total revenue between $38.5 million and $39.5 million, representing an increase of 37% year-over-year at midpoint of the range.

- Subscription revenue between $34.0 million and $35.0 million, representing an increase of 42% year-over-year at midpoint of the range.

- Non-GAAP operating loss between $(7) million and $(6) million.

ServiceMax is providing financial guidance for its fiscal year 2022 ending January 31, 2022, inclusive of the LiquidFrameworks Acquisition, as follows:

- Total revenue between $134 million and $135 million, representing an increase of 23% year-over-year at midpoint of the range.

- Subscription revenue between $116 and $117 million, representing an increase of 28% year-over-year at midpoint of the range.

- Non-GAAP operating loss between ($18) million and ($17) million.

Financial Outlook

On July 15, 2021, ServiceMax entered into a business combination agreement with Pathfinder, a publicly traded special purpose acquisition company co-sponsored by affiliates of HGGC and Industry Ventures, which was amended and restated on August 12, 2021. The Business Combination is expected to close in the fourth quarter of calendar year 2021. The transaction is expected to deliver as much as $335 million of gross proceeds to the combined company, assuming no redemptions by Pathfinder shareholders, and including proceeds from a strategic common equity investment immediately prior to closing by leading software companies (PTC Inc. and Salesforce Ventures) at the same per share valuation as the Business Combination transaction. The closing of the Business Combination is expected to result in ServiceMax becoming a Nasdaq listed company under the ticker symbol "SMAX".

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about ServiceMax on Field Service News @ www.fieldservicenews.com/servicemax

- Find out more about ServiceMax @ www.servicemax.com

- Connect with ServiceMax on LinkedIn @ www.linkedin.com/company/servicemax/

- Follow ServiceMax on Twitter @ twitter.com/ServiceMax

Nov 19, 2021 • Features • White Paper • FieldAware • Leadership and Strategy • customer experience • customer success

In this new feature from a recent white paper we published in partnership with FieldAware, we discuss the proper technological infrastructure to ensure that the service operation can operate at maximum efficiency.

In this new feature from a recent white paper we published in partnership with FieldAware, we discuss the proper technological infrastructure to ensure that the service operation can operate at maximum efficiency.

This feature is just one short excerpt from a recent white paper we published in partnership with FieldAware.

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

In the previous section of this paper, we discussed the importance of a new role at the executive level, the CRO, that has oversight of revenue generation and operational efficiency. We also noted that core to this role is an understanding of how the wider business must adapt, support and buy into the broader servitization strategy.

However, perhaps of equal importance is the flow of data across the business.

Often, data is locked away in silos across a business, yet in a servitized model, the seamless movement of data is essential. For example, asset data that provides actionable insight for when service is required, which is the key to unlocking genuinely efficient predictive maintenance, is also exceptionally valuable to the product design teams as it enables them to see the common causes of asset failure and work to resolve these issues.

If accessible to account managers in a customer success model, that same data allows for a level of transparency within the relationship that can be the foundation of trust that is required for deeper, more effective partnerships. Similarly, data flow into the accounting tools used within an organization can significantly reduce the service-to-cash cycle.

To achieve this flow of data, there is an inherent need for critical systems to be able to talk to each other. Two approaches are applicable here. Either a broad platform that encompasses all of the solutions required, such as FSM, ERP and CRM or a focus on best of breed solutions in each of these areas that have easy to use APIs that allow for effortless data flow across the broader system.

While there are arguments that can be put forward for both approaches, largely, it is the latter that is the more common.

There is a degree of complexity in any organization that operates a field service division that means multiple systems in place will be running alongside each other. Replacing all of these with one platform may seem like a straightforward proposition, but in fact, it is a challenge not only from a technology standpoint but also from a change management perspective. Put simply, such a project requires time and resources that many organizations, especially those in the mid-market, just don’t have.

The alternative is not only more achievable for companies of all sizes, but with an open approach to integration, the ability for data flow to drive forward customer success efforts can be harnessed while also having the added advantage of best in class solutions where they are most needed.

When we look at the field service operation, the tools and technology that enable the efficiency required for a servitized approach are now mature and well established, with most field service organizations having at least a legacy form of FSM. Indeed, technology has become a critical aspect of field service operations. As we continue to move towards more advanced service offerings, this symbiosis of processes and technology will only increase.

Ultimately, the ability to deliver effective and efficient field service is firmly wedded to having a technology infrastructure in place.

The pandemic has been shown to have significantly driven investment within digital transformation amongst field service organizations. A study by Field Service News Research, Benchmarking the New Normal from Year Zero, from late 2020 revealed that two-thirds (65%) of field service companies stated that their digital transformation programs had been accelerated since Covid-19.

Technologies that enable remote service delivery and accurate predictive maintenance scheduling such as Augmented Reality and Internet of Things connectivity have rapidly evolved from being at the leading edge of an adoption curve to becoming utilized far more prevalently by field service organizations.

Adoption of such new technologies, of course, only strengthens the argument for core systems such as CRM and FSM to have robust API development.

However, while it is the newer technologies that often dominate the headlines when we consider the shift in focus of servitization and customer success models from being a mere service provider to becoming a genuine partner with a vested interest in the optimal performance of an install base, then the need for a robust technological foundation underpinning field service operations is more crucial than ever before.

From the back-office perspective, tools such as asset management, work order management, scheduling and dispatch and route optimization are now table stakes for field service organizations to deliver effective field service delivery.

Tools that can empower our field service technicians and engineers such as knowledge management, easily accessible forms, alerts and notifications and more, all packaged in an intuitive mobile app, are equally essential.

In addition to these more traditional tools found within an FSM system, customer portals, reporting and insight surfacing tools and invoicing are all becoming increasingly critical to allow the field service organization to operate at a sufficient level of efficiency where servitization or customer success models can be effectively executed.

Having looked at the potential requirements of both management structure and technologies needed to adopt a customer success orientated approach to service strategy, the final question we shall address next week is whether these changes mean that we must also change the way we measure success...

This feature is just one short excerpt from a recent white paper we published in partnership with FieldAware..

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about Data Management @ www.fieldservicenews.com/data-management

- Read more about FieldAware on Field Service News @ www.fieldservicenews.com/exel

- Learn more about FieldAware @ www.fieldaware.com

- Follow FieldAware on Twitter @ twitter.com/fieldaware

Nov 15, 2021 • News • BigChange • Leadership and Strategy • EMEA • field service industry • Field Service Expo

During our Field Service Expo, which took place in Birmingham on 27th and 28th of October, BigChange held a presentation discussing the findings of a major research project that the company has conducted about the state of UK's field service sector.

During our Field Service Expo, which took place in Birmingham on 27th and 28th of October, BigChange held a presentation discussing the findings of a major research project that the company has conducted about the state of UK's field service sector.

Nick Gregory, Chief Marketing Officer at BigChange, discussed how the company has performed a health check of the status of the UK's field service sector to better understand the impact of the pandemic in the industry, how businesses have fared since COVID-19 restrictions have been lifted and what challenges and opportunities field service organisations are facing today.

If you haven't been able to attend our event, you can now watch BigChange's presentation by clicking below.

Data usage note: By accessing this content you consent to the contactdetails submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content BigChange who may contact you for legitimate business reasons to discuss the content of this video, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Further Reading:

- Read more about Leadership & Strategy @ www.fieldservicenews.com/leadership-and-strategy

- Read more about the impact of COVID-19 in the Field Service industry @ www.fieldservicenews.com/covid-19

- Read more about BigChange on Field Service News @ www.fieldservicenews.com/bigchange

- Learn more about BigChange @ www.bigchange.com

- Follow BigChange on Twitter @ twitter.com/bigchangeapps

Nov 12, 2021 • Features • White Paper • FieldAware • Leadership and Strategy • customer experience • customer success

In the second feature from a recent white paper we published in partnership with FieldAware, we analyse the need of a shift in management structure for service organisations with a customer success focused model.

In the second feature from a recent white paper we published in partnership with FieldAware, we analyse the need of a shift in management structure for service organisations with a customer success focused model.

This feature is just one short excerpt from a recent white paper we published in partnership with FieldAware.

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Suppose we consider customer success more in line with a servitization model than simply increasing CSAT metrics. In that case, we may start to see a more straightforward path towards developing the model. However, this

also leads us to conclude that such a shift in focus for a service organization will require significant changes within processes and potentially a change in management structure.

The established servitization models are centred around establishing long- standing partnerships between the service provider and the customer. Indeed, as we look at many of the high-profile examples of servitization, often in the early adoption of such service strategies, not only is customer selection crucial, very often, the evolution of the service model is one of genuine co-creation.

One acknowledged approach in developing such forward looking service design is establishing a tiger team – a group of specialists dedicated to the project full- time. In the co-creation model, such a team can comprise both organizations bringing in their specialist expertise, knowledge and insight. Additionally,

both organizations also develop the new approach parallel to existing service agreements, which is especially important when considering the mission-critical status that field service operations hold.

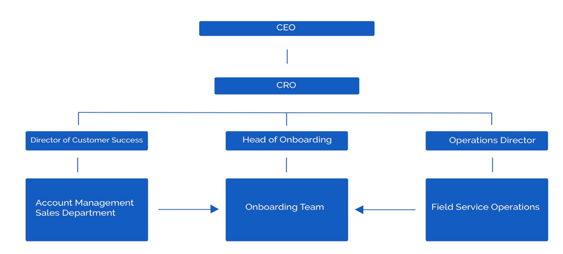

However, once the proof of concept is established, should the service provider wish to roll out a more comprehensive servitized offering, a clear management structure to facilitate the effective rollout is required.

We would expect to see an executive-level leader at the top of this structure – ideally reporting directly to the CEO.

Such a position may come in several guises. One option is the role of a chief revenue officer (CRO), which we are beginning to see emerge as a blend of the two roles of Chief Service Officer and Chief Sales Officer.

Another alternative could be Vice President of Customer Success. For ease of reference, we shall use the term CRO in this paper. Regardless of the name, the function of the role remains the same.

This is a position that requires an intimate understanding of where the value proposition of the service provider lies within the eyes of the customer (to drive successful approaches to revenue generation), while simultaneously having detailed knowledge of how the service operations can effectively meet the service delivery requirements while retaining efficiency both in terms of internal costs but also meeting the customer goals.

In addition to both of these skillsets, the potential CRO must also have the broader business acumen and insight to see how such a move will impact and draw upon other aspects of the organization as well – from R&D through to marketing.

Beneath the CRO, a hypothetical management structure could be mapped out into three key areas as per the graphic below.

On the left-hand side, we have a customer success team led by a director of customer success.

This would be a business division that evolves from the traditional sales team – with a heavier emphasis from account management on customer success and account development – i.e. building those long-standing, more deeply embedded relationships discussed earlier.

On the right-hand side, this structure is where our service operations business unit sits under the leadership of an operations director.

On this side of the operation, the shift in focus is perhaps less pronounced than the sales operation. In one sense, little changes in seeking the maximum efficiency and operational metrics such as technician utilization, mean-time-to- repair and first-time-fix rates remain as crucial as ever.

Ultimately, even in a fully servitized business model, the SLAs to be adhered to remain the same; however, they move from being an external agreement with the customer to being an internal requirement designed to allow the service operation to meet the guarantees of uptime that are now the bedrock of service contract.

However, we see a potential new business unit emerge in the centre of this new management structure – one dedicated to onboarding. In this case, it is also important to note that onboarding isn’t limited to new customers.

" While a similar structure could be adopted for various types of servitized offering, be it outcome-based service or a customer success focused model, the evolutionary leap from a csat focus will very likely involve both executive- level support and some restructuring of management structure..."

Most service organizations adopting such an approach will be taking their existing customers from a service model that they have been comfortable with for a long time to a far more holistic and encompassing model of service delivery.

Such significant change will almost always face some form of resistance. It is essential to have this interim team in place to help guide the customers through the transition from what is often a transactional relationship initially to one that becomes a true partnership.

Ideally, this onboarding team will bring a blend of in-depth operational experience and fantastic account management skills. A recommended approach could be to draw from both the operations and sales sides of the business to establish this new business unit.

This is, of course, just one hypothetical and fairly straightforward management structure to help illustrate the point. Many more complex variations could be implemented to achieve the effective development of a servitized or customer success-focused business model.

What is clear, though, is that while a similar structure could be adopted for various types of servitized offering, be it outcome-based service or a customer success focused model, the evolutionary leap from a CSAT focus will very likely involve both executive-level support and some restructuring of management structure.

Another critical aspect essential to the successful adoption of such a model is the easy flow of data across business units and the proper technological infrastructure to ensure that the service operation can operate at maximum efficiency – which we will discuss in the next feature from this white paper.

This feature is just one short excerpt from a recent white paper we published in partnership with FieldAware..

www.fieldservicenews.com subscribers can read the full white paper now by hitting the button below.

If you are yet to subscribe you can do so for free by hitting the button and registering for our complimentary subscription tier FSN Standard on a dedicated page that provides you instant access to this white paper PLUS you will also be able to access our monthly selection of premium resources as soo as you are registered.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content FieldAware who may contact you for legitimate business reasons to discuss the content of this white paper, as per the terms and conditions of your subscription agreement which you opted into in line with GDPR regulations and is an ongoing condition of subscription.

Further Reading:

- Read more about Digital Transformation @ www.fieldservicenews.com/digital-transformation

- Read more about Data Management @ www.fieldservicenews.com/data-management

- Read more about FieldAware on Field Service News @ www.fieldservicenews.com/exel

- Learn more about FieldAware @ www.fieldaware.com

- Follow FieldAware on Twitter @ twitter.com/fieldaware

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Leave a Reply