Manufacturers will more than double Multicloud use in the next two years, a new report predicts.

ARCHIVE FOR THE ‘manufacturing’ CATEGORY

Jul 04, 2019 • Future Technology • News • future of field service • manufacturing • cloud • IoT

Manufacturers will more than double Multicloud use in the next two years, a new report predicts.

Nutanix has announced the findings of its Enterprise Cloud Index results report for the manufacturing sector, measuring manufacturing companies’ plans for adopting private, public and hybrid clouds.

The report revealed that the manufacturing industry’s hybrid cloud usage and plans outpace the global average across industries. The deployment of hybrid clouds in manufacturing and production companies has currently reached 19% penetration, slightly ahead of the global average. Moreover, manufacturers plan to more than double their hybrid cloud deployments to 45% penetration in two years; outpacing the global average by 4 percent.

The manufacturing industry is at an “innovation impasse,” 1 meaning manufacturers have a desire to innovate and drive transformation, but legacy IT systems have the potential to constrain their ability to do so. The opportunity for manufacturers to embrace digitization efforts including “Industry 4.0” initiatives can break the impasse, but executives must focus on new opportunities to create value and not only prioritize traditional business operations. Manufacturing organizations face the constant challenge of trade-offs: they are under pressure to meet current productivity and operational goals in an increasingly global and highly competitive marketplace, but they also need to invest in future growth.

This challenge has created a demand for new technology solutions that can help balance the trade-off between current and future goals. IT leaders in manufacturing must avoid the beaten path of finding short-term fixes for increasing revenue; instead, they should look to long-term solutions that enable automation, enhanced use of data and improvements in customer experience. The Enterprise Cloud Index findings indicate that manufacturing leaders are aggressively adopting new technology to embrace modernization instead of getting left behind with legacy systems. The distributed cloud model offers a solution that delivers speed, flexibility, and localization, allowing manufacturers to improve efficiency without compromising quality.

While 91% of survey respondents reported hybrid cloud as the ideal IT model, today’s global average hybrid cloud penetration level is at 18.5% — the disparity due in part to challenges of transitioning to the hybrid cloud model. Manufacturing industries reported barriers to adopting hybrid cloud that mirrored global roadblocks, including limitations in application mobility, data security/compliance, performance, management and a shortage of IT talent. Compared to other industries, manufacturers reported greater IT talent deficits in AI/ML, hybrid cloud, blockchain, and edge computing/IoT.

Other key findings of the report include:

- 43% of manufacturers surveyed are currently using a traditional data center as their primary IT infrastructure, slightly outpacing the global average of 41%;

- However, manufacturers currently use a single public cloud service more often than any other industry. 20% of manufacturing companies reported using a single cloud service, compared to the global average of 12% — a testament to the fact that manufacturers are starting to turn to the cloud as a solution, given that they deal with legacy IT systems and cannot handle workloads on-prem;

- Manufacturers are also advancing the movement to private cloud: 56% of manufacturers surveyed said that they run enterprise applications in a private cloud, outpacing the global average by 7%;

- Manufacturers are struggling to control cloud spend. One motivation for deploying hybrid clouds is enterprises’ need to gain control over their IT spend. Organizations that use public cloud spend 26% of their annual IT budget on public cloud, with this percentage predicted to increase to 35% in two years’ time. Most notable, however, is that more than a third (36%) of organizations using public clouds said their spending has exceeded their budgets;

- Manufacturers chose security and compliance slightly more often than companies in other industries as the top factor in deciding where to run workloads: while 31% of respondents across all industries and geographies named security and compliance as the number one decision criterion, 34% of manufacturing organizations chose security and compliance as the top factor.

The bullish outlook for hybrid cloud adoption globally and across industries is reflective of an IT landscape growing increasingly automated and flexible enough that enterprises have the choice to buy, build, or rent their IT infrastructure resources based on fast transforming application requirements.

“Manufacturers are investing in modernizing their IT stack, and adopting industry 4.0 solutions to keep up with ever-changing business demands in areas like production and supply chain management,” said Chris Kozup, SVP of Global Marketing at Nutanix. “A hybrid cloud infrastructure gives manufacturers a fresh approach to modernizing legacy applications and services, enabling manufacturing IT leaders to focus on their long-term investments in big data, IoT, and next-generation enterprise applications. While the manufacturing industry is still facing obstacles in transitioning to multi-cloud use, this study shows us that manufacturing organizations are ready to accelerate growth and take the lead in IT innovation in the future.”

To create this report, Nutanix commissioned Vanson Bourne to survey more than 2,300 IT decision makers, including 337 worldwide manufacturing and production organizations, about where they are running their business applications today, where they plan to run them in the future, what their cloud challenges are and how their cloud initiatives stack up against other IT projects and priorities. The survey included respondents from multiple industries, business sizes and geographies in the Americas; Europe, the Middle East, Africa (EMEA); and Asia-Pacific and Japan (APJ) regions.

1 IDC FutureScape: Worldwide Operations Technology 2018 Predictions, doc #US42126317, October 2017

Jun 04, 2019 • Features • 3D printing • manufacturing • Additive Manufacturing • Parts Pricing and Logistics

An industrial products manufacturer has a large portfolio of spare parts in its portfolio. It has 10 year service contract with its customers implying that the company must be able to deliver spare parts on time for 10 years to its customers even though the product may longer be produced. Thus, the company has to maintain inventory of some of those spare parts. Such inventory costs run into millions of dollars. Many of those spare parts are produced by suppliers. Demand for those spare parts are low and unpredictable.

On Monday morning, the spare parts manager received a call from a customer in another continent “ Mr. Paul, our equipment is out of action as it cannot be started in the morning shift. My maintenance guys confirmed we need to replace a part, supplied by you and we do not have it in inventory. I am sending you the part number. Please deliver it within three days otherwise there will be heavy loss.” Mr. Paul checked the part number in the ERP and found that they also do not have in stock.

He found out who the supplier is and called him up. The supplier replied saying that they cannot make only one piece. They will need an order size of at least 20 and it will take 1 week. What will Mr. Paul do? He remembered that the Vice President (VP) of Supply Chain was talking about 3D Printing of spare parts in the last meeting. Can the part be printed? How will Mr. Paul figure that out?

He refers to the presentation by VP- Supply Chain and finds the name of a company called 3D Hubs (UPDATE: 3D Hubs is now Hubs). Mr. Paul checks out the website of 3D Hubs and found that he can upload the drawing of the parts and get an analysis for printability along with a quote. He uploaded the drawing, got the quote for delivery within three days and went to his boss.

His boss, Mr. James said “Are you crazy? How will I be able to justify that price? Also, have you noticed that they are not printing our part using our specified material? This will never work.” Mr. Paul tried to argue “This is a very strategic customer for us. If they are not satisfied and cancel the service contract, it will be a big trouble for us. We can say that they can run their equipment with it until an actual replacement spare part is produced and delivered by the supplier. I can talk to R&D about the approval for the deviation in material. It doesn’t seem to be a big change.” Mr. James said “You are taking a big risk, Paul. If you want to try, go ahead.”

In the end, everything turned out well. That part was produced using additive manufacturing (AM) and delivered on time. Paul received appreciation for his efforts. VP- Supply Chain was very happy and said to Paul. “Now, I want to evaluate our entire spare part portfolio and develop a systematic process of evaluating which of those parts can be printed and which cannot. It will be great if you can evaluate our portfolio and present in our next month’s meeting.”

Paul has 10 years of experience in spare parts but he does not know much about 3D Printing. How can we help Paul? I am sure that there are many people like Paul in large industrial manufacturers, who need similar help. Lets try to outline a steps-by-step process for selecting spare parts suitable for additive manufacturing.

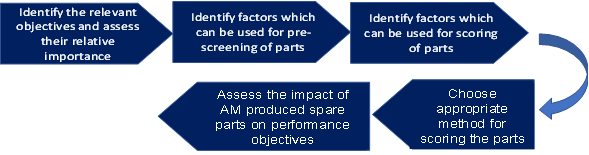

Step 1: Identify the objectives

Some potential objectives for producing spare parts using AM can be:

• Supply risk reduction;

• Lead time reduction;

• Inventory cost reduction;

• Ensuring local content;

• Minimizing loss of production;

• Reducing carbon foot print across life cycle.

Companies can decide the most relevant ones from those and provide relative importance of those using a method called analytic hierarchy process. Instead of directly assigning importance weights to each objective, experts within the company can make pairwise comparison of the objectives using a scale (for example 1-3-5-7-9) and derive the importance weights.

Step 2: Identify the factors to be used for screening the spare parts for AM suitability

Some factors, which can be used for screening the spare parts for AM suitability can be as follows: It is important to note that the company should have data on the following factors to be considered for screening.

If such data is not available or available in different IT systems or in physical form ( i.e. drawings with dimensions and material specifications), it will be difficult to include those at the screening stage.

1)Demand and demand uncertainty of the parts

Parts with low and uncertain demand are more suitable for spare parts

2) Overall part size

(Part must fit build volume of the equipment) As the equipment for different AM technologies have build size restrictions, part-size is usually a restriction, if it cannot be fitted in the build chamber. Sometimes changing the orientation of the part may be needed to fit it into the build chamber, but it might require additional support structures and may increase the overall production time. Decisions about part orientation in the build chamber can be taken only for the selected parts and not at this stage. The company can specify the upper limit of size or a range of sizes of parts, which they would like to consider

3) Materials

Not every material can be printed. Thus, parts whose specified materials can be printed can be screened when a company is starting on its journey of producing spare parts using AM. Later, alternate materials which closely match the specifications can be explored.

4) Supply lead time

Parts with long supplier lead time for conventional manufacturing can be more suitable for producing using AM as overall lead time can be reduced. A company may decide to specify either the lower limit or range of lead time, which they would like to consider.

5) Purchase price or unit cost

High priced parts, in general, can be suitable for AM but some high valued parts may be infeasible because of their size or materials etc.

6) Value of inventory across all locations

Usually parts with high inventory value can be good candidates to be produced using AM. High value of inventory can be due to high number of parts in stock or due to high prices. Sometimes, if a lot of stock is available, a company may decide not to proceed with producing such a part using AM. Some other company may decide that they would like to get rid of that stock and hence it may be worth producing those using AM. A company may also decide to include either price or inventory value as a screening factor.

Figure 1: Step-by-step approach for selecting spare parts suitable for AM

Step 3: Identify the factors to be used for scoring the spare parts for AM suitability

Some potential factors for scoring spare parts in terms of their suitability for AM can be as follows:

• Lead-time;

• Unit cost;

• Criticality in terms of influence of the part for equipment shutdown;

• Demand predictability measured as standard deviation of demand;

• Supply risk in terms of number of suppliers;

• Minimum order quantity.

The screened parts can be scored based on the above factors and how the factors are related to the objectives. Parts with long lead time, high cost, high criticality, low demand predictability, high supply risk and high minimum order quantity in the existing manufacturing process will be more suitable for AM.

Step 4: Choose appropriate method for scoring the parts

There can be multiple approaches to score the spare parts in terms of suitability to be produced using AM.

We mention some basic guidelines below:

1. Multi-criteria decision making approach (MCDM) –scoring parts on factors and linking factors to be objectives (suitable for less number of factors and less number of parts).

2. Logic decision diagrams, cluster analysis and fuzzy inference system (suitable for large number of parts, medium number of factors but strong interrelationships of factors and objectives). If the factors are dependent on each other and how they influence the objectives depends on the levels of the factors i.e. low, medium and high, logic decision diagrams can be built to score a part using different decision rules. In terms of disagreement between experts about the relationships, the relationships can be expressed as fuzzy numbers and fuzzy inference system can be used to score the parts.

3. Cluster analysis and MCDM approach for ranking of part clusters and within cluster ranking of parts (large number of diverse parts, limited to medium number of factors and independence of factors) If the factors considered are independent but the spare parts portfolio is very diverse, it will be necessary to cluster the parts, rank the clusters and then rank the parts within the clusters.

4. Bottom-up expert driven selection using a questionnaire or selection protocol (no data available or not possible to do quantitative analysis) If no data is available in digital form to score the parts, it is prudent to use the expert judgment of the service personnel or maintenance technicians. But, as those persons may not be aware of AM technologies, it is important to demonstrate to them what is possible using AM through workshops and ask them to suggest spare parts, which they find most difficult to get. Companies can also potentially run internal competitions to identify some spare parts to start with.

Step 5: Assess the impact of AM produced spare parts on performance objectives

Once some spare parts are identified, the next step is to develop business cases for the parts. But, those can be done once the appropriate technologies and equipments are identified. For that purpose, a database of all available AM equipments, the technologies they use, the materials they use, the build chamber of the equipments, the surface finish achievable need to be documented.

For the spare parts which are scored high in terms of their suitability for AM, the most appropriate technologies and equipments can also be shortlisted. Then total-cost of ownership based cost models need to be developed to understand the economic implication of producing the parts using AM. The relevant cists which need to be considered are materials, production, energy, labour as well as the savings in inventory and transportation costs over the lifecycle of usage of the parts for different demand scenarios.

Quotes from different service providers can also be used as a reference for taking the final decision. Once a company has done this exercise and identified a few feasible parts, some machine learning techniques can be used to identify the patterns amongst the most suitable parts so that the process can be automated when new parts are added to the portfolio.

May 23, 2019 • video • Features • Astea • Kris Oldland • manufacturing • Video • field service • Internet of Things • IoT • Servitization • John Hunt

May 16, 2019 • video • Features • Astea • Kris Oldland • manufacturing • Video • field service • Internet of Things • IoT • Servitization • John Hunt

May 09, 2019 • video • Features • Astea • Kris Oldland • manufacturing • Video • field service • Internet of Things • IoT • Servitization • John Hunt

May 02, 2019 • video • Features • Astea • Kris Oldland • manufacturing • Video • field service • Internet of Things • IoT • Servitization • John Hunt

Apr 13, 2019 • Features • Future of FIeld Service • manufacturing • Risk Management • Shaun West

When a supplier decides to provide more than just product-related services it has to consider risk over the whole product life-cycle because the risk is no longer just a “warranty”.

Traditional manufacturing companies are often strong with risk-management process on the product side, however they fail to grasp the complexity associated with managing risk on the service side. Based on the interviews with fourteen companies operating globally and domestically in different fields: from power generation to food industry, this paper introduces their insights on risk awareness and evaluation in services.

Some companies produce high capital goods and services constitute the part of the product-service portfolio; others offer purely services; their annual revenues vary from millions to billions. Another aspect is that some of those are pioneers in service provision rather than others already have long experience in the service business. So, we can classify them by the percentage of service sales: three companies with service sales up to 25%, five companies indicate service sales between 25 and 40%, and four firms provide purely services (100%); also, two respondents present opinion on risk from the customer perspective.

Industrial feedback on risk in services revealed that service providers neither recognise risk as a competitive advantage nor actively implement risk management practices into service offer creation. This white paper provides guidance on how to understand and manage risk to create competitive advantage in a product service system environment.

Risks From An Asset Life-Cycle Perspective

Risk should be initially considered on an asset life-cycle perspective. (See Figure 1.)

Today a well-documented example is the Rolls-Royce Trent engine, the turbines of which fail to meet the operational performance due to poor design. The deterioration of turbine blades inside Rolls-Royce jet engines has required constant monitoring of the engines, urgent maintenance and repairs through 2022.

The problems have caused serious disruption to airlines — and they are proving costly to the engine-maker. Rolls-Royce reported an accounting charge of $315 million to cover ongoing repairs to two models of its jet engines it has supplied for more than 200 aircraft as well as compensation to airlines for planes taken out of service for the engine retrofits.

Which confirms the fact that issues at early stages cause significant risks and endanger not only product performance but also the reputation and financial stability of the service provider.

Service offering and embedded risks

In order to see what particular services industrial companies offer we analysed 14 firms. The analysis confirmed that in general there was risk transfer from the basic services to the more advanced services. A variety of services can be built-up in product-service portfolios depending on company’s ability and readiness to deliver good service, risk acceptance, as well as the type of relationships service provider wants to establish with a customer.

The analysis also showed that they provided three different levels of service: product services, operations support services, life cycle and asset support services. The typical services in each level are shown in Table 1 (below) and have been categories based on the service level.

I. Product services – represent services which are closely associated with a product or to help the customer to gain access to it, often mostly associated with the maintenance of the equipment.

II. Operations support services – represent services that support the operation of the equipment provided.

III. Life-cycle/asset support services – support the product over its life; they are designed to ensure good asset performance and to help to improve performance based on new technologies and market requirements. When building a portfolio of products and services, companies should consider risks over the product life no matter whether it is basic or advanced service

agreement.

The execution risks will continue to repeat unless effective control and improvement measures are put in place. The statistical information on the failure rates will support the understanding of the commercial risks ensuring that they reduce the negative impact.

Finally, if it is not tracked, how do you know where the problem is, the root cause and how to best solve it in future products?

Execution and Commercial risks

This white paper breaks risks into two closely related categories, the first is execution risk and the second is a commercial risk. Execution risk is the additional cost that the firm has due to execution failures and closely associated with service delivery, includes internal and external quality problems, late completion, or post service failures due.

For example, the late delivery of a small consumable item can mean that inspection work on the machine cannot be completed on time. This can then trigger commercial risk to come to play which could be many times larger than the cost of the consumable item.

The commercial risk can be made by the supplier at the contracting stage, such as unsuitable contract decisions, typically firms overpromise performance (delivery, availability etc.), or have unsuitable agreements for services. These are often related to the execution risk (e.g., late delivery) and can be significantly higher in value (e.g., liquidated damages resulting from the late delivery).

This is shown graphically in Figure 2 (below) where the supplier’s liquidated damages never cover the customer’s risk fully, this is because the customer’s business risk is typically orders of magnitude greater than those of the supplier.

Therefore, the customer needs to either self-insure and to buy insurance to cover their full consequential and business interruption costs. The supplier should always consider the full impact it can have on customer’s business because the liquidated damages will likely only cover a part of the customer’s losses.

The use of risk/reward-type performance commitments should incentivise the supplier to achieve the right outcome for their customer, it is not a replacement for insurance.

Understanding Risks

At each stage from the beginning, different risks may unstable internal processes, increase the time to the market and affect future performance of the product. For example, poor reliability of a part decreases the overall reliability of the product, consequently, the supplier under a basic after-market service holds minimum risk and only responsible for the replacement of the first failing part under warranty.

Under an advanced service agreement (performance/output-base) the supplier is responsible for removing and replacing the part as well as paying the liquidated damages for poor performance due to machine downtime because its customer has a revenue loss.

So, the supplier is not only exposed to execution risk but also to significant commercial risk: it has to pay the liquidated damages meaning customer is partly compensated for the loss of performance. Interviews confirmed that risks rise both at the service contracting stage and at the delivery stage, so they refer to commercial risk and operational (execution) risk.

It is common for manufacturing firms to have well defined contracts for new equipment sales whereas service contracts may be less appropriate for the service environment, being more applicable to the sale of basic rather than advanced services.

It is very challenging for contract or project managers identify and measure potential risks and create sort of standardised approach for risk assessment.

Their role is to determine the risks that customers expect them to take with service contracts as well as evaluate the critical risks that they finally accept. The deep understanding of the customer, awareness of your capabilities can decrease the lack of information and associated counterparty risks.

The supplier can actually create competitive advantage by building an active model for risk management. Understanding the risk implies that service provider can identify and measure the risk it transfers from the customer.

Calculating the Value at Risk

Only knowing the possibility of risk appearance does not solve the problem, more important is to know the frequency of events, its execution and commercial impact. Digitalization can help here in the form of data analysis of performance (e.g., lead times, number of failed starts, output), so the firm should create a database that allows the supplier to model and predict risks. By collecting and analysing data on product design or manufacturing issues, failure rates and time (logistics or maintenance completion), the supplier also knows what must be changed or improved as well as understanding the cost of mitigation. Statistical analysis helps service providers to understand better their capabilities and to control risks.

The Value at Risk (VaR) concept is defined as an expected maximum loss of the risk position and it is widely applied in the finance industry. For example, we take the planned maintenance and the issue would be late delivery of parts which was promised at 26 days.

From the past (data analysis), we have to find out what is our actual lead time and deviation from the ‘expected’ lead time. Form this we can calculate the expected execution cost and predict the commercial impact based on the lead time.

The total risk is the position valued at current prices, in our case is the total execution and commercial, from which we can define the expected maximum loss.

The higher the chosen confidence level is, the higher the potential maximum loss. From these principles and calculations results drawn from the concept, the VaR of individual risk position can be derived.

This analysis will help the supplier to decide on what delivery terms, performance commitments or other KPIs they can provide as well as calculate the commercial value of the contract with particular services.

Answers to these questions also will tell what liquidated damages to expect for availability, reliability, efficiency and late delivery if supplier choses terms that do not correspond to statistical analysis.

Pricing the risk

Now that we understand the value at risk, it is important to price the risk. This is because you are taking risk from the customer and you are therefore providing a valuable service for them. How can this additional service be priced? First, the price should be above the cost otherwise you are not getting a reward for taking the risk! Questions to ask yourself when estimating the ‘fairprice’ to charge:

• What are the customers critical performance measures or outcomes?

• How much would it cost the customer to take the risk themselves?

• How much pain are you really taking from the customer?

• Is the gain/pain sharing balanced?

• What do you think is their ‘willingness-to-pay’?

Do not accept to hold a risk where they cannot control or mitigate the risk, taking market risks is not a sure-fire way to go out of business. Finding a balance with the risks so that you are incentivised to improve performance and outcome for the customer is nevertheless difficult but something worth doing.

Learn from past experiences, the RR example with the Trent engine was predictable as were the costs. Recommendations Firms should consider how they assess risk for product service systems, this is practically important for advanced services. It is recommended to measure execution and commercial risks for every project.

Learning to track the events that cause both execution and commercial risks will help you to better understand the risks and the costs associated with them.

By being more proactive in risk management, industrial firms can turn the risk into commercial advantage.

Mar 27, 2019 • Features • Advanced Services Group • Aston Centre for Servitization Research and Practi • Data Capture • Future of FIeld Service • manufacturing • Monetizing Service • Professor Tim Baines • Servitization • tim baines

Digital technologies, IoT and digitalisation have been big topics in the manufacturing sector. Combined with services, digital seems to be the answer for a multitude of manufacturing questions, if you take the hype at face value.

But for many manufacturers, digital actually raises more questions than it answers, with one particular question at the centre: how to capture the value of digitally-enabled services?

The Advanced Services Group at Aston Business School has recently released a whitepaper on performance advisory services, which aims to cut through the hype and provide clear information and insight into how manufacturers can make the most of digitally-enabled services.

Real business insight

In this whitepaper, we wanted to reflect real business insight and real business challenges. We invited senior executives from a range of manufacturing companies - from multinationals such as GE Power and Siemens to local SMEs – for a structured debate on digitally-enabled services.

The discussion and its outcomes formed the basis of the research for the whitepaper and helped crystallise the three areas that are most important to manufacturers:

1. Performance intelligence and data as a service offering;

2. How to capture value from these services;

3. How to approach the design process to achieve success.

What are performance advisory services?

The process by which a manufacturer transforms it business model to focus on the provision of services, not just the product, is called servitization. Generally, we distinguish three types of services. Base services, such as warranties and spare parts, are standard for many manufacturers and focus on the provision of the product. Intermediate services, such as maintenance, repair and remanufacturing, focus on the condition of the product. Advanced services take a step further and focus on the capability that the product enables.

In this framework, performance advisory services are situated in between intermediate and advanced services. Typically, these are services that utilise digital technologies to monitor and capture data on the product whilst in use by the customer. These insights can include data on performance, condition, operating time and location – valuable intelligence that is offered back to the customer, in order to improve asset management and increase productivity.

Why are they attractive to manufacturers?

Performance advisory services are attractive to manufacturers because they allow the creation and capture of value from digital technologies that are likely in use already. Take the example of a photocopier - with the addition of sensors that monitor paper and toner stocks, it can send alerts when stocks are getting low. This kind of data is valuable to the customer, as it will help improve inventory management and avoid service disruptions or downtime, but it is also valuable to the manufacturer in helping them understand how the product is used, providing data that they can use to re-design products or to develop and offer new services.

Making money from performance advisory services.

Performance advisory services offer the manufacturer the potential to capture value either directly or indirectly and there is a strong business case for either. Whilst charging a fee directly for data or a service provided is compelling, the potential indirect value for the manufacturer should not be underestimated, as it can yield not only greater control and further sales, but also new and innovative offers, as well as improved efficiencies.

"Performance advisory services are situated in between intermediate and advanced services..."

In the photocopier scenario, the data generated could be sold to the customer as a service subscription, thus earning money directly.

Alternatively, the manufacturer could use the data generated for maintenance programmes or pre-emptive toner and paper sales, thus earning money indirectly. In reality, however, direct and indirect value capture are likely to go hand in hand. A prime example of this is equipment manufacturer JCB, whose machines are fitted with technology to alert the customer if the equipment leaves a predefined geographical area.

For the customer, knowing the exact location of the equipment is valuable – as it may have been stolen. But it also greatly improves efficiency for the manufacturer when field technicians are sent out for maintenance work and do not lose time locating the vehicle.

Performance advisory services - just one step on the journey to servitization

Performance advisory services present a compelling business case for manufacturers looking to innovate services through digital technologies, in order to improve growth and business resilience.

With the immediate opportunity to capture value, these digitally-enabled services are a first step for many manufacturers towards more service-led strategies and servitization.

But that is what they are – just one step on the journey to servitization. Manufacturers looking to compete through services should not stop with performance advisory services.

In the environment of a more and more outcome based economy, it is imperative to understand the potential of taking a step further to advanced services and to recognise performance advisory services as a step toward this.

The full whitepaper Performance Advisory Services: A pathway to creating value through digital technologies and servitization by The Advanced Services Group at Aston Business School is available for purchase online here.

Mar 25, 2019 • Features • 3D printing • manufacturing • Parts Pricing and Logistics

Of all the technologies currently vying for the attention of field service professionals, 3D printing is the one that appeals most to the imagination.

Sure, Augmented Reality and Artificial Intelligence are exciting, and the use-case for both is becoming stronger. But how about a printer that prints a tangible, useful component? A spare part that an engineer can produce and integrate while out on a job. What if 3D printers with robot arms were the final part of a first-time fix process, working in tandem with selfmending, machine learning assets?

I say the above with tongue firmly in cheek. I think we’re a long way from a technician-free fixing procedure; in fact, I think the human, engineer element will always be a constant, but you can see why the technology gets the juices flowing.

That said, the concept of 3D printing or additive manufacturing is not as new as we might think and has been in a period of gestation for nearly 40 years. Its first milestone was in 1981 when Dr. Hideo Kodama from the Nagoya Municipal Industrial Research Institute published an account of a working photopolymer rapid prototyping system. A machine that produced photo-hardened materials, corresponding to a cross-slice of a model, that when layered create 3D tangible parts.

Unfortunately, lack of funds meant Doctor Kodomo was unable to pursue his theories but American Charles Hull, in 1984 etched (or printed) his name in history by inventing stereolithography which used digital data to produce the 3D model. Then in the early 90s, the world’s first Selective Lasering Sintering (SLS) machine was invented, which shot out a powder, rather than a liquid, to build a solid (if slightly imperfect) 3D object.

The turn of the millennium saw the medical sector fully embrace 3D printing when over the space of ten years, scientists were able to create a miniature kidney, a prosthetic limb and bio-printed the first blood vessels using only human cells.

But where are we now with the technology and what manufacturing industries are really squeezing out the potential of additive manufacturing?

“We do not have enough people who can design a product for 3D printing..."

“The forerunners of the adoption of these technologies have been the aerospace and automotive sectors,” says Atanu Chaudhuri an Associate Professor of Operations and Supply Chain Management at the University of Aalborg and an expert in additive manufacturing. “However, there are a lot of other industrial manufacturers who are exploring this but are at different stages of adoption.”

I recently recorded a podcast with Atanu, ahead of his presentation at the Spare Parts Business Platform in Stockholm, which focused on the 3D printing of manufactured spare parts. With producers at various stages of integration, I asked what challenges they faced.

“One of the most critical challenges is the lack of skills,” he says. “We do not have enough people who can design a product for 3D printing, who can understand the process and technology. However, I think the companies who have invested in the machines, they have taken a step forward, but it is always a costly investment and there has to be a strong business case.”

The business case is essential when discussing any adoption of technology not just in additive manufacturing but in other young technologies. Boards are keen to see a genuine return on its investment especially when it carries financial risk.

However, in the case of 3D printing, Chaudhuri urges companies to take a long-view. “If a company was to do a one-to-one comparison with existing manufacturing technology, it’s most likely that 3D printing will not be suitable,” he admits.

“But if you take a more life—cycle perspective and look beyond the cost on a part-to-part comparison or look at the usage of the part over a lifetime of the product, say 15 or twenty years, suddenly you will see a huge difference.

“You will not be having a lot of inventory, you reduce the inventory carrying costs and maybe the environment will benefit, you will use fewer materials and suddenly the business case looks much better,” he says.

Atanu is an enthusiastic, yet realistic advocate of the technology and its infrastructure. Alluding to his earlier point of training, he admits that universities can come under scrutiny for not providing enough skilled workers, however when I ask what inspires him to do what he does, he cites his students and the role they will eventually play in the future integration of additive manufacturing as a key influence.

“It’s a motivation for me to train the next generation of engineers, industrial engineers or supply chain professionals who are ready to take on the world of digital manufacturing.

“I get immense satisfaction when my students graduate and get positions at the top companies and I can continue working with them. That is the main motivation I have,” he concludes.

You can listen to the Field Service Podcast with guest Atanu Chaudhuri here.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Leave a Reply