In a new series of extracts from an excellent white paper published by IDC and sponsored by IFS, we will explore the IDC Servitization Barometer which is designed to allow field service organisations to chart their path to new revenue streams. In ...

ARCHIVE FOR THE ‘servitization-and-advanced-services’ CATEGORY

Jul 24, 2020 • Features • IDC • White Paper • Digital Transformation • IFS • Servitization and Advanced Services

In a new series of extracts from an excellent white paper published by IDC and sponsored by IFS, we will explore the IDC Servitization Barometer which is designed to allow field service organisations to chart their path to new revenue streams. In part one we looked at the rapid and wide reaching change that is being faced by manufacturers in all sectors, in all regions. Now in part two we look further at IDC's Servitization Maturity Framework

Would You Like to Know More? www.fieldservicenews.com subscribers can access the full white paper on the link below.

Sponsored by:

-1.jpg?width=65&name=IFS%20Logo%20(CMYK)-1.jpg) Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content, IFS who may contact you for legitimate business reasons to discuss the content of this content.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content, IFS who may contact you for legitimate business reasons to discuss the content of this content.

IDC strongly believes servitization will make or break digital transformation initiatives in physical value chains. As the concept is still relatively new to many organizations, it needs to be articulated and clarified.

To help organizations understand where they currently are on this journey and, more importantly, how to proceed to the next level, IDC has built the IDC Servitization Maturity Framework, identifying key dimensions and stages defining an organization’s readiness. In connection to this effort, IDC and IFS have cooperated for this first edition of the IDC Servitization Barometer, a data-based assessment of where companies around the globe find themselves in the servitization journey.

The barometer is fed by an IFS-sponsored survey carried out in July 2019, touching 420 companies active in the physical supply chain world. In this section, we will provide an overview of the tenets of the Maturity Framework, before deep diving into the results of the Barometer. For more detailed information on the survey, including demographics and background, please refer to the Methodology appendix. IDC believes an organization’s status as regards to servitization is defined by the five equally important dimensions described in Figure 3 below.

IDC believes the servitization journey can be summarized in four key stages, as shown in Figure 4.

The four stages can be described as follows:

-

Splintered. The organization struggles under a myriad of silos that lead to disjointed, manual processes. Legacy, fragmented ERP environments provide little or no visibility on operational performance. The business model is on pure product, with challenges to profitability.

- Side-car. The organization has standardized the two chunks of the value chain (back-office and front-desk) but keeps them separated. The keyword in the company is efficiency and few add-on services are delivered. Field service is based on basic mobile capabilities and IoT stacks are at proof-of-concept stage. Growing the business is hard.

- Joined-Up. Front-office and back-office flows have been integrated in both directions and leverage the power of advanced technologies such as IoT to feed the core systems with real-time data. In some cases, Edge capabilities bring coordinated autonomy to local sites. A suite of digital services is fully available, and business model enhancements such as pay-as-you-use and outcome-based contracts are being explored.

- Borderless. Processes start and end outside the organization and operations and technology enable different elements of the value chain to connect. Co-creation, data-sharing and collaboration with customers, suppliers, partners from other sectors and in some cases even competitors are part and parcel of the business model.

Servitization - A Real Example

Further Reading:

- Read more about Servitization and Advanced Services @ www.fieldservicenews.com/blog/tag/servitization-and-advanced-services

- Read more about Digital Transformation @ www.fieldservicenews.com/blog/tag/digital-transformation

- Read exclusive FSN features from IDC's Aly Pinder @ www.fieldservicenews.com/blog/author/aly-pinder

- Read FSN Features and News from the IFS team @ www.fieldservicenews.com/hs-search-results?term=IFS

- Find out more about the solutions IFS offer to help field service companies @ www.ifs.com

- Follow IFS on Twitter @ twitter.com/ifsuk

Jul 17, 2020 • Features • IDC • White Paper • Digital Transformation • IFS • Servitization and Advanced Services

In a new series of extracts from an excellent white paper published by IDC and sponsored by IFS, we will explore the IDC Servitization Barometer which is designed to allow field service organisations to chart their path to new revenue streams. In...

In a new series of extracts from an excellent white paper published by IDC and sponsored by IFS, we will explore the IDC Servitization Barometer which is designed to allow field service organisations to chart their path to new revenue streams. In part one we look at the rapid and wide reaching change that is being faced by manufacturers in all sectors, in all regions...

Would You Like to Know More? www.fieldservicenews.com subscribers can access the full white paper on the link below.

Sponsored by:

-1.jpg?width=65&name=IFS%20Logo%20(CMYK)-1.jpg) Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content, IFS who may contact you for legitimate business reasons to discuss the content of this content.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content, IFS who may contact you for legitimate business reasons to discuss the content of this content.

Production-oriented industries anchored in physical value chains are undergoing a process of deep transformation. Business leaders must find new ways to adapt to rapidly changing customer expectations and volatile market conditions. Rethinking the approach to ideation, innovation, and new product and service development is critical to maintaining top- and bottom-line growth.

Digital transformation initiatives are being rolled out with the end goal of making enterprises “Borderless.” This means the powering of a digital network that integrates internal and external silos to deliver more value to the ecosystem, including employees, customers, suppliers, and partners.

IDC research (see figure 1 below) indicates that digital organizations in production-oriented industries are benefitting from strong growth in terms of revenue and profit. Non-digital organizations struggle.

As digital transformation evolves from a cluster of one-off projects to the generation of new business models, business leaders are required to deliver the associated business outcomes from digital investments. In fact, in a recent IDC survey 65% of CEOs stated that they were under considerable pressure to craft and execute a successful digital transformation strategy that enables financial growth in their organizations.

In production-oriented industries, success is dependent on the ability to bring a much stronger service value proposition to play. Servitization is therefore turning into a top agenda item in this sector, with 82% of firms actively exploring or moving to servitize their businesses. The transition towards servitization in these industries is potentially motivated by the fact that the respondents expect the average proportion of annual revenue generated from services versus products to double from 8% in 2019 to 16% in 2022.

IDC describes servitization as the process whereby organizations with physical value chains enhance their products with — and ultimately package them within — advanced services such as digital applications and payment models based on consumption or outcome. According to IDC’s research, there is a strong correlation between servitization maturity and revenue growth. All organizations in the most advanced stage of servitization have reported growth in the top line in the past year, often over 5%. On the other hand, the revenues from 88% of organizations in the earliest stage of servitization maturity have either decreased or stayed the same in the past 12 months.

"Servitization is a journey and its end stage is the creation of an end-to-end value chain..."

In most organizations, servitization is a critical element of the overall digital transformation. It involves a transformation of the core systems, leveraging emerging technologies such as IoT and machine learning, which in turn enable organizations to access real-time data from the ecosystem and transform it into actionable insights.

Servitization is a journey and its end stage is the creation of an end-to-end value chain. This can only be enabled by driving interoperability at the application level, where the ERP systems underpinning the supply chain are seamlessly connected to the applications enabling field service and contact center agents, as well as the sensors collecting data from deployed products. The outcome is a continuous flow of relevant information across front-office and back-office to increase operational performance and new revenue streams based on data-driven services. Figure 2 (below) illustrates some of the benefits that servitization could deliver to production-oriented organizations and their end customers.

Examples of companies heading towards servitization include:

- An Israeli-based industrial valves manufacturer embedded IoT modules in its products, allowing it to charge customers based on volumes of liquid processed. The customer can program the valves for remote manual operation or set a machine-learning algorithm to do that. This increases efficiency in the industrial operations.

- A forklift maker connected one of its products to a cloud backend with GPS tracking, offering its logistic customers remote maintenance services and a fleet management service to locate its forklifts.

- A global defense and security provider offered aircraft fleet maintenance and repair services. In order to ensure high availability of the equipment for its customers, this organization has linked the systems that underpin the maintenance and repair cycle to its enterprise resource planning (ERP) applications. The outcome is the delivery of an effective fleet readiness management to customers and the generation of new revenue streams coming from more after-sales services and improved customer satisfaction.

Based on discussions with companies in the sectors impacted, IDC believes changes in business models are part and parcel of servitization. These can be played out in three ways:

- Augmentation of product-based revenue with additional service revenue going beyond traditional services (maintenance, break-fix etc.) to include data-driven digital services (e.g., Fleet management service above)

- Partial or complete switch from upfront sales towards consumption or outcome-based models (e.g., “pay-per-liquid volume processed”)

- Monetization of proprietary data through licensing to third party (e.g., a car manufacturer selling access to driving behavior data to an insurer)

While complexity and impact on overall organization changes between the three approaches, IDC believes that all these new approaches to business models signal that a servitization journey is on the way and positive effects for the top and bottom line are a consequence of those.

Further Reading:

- Read more about Servitization and Advanced Services @ www.fieldservicenews.com/blog/tag/servitization-and-advanced-services

- Read more about Digital Transformation @ www.fieldservicenews.com/blog/tag/digital-transformation

- Read exclusive FSN features from IDC's Aly Pinder @ www.fieldservicenews.com/blog/author/aly-pinder

- Read FSN Features and News from the IFS team @ www.fieldservicenews.com/hs-search-results?term=IFS

- Find out more about the solutions IFS offer to help field service companies @ www.ifs.com

- Follow IFS on Twitter @ twitter.com/ifsuk

Jul 15, 2020 • Features • Advanced Services Group • manufacturing • Professor Tim Baines • The View from Academia • Covid-19 • Servitization and Advanced Services

Professor Tim Baines, Director of the Advanced Services Group, Aston University and Dr. Ali Zia Bigdeli, Senior Lecturer in Industrial Services Innovation at Aston University argue manufacturing should embrace services as part of its post-COVID-19...

Professor Tim Baines, Director of the Advanced Services Group, Aston University and Dr. Ali Zia Bigdeli, Senior Lecturer in Industrial Services Innovation at Aston University argue manufacturing should embrace services as part of its post-COVID-19 strategy.

Change, a 1985 paper argued, can be characterised as a “punctuated equilibrium”: long periods of relative calm and small incremental alterations that are interrupted by brief, but radical, seismic shifts. COVID-19 means that we are now living through one of those revolutionary moments.

Advanced Services and Positive Business

But that also means that there is an opportunity to look at things in a new way. For the past 20 years, we’ve been conducting research and advising manufacturers to compete through services – activities aimed at solving customers’ problems – rather than simply just pushing boxes out of the factory.

And our reasons are simple: services are good for business, good for the economy and environment, and good for society. Now accounting for 80% of the UK’s economic output, services have grown by 30% over the past 20 years. By comparison, gross domestic product (GDP) generated from selling products has contracted – a trend that is being replicated in every developed economy across the world.

But it has been a slow and sometimes painful journey – “What is this thing called servitization,” we are asked. “And how do you spell it?!” Up until now, change in this field, like in so many others, has been evolutionary, somewhat incremental and exploratory. But then arrives a global pandemic that shatters the equilibrium and stimulates radical innovation.

These are challenging times, and it’s important not to make light of the struggles facing the global economy. Business activity is currently polarised around sector and geography. On the one hand are manufacturers who support the food and health sectors and have never been busier. On the other are those businesses linked to the aerospace, automotive, and oil and gas industries which are being forced to mothball facilities and lay off staff in their tens of thousands.

For some, the implications are so severe that they may not survive. Even those that are doing well are having to deal with a reduced workforce, social distancing in the workplace, and the economic fallout of customers being unable to pay their bills.

Disrupting the old norms

How appealing the old norms may now seem. Until just a few months ago, most executives within manufacturing organisations had a rather passive, established view of services. For us, it was frustrating, but comfortingly familiar.

We could work with these manufacturers to help them better understand the value of services, influence key decision-makers and then hopefully get a chance to support their innovation of new business models, technologies and organisational structures. But we often experienced an equilibrium – the harder we helped manufacturing executives to push for more services, the harder the system pushed back.

Now, however, that equilibrium is being disrupted.Take performance advisory services. These are services that allow manufacturers to use digital technologies to gain insight into how customers use their products, and then offer data and/or intelligence back to that customer on how to gain more value from those products.

"The end of this period of disruption will bring a new set of norms, and it’s beyond belief that we will return to the days of simply shifting boxes..."

An example of this type of service is Siemens’ monitoring of the condition of airport baggage carts. The company gathers acoustic and vibration data from rail-mounted luggage carts around the airport and uses this data to assess the likelihood of breakdowns before they happen.

Breakdowns cost time and money. So spotting potential breakdowns in advance saves airport operators the penalties that must be paid when luggage isn’t loaded onto flights on time, and improves the passenger experience through the punctual delivery of baggage.We have seen a wealth of technically excellent digital systems like this. Most, however, have so far failed to be commercially viable and manufacturers have been reluctant to invest in and push them to customers. But in the current climate, that may change.

As well as opening up a huge new market opportunity, these services could be far more profitable than simply selling the products themselves. Such services can also develop enviable intimacy with and loyalty from customers as the provider is able to address their customers’ demands and problems much more quickly and effectively.

And now times are changing, the economic potential of services is becoming more visible. Indeed, remote support and performance advisory services – helpdesks, remote support for breakdowns, digital installations – provide obvious solutions in an age of social distancing, remote working and lockdowns.

Customers either want remote advice on how to fix problems themselves, or they want the manufacturer to remotely fix and upgrade their equipment. It’s not all about technology, of course – customers still value speaking to a person, just not face to face. But manufacturers no longer need to gamble as much on selling these new systems; customers actively are seeking them. Both parties are starting to look at the bigger picture, and services are proving vitally important to both.

Accelerated change

For some time yet, change will be accelerated and hastened. The end of this period of disruption will bring a new set of norms, and it’s beyond belief that we will return to the days of simply shifting boxes. At the very least, business plans will need to include how to deal with disruption – whether it’s related to health, the economy or the environment.

The opportunities that this creates for services are potentially dramatic. Services are in the midst of radical change and, of course, we all look forward to returning to those long periods of relative calm. However, in so many ways, things will never be the same. Business models for manufacturers will have been disrupted, and there will be new and different conversations about the value of services. These business models have the potential to deliver huge value, and a level of resilience that we may never see again for production-based ways of competing.

Further Reading:

- Read more articles by Tim Baines @ https://www.fieldservicenews.com/tim+baines

- Read more articles by Ali Zia Bigdeli @ https://www.fieldservicenews.com/AliZiaBigdeli

- Find out more about the World Servitization Conference @ https://www.advancedservicesgroup.co.uk/wsc2020

- Read more articles about servitization @ https://www.fieldservicenews.com/servitization

- This article first appeared The Conversation.com here

- Follow the work of the Advanced Services Group @ www.advancedservicesgroup.co.uk/

- Follow the Advanced Services Group @ twitter.com/theasgroup

Jun 25, 2020 • Features • Jan Van Veen • Outcome-based service • Servitization and Advanced Services • worldwide • advanced services

Jan van Veen explains how to accelerate your service innovation in disruption times and to ultimately thrive, leveraging servitization and outcome-based services.

Jan van Veen explains how to accelerate your service innovation in disruption times and to ultimately thrive, leveraging servitization and outcome-based services.

We hear a lot about servitization, outcome-based services and product-as-a-service business models. However, we see little examples in the industrial sectors. I often hear about serious challenges manufacturers face developing and launching new service offerings:

- Clients do not see the value, have many objections and are not ready for it

- Lack of strategic support to invest in necessary capabilities and to develop their business model

3 of the root causes are;

- The gap between academic terms like servitization, outcome-based services and product-as-a-service and the practice is not being closed yet

- Poor definition of the critical business problems of clients which will be solved with the new offering

- The impact for the manufacturer’s business is not clear yet

In this article I share some of the best practices for designing advanced offerings which will help you to overcome these challenges.

Servitization, digital solutions and Advanced Services

Just as an increasing number of manufacturing companies, you may be looking for ways to thrive during disruptive change in your industry. This is an exciting journey of enhancing your business models with digital solutions and advanced services.

Some of the major trends which make this mission critical for your future success are;

- Digital technologies

- Digitalisation of clients’ operation

- New emerging business models

- Shifts in the value chain / ecosystem

The vision behind these innovations is;

- Developing advanced services and solutions to develop new and recurring revenue streams and increase long-term differentiation

- Develop better performing and more efficient predictive maintenance services

- Meet a broader scope of (latent) customer needs, beyond availability and condition of equipment like operational performance solutions.

Here is the problem

Most service leaders and innovators, solution providers, academics and consultants use broad and abstract concepts to describe their vision, strategy, innovations and new offerings with container words like;

- Servitization

- Advanced services

- Outcome-based services

- Remote services

I often hear from service leaders and innovation teams that;

- Clients do not see the value of the new offering or solution

- Clients see many obstacles and risks

- Clients are not willing to pay more for the new solutions

- Clients are not ready for the new solutions

- They lack the support of strategic stakeholders and other functions in their organisation

In essence, all boils down to the following 3 problems;

- The new solutions and services do not solve (new) critical business problem of the clients. The value or impact is not clear (other than potentially lower prices for the maintenance services)

- It is not clear how these services contribute to the overall business challenges and vision of the company as a whole

- The service vision is too abstract for internal stakeholders to understand and endorse. Words like servitization, outcome-based services, remote services and product-as-a-service are too theoretical and do not clearly articulate a vision and strategy.

This is pretty frustrating isn't it?

The solution

In this article I share a couple of frameworks which many service teams miss in their service innovation strategies. These are;

- Build deeper customer insights

- Segment clients based on their needs

- Approach your business models more holistic

This is by no means exhaustive; many aspects come into play to get it right.

Build deeper customer insights

To be truly outside-in and customer driven, you need to have a deep insight in the challenges and problems your clients are facing in their business. Deep customer insights should;

- Go beyond their requirements about uptime and maintenance of their assets

- Cover a time window of 3-7 years

- Be thought provoking eye-openers for your clients

You can read more about this in my contribution “Build a Strong Customer Story in 7 Steps and Launch Irresistible Advanced Services” in the Handy Little Book, published by Field Service News (add link)

Segment clients based on their needs

One size does not fit all. Different clients have different visions and strategies, different challenges and therefore different needs. When defining the (latent) customer needs for today and the near future, it is crucial to have some sort of segmentation of your important clients based on their (future) needs.

This segmentation will help you to develop a robust strategy which defines which customer segments you will target, with which new service offerings and which business models you will develop.

There are many ways to segment clients based on their needs, largely depending on the specific industry. I will share two generic patterns for customer segmentation which can be useful for you to take as a starting point. They are based on segmentations of innovative and successful manufacturers and service leaders.

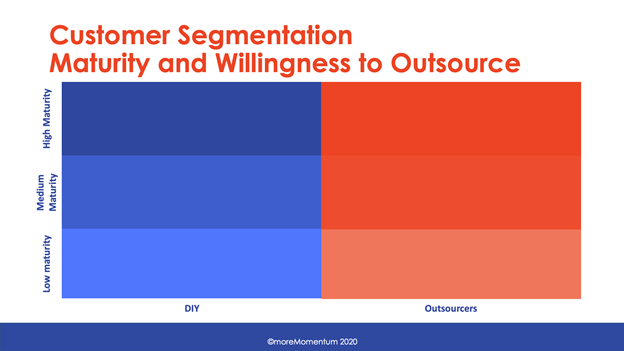

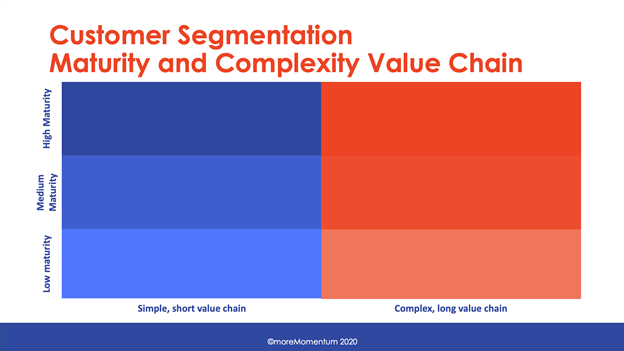

The two patterns are:

- Maturity – Willingness to outsource of a business

- Maturity – Complexity of a business

This could be a useful pattern in industries where many of your (potential) clients tend to do most functions themselves instead of outsourcing the activities (like maintenance of equipment).

Along the vertical axis you can separate segments based on the maturity of their core capabilities and processes. For example, in the industry of metalworkers this could be;

- Traditional craftsmen

The entrepreneurs personally (together with their employees) manufacture the metal products themselves, love part of the manual work and working with their machines and tools. This is their pride. Little of the activities are put into structured processes. - High tech workshops

The entrepreneurs have invested in state-of-the-art tools to improve quality, consistency and efficiency. Their main focus is still on the technical side of the profession. Probably there is more structure in the workflow and processes, predominantly organised from a technical point of view. From a more economical point of view, the structure is by far not efficient yet. - Lean manufacturers

The entrepreneurs have a more economic view (or hired an operations director with economic competencies) and are working on efficient processes, workflow and organisation. They follow lean-six-sigma or similar approaches to optimise human resources, capital investment and materials. - Value chain optimisers

These entrepreneurs have a broader scope and are looking to their added value in the entire value chain, partnerships, vertical integration or specialisation. They may also develop more advanced value propositions to their clients like inventory management and delivery of the components they manufacture in small packages in the production line of their clients.

This is a very brief description. You should probably also look into functions like sales, marketing, engineering, internal logistics, inventory management, tools management, financial management, human resources management etcetera. You get the picture.

Along the horizontal axis you can segment your market into clients that tend to do as much as possible themselves versus clients that outsource many functions which are not part of their core-process. Clients in the first category probably have various dedicated departments, competence centres or teams for functions like process optimization and maintenance

Along the horizontal axis you segment your market into clients that have short and simple value chains versus clients with longer and more complex value chains. For example, again in the industry of metalworkers this could be;

- Jobbers or workshops that fulfil specific tasks like welding, cutting, bending, drilling etcetera and that manufacture intermediate components or semi-finished products

- Component manufacturers which perform several tasks to manufacture components, like engine blocks for the automotive industry

- Product manufactures, which manufacture complex products

- Machine manufacturers

Whatever pattern you use, with these segmentations, you now have 4 (or more) segments in a logical structure. For each segment you can

- Find a descriptive name

- Further describe their specific needs

- Define their characteristic to recognise them

For each segment you should;

- Decide whether you want to serve them or not. Or at least define which segments have your focus

- Develop a customer insight or customer story

- Develop specific messages to use in your marketing, sales and service delivery

- Develop and map specific services, offerings and delivery models

- Develop a specific commercial approach

When you are still in early stages of developing advanced new service offerings, it often pays to focus on one specific segment first.

Approach your Business Models with more holistically

As soon as your advanced services go beyond the maintenance and the condition of the equipment your company manufactures and sells, you will be reconfiguring or extending the business model of your company as a whole, that is, the value proposition of your business model. This means, you need to have a strategic dialogue and innovation process with strategic stakeholders.

To make this a fruitful and coherent process, you should avoid a discussion about product versus services. It starts with;

- A shared concern about developments in the industry

- The threats and opportunities for your business as a whole

- A vision about the future state of your entire business and what needs to change to achieve this.

This will result in a few strategic priorities, one of which (hopefully) is services innovation.

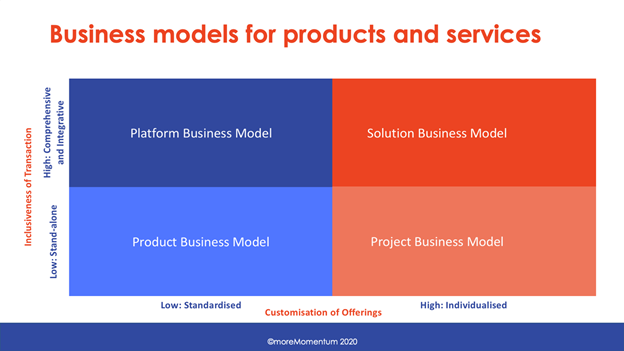

Here I would like two share two useful frameworks that help to take the development of the business models to a more holistic - company wide - level. Note that these frameworks are not limited to services or products alone. They address the overall value proposition, which can be a combination of products, software, data and services.

In the matrix above, you can describe changes of your business model along two aspects.

Along the vertical axis, you differentiate value propositions;

- From stand-alone offerings (like single products or services)

- To comprehensive and integrative solutions which cover a broad scope of needs and solutions

Along the horizontal axis, you differentiate highly standardised offerings from highly customised offerings.

This results in 4 types of business models, which I will further describe with document printers as an example;

- Product Business Model

- Only printers, probably including service contracts

- A wide portfolio of different models to choose from

- Additional equipment for folding documents, putting them in envelops etcetera

- Getting the printer for free and paying for the ink only

- Predictive and remote maintenance

- Cloud storage solutions and Microsoft Office 365 still fit in this model, even though you pay a small fee per month

- Also retail banking fits in this business model

- Project Business Model

- An assessment of the entire business, to define how much printers, which type and where

- Connecting the printers to the network, configuring security systems

- Designing, building, commissioning an entire print room for high volume printing and mailing of documents

- Designing more effective and efficient processes

- Solution Business Model

- Taking over the entire print room from clients, which could still be at your clients’ locations

- Connecting the Salary Administration system to the print room, to print all salary slips at the end of the month, put them in envelops, and send them to the postal services

- Platform Business Model, in the printer industry the example may become a bit theoretical, anyway

- An online platform where clients can upload templates, designs and lists of destinations and pay for the job. The platform will split this in smaller jobs for various connected and certified print facilities across the world and process the financial transaction. (I am not sure if this kind of service ever existed)

- In the Additive Manufacturing sector, we do see initiatives in this direction to allow manufactures to print metal spare parts anywhere in the world close to the customer

- Other examples of today are Apples Appstore, iTunes, Spotify, Amazon, Uber and Airbnb

The framework above will help you to better articulate the kind of value and related business models you are aiming for.

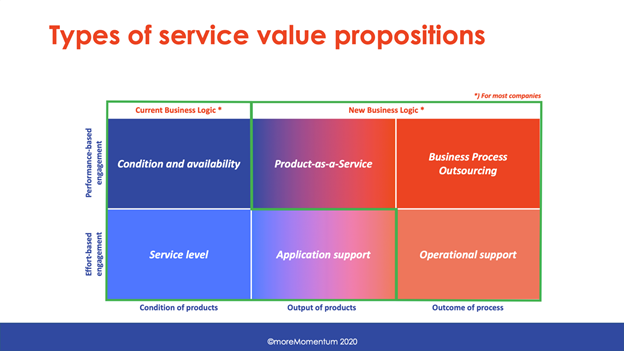

With this framework you can define your value proposition along the horizonal axis based on the scope of the services. There are several ways to add value to your clients (deliver outcome if you like). I will use the commercial truck industry as an example;

- Better products

For example. improve fuel efficiency of the truck and engines - Better availability

Your services can maintain and improve the availability and condition of the equipment when your clients need them. This could be quite advanced with real time data, smart diagnostics predictive analytics or supported self-help offerings using AR.

For example, predictive maintenance to improve availability (and maybe also improve fuel consumption) - Better application or use

Your service can drive the output or performance of the equipment you delivered to clients by improving the use, configurations, settings and ongoing optimization tactics. Also, these services can be onetime projects or ongoing support.

For example: Reduce fuel consumption by improving the driving behaviour of truck drivers - Better processes

Your services can also concentrate on the overall processes and operation.

For example: Reduce fuel consumption (and other cost) by improving the route planning, combining jobs, choosing the right vehicles for each job etcetera

Along the vertical axis you can separate offerings which are;

- Effort based, where you promise to do certain activities for which your client pays, regardless of the result of the activities. It remains the responsibility and risk of your clients to manage the overall performance and take the right decisions.

- Performance based, where you promise your clients a certain result and get a fee depending on this result. In the example of commercial trucks, this could be;

- Guaranteed uptime and availability of the truck of 99% and penalties if the performance is below 99%

- A fee per percent-point of reduction of fuel consumption

- A fee per transportation job

How to use these frameworks

Map your current business model(s) in one or more of these matrixes. Also map a few scenarios for the envisioned business model(s).

This will help you and your stakeholders to have a more structured and neutral discussion about the major trends in the market, technology and competitive landscape as well as in what direction your value propositions and business models should develop. Any choice will have an impact on engineering, manufacturing, software development, marketing & sales and services.

What are the takes

If manufactures cannot successfully adjust their business model, they run a serious risk of falling behind existing and new competitors.

Clients are developing digital capabilities in all their functions. They will have other needs for services and solutions.

This is an important opportunity for manufacturers to grow their relevance for their clients and grow their business.

It is also a unique opportunity for digital native service providers and system integrators, which offer remarkable and complete solutions to the (new) problems of your clients. They are your new competitors.

Benefit

If you use these frameworks and embed them in your service vision, your innovation strategy as well as in your dialogue with strategic stakeholders, you can develop the;

- Shared concern for the business as a whole

- The strategic priorities for the business as a whole, one of which will be services

- Shared vision for the business as a whole, which includes services

- A specific shared concern for the services business unity

- The strategic priorities for the services business unit

- A shared vision for the services business unit

Rome was not built in one day

It is an iterative journey. It takes time and work. The frameworks above will help you to facilitate and structure this journey.

Manufacturers and service leaders with successful advanced services have used these kinds of frameworks for a long time and still are. This allowed them to achieve quick, continuous and more radical innovations and thrive in disruptive times.

Conclusion

For quite a few service leaders, the journey of service innovation is a tough one. Their clients do not see the value of new advanced offerings, they do not want to pay for them, and internal stakeholders do not provide the necessary support.

Some of the key reasons are;

- The critical business issues of the clients are not clear and are not addressed with the new offerings

- The business value of the new offerings and business models are not clear

- The envisioned business model(s) are not clearly described

Litmus proof

I would like to challenge you with the following questions.

Can you describe your services vision and strategy in concrete words? Without using words like;

- Advanced services

- Servitization

- Product-as-a-Service

- Remote services

- AR, AI, IoT

Does your services vision start with a description of;

- Major trends in the industry of your clients

- How challenges and priorities of your clients are changing

- How that will change their needs

Recommendation

If you want to be leading the transition of your business and industry, I would recommend you to;

- Define a clear shared concern with your strategic stakeholders;

- What are the developments and trends?

- How are customer needs changing? (our worksheet “Build your Customer Story” will be useful)

- What is the (potential) impact of these changes for your business?

- Does your business want to act on this by innovating the business model?

- Together with your strategic stakeholders, consider various options for developing the business model(s) and assess how these business models would help your business to thrive

- Agree on the innovation strategy and next steps

- Iterate!

Further Reading:

- Read the "Build your Customer Story" worksheet @ https://moremomentum.eu/worksheet-customer-story

- Read Jan van Veen's article, “Build a Strong Customer Story in 7 Steps and Launch Irresistible Advanced Services” @ https://www.fieldservicenews.com/blog/build-a-strong-customer-story-in-seven-steps

- Read more articles by Jan van Veen @ https://www.fieldservicenews.com/hs-search-results?term=jan+van+veen

- Read more about moreMomentum @ https://moremomentum.eu/

- Read more about servitization @ https://www.fieldservicenews.com/hs-search-results?term=servitization

Jun 15, 2020 • Features • The View from Academia • Servitization and Advanced Services

Professor Shaun West of Luzern University uncovers some of the fundamental barriers manufacturers face when trying to implement a servitization strategy.

Professor Shaun West of Luzern University uncovers some of the fundamental barriers manufacturers face when trying to implement a servitization strategy.

The development of new services is not like new product development and here starts the problem in many manufacturing firms (Figure 1). It creates a significant disruptive change to the business – it is a change management process, and it is a journey.

Servitization may be a 'good move', But it is a complex undertaking...

Strategically, management generally likes the idea of service because customers ask for it and because margins are higher than in traditional product sales business. Given that customers want it and it has good margins, “senior management’ generally considers servitization a good move, without first understanding the challenges and the underlying barriers that could slow the journey into service.

(Figure1: Differences between service- and product-based business)

The journey to services is often bumpy, and we have seen that services are not the same as products. Most of the value is created from the intangible aspects of the service, making it hard to identify and measure. Manufacturing firms often find it harder to deal with the intangible elements of services. For them, it is easier to measure metrics such as “on-time delivery” rather than “customer satisfaction” as they value hard facts more than soft facts (Table 1). Andy Neely and his research term provided a framework that helps us to identify the barriers that stop us from making the switch to services and categorized servitization barriers into seven categories.

(Table 1: Differences between technology- and service-based firms)

We dug deeper to understand the specific challenges and learnt more via a series of surveys and interviews. We found there were common challenges that leaders had faced within each of the barriers. The good news is that that, in general, you are not alone. The downside is that contextual issues mean most transitions are unique as they have different starting points and different visions. Assuming that the firm has made the strategic decision to deliver services, then you need to understand the market readiness, the strategic fit, and the firm’s cultural context. Building the longer-term business structures (e.g., a business unit with its own P&L) is critical, and without this, there is limited long-term sustainability.

Resources need to be freed up for both service innovation and delivery; without budgets, nothing will ever happen. This also means that you need to develop and embed service processes, these are likely to be very different in detail to the processes that your manufacturing colleagues use, and this will create conflict, often because with services you work on a customer’s site together with the customer. Given that services are co-created and delivered with customers, engagement has to be proactively managed, and trust built so that you can continually innovate with your customers and improve customer experience.

Observation of the implementation-based barriers to servitization

Based on 40+ interviews and survey data from over 150 individuals, we tried to clearly describe the observations that slow or prevent the implementation of a servitization strategy. We start by providing some quotes (Table 2) from people who have been directly involved in a transition before giving a summary of the best practice as we view it at this time. In our servitization study, we quantified and ranked them the barriers in order of importance based on the input from the surveys.

Based on 40+ interviews and survey data from over 150 individuals, we tried to clearly describe the observations that slow or prevent the implementation of a servitization strategy. We start by providing some quotes (Table 2) from people who have been directly involved in a transition before giving a summary of the best practice as we view it at this time. In our servitization study, we quantified and ranked them the barriers in order of importance based on the input from the surveys.

(Table 2: Main barriers to servitization)

The move to ecosystem innovation is essential for the servitization journey when we consider the competition, suppliers, and partners. This is a significant change for firms as customers and agents can become important partners, and in some cases, competitors may become customers. Localization aspects are essential, and this depends on the size of the company – a large firm is different from a small firm. Local rules (or norms) can create barriers to service delivery, finding local partners can reduce costs and limit others from entering the market. It is important to learn to work and use customer pull to support servitization; some of your best supporters for servitization are your customers.

In many cases, they will champion your innovations and provide opportunities for prototyping ideas and helping you convert them into new value propositions. They will also support you with pricing signals and provide insights into new revenue models. Customers are critical to sales growth (clearly!) and margins. In service, the long-term retention of customers is recognized as a crucial success factor for both the service and equipment businesses.

As you grow your service business, sharing of knowledge and information about the services in action and your customers’ processes becomes more important. Information sharing needs to be managed within the service business as well as to the equipment business, and there are more customer touchpoints with service than with an equipment business.

Providing the information gathered as feedback to the equipment business can also reduce servitization barriers. There is often a push to move to advanced services, but basic data and understanding is required before moving to more advanced product-service systems – moving too soon to advanced services as a way to hide your weaknesses in service delivery can kill the service business.

Finally, businesses must have their own P&L and the support of HR to deliver the change because of the difference in processes and organizational culture.

What you can do to help with the shift to services

To help you, we recommend three things that you could do to help your firm, based on our insights from the study:

- Open your mind and that of your colleagues to the differences between a product-business and a service-business. They are not the same, even if the underlying equipment is the same.

- Focus on your customers, learn how they use the equipment, and how and where you can support them. Listen to them and allow them to support your service innovations.

- Empower your service teams to deliver the service projects and ensure that the P&L contribution is recognized by the firm.

What are we doing to help with the transition? We are currently working on a book to support the shift to services in a practical way, basing the book on cases and providing examples of tools that we have seen being used to help product-based firms make the transition successfully.

Acknowledgements:

I would like to thank the following for providing valuable input into the study.

- Paolo Gaiardelli (paolo.gaiardelli@unibg.it),

- Nicola Saccani (nicola.saccani@unibs.it),

- Ali Bigdeli (a.bigdeli@aston.ac.uk),

- Tim Baines (t.baines@aston.ac.uk)

- Peter Alexander

Further Reading:

- Read more articles by Shaun West @ https://www.fieldservicenews.com/Shaunwest

- Read more articles on servitization @ https://www.fieldservicenews.com/servitization

- Read more articles by Tim Baines @ https://www.fieldservicenews.com/Timbaines

- Read more articles by Ali Bigdeli @ https://www.fieldservicenews.com/AliBigdeli

- Find out more about the World Servitization Conference @ https://www.advancedservicesgroup.co.uk/wsc2020

Jun 08, 2020 • Features • Advanced Services Group • The View from Academia • Covid-19 • Servitization and Advanced Services

Aston University’s Professor Tim Baines reflects on how the impact of the coronavirus pandemic has meant that he has had to re-evaluate his predictions from 2019 as industries rapidly pivot and shift their priorities and why servitization has a role...

Aston University’s Professor Tim Baines reflects on how the impact of the coronavirus pandemic has meant that he has had to re-evaluate his predictions from 2019 as industries rapidly pivot and shift their priorities and why servitization has a role to play in that recovery.

People don’t like to admit their mistakes and professors are no different. Indeed, we like to believe that we give more attention to the science anfacts than others may do. But I was wrong. Late last year, I wrote a piece that predicted that the three priorities for manufacturing business in the 2020s would be about responding to the challenges of poor productivity and climate change, and grasping the opportunities of digital.

Servitization's role in Covid recovery

I think it’s now quite safe to say that although these will remain important, priorities will shift towards the recovery of the economy – in particular the recovery and rebuilding of industry large and small. I also think that we will start to pay more attention to embedding greater industrial resilience, in an attempt to insure against similar disruptions in the future. It’s early days, but how might we do this?

My earlier judgment seemed sound at the time. I based my prediction on what I saw, was told and read about. I rationalised that there were three principal forces driving change, and my logic went something like this:

The UK, among other western economies, has an historical problem with productivity, we work too many hours to generate the level of wealth we create and this adversely affects growth something that everybody is keen to address. The evidence of climate change is becoming more acute; it can be seen in the melting ice sheets in Greenland and raging bushfires of Australia.

Customers and consumers are becoming more sensitive to the environmental impact of consumption, and supply chains are being restructured. Meanwhile, digital innovation is all around - whether you see it as IOT, Industry 4.0 or simply a new App - and its adoption within industry is being widely advocated.

What my logic did not account for was the seismic shock of a pandemic. Business has changed in a way none of us could have foreseen; borders have closed, travel is banned, staff are in isolation, society is in lock-down, working from home is the new norm and the kids are off school! Business activity is polarising; some factories are being mothballed, while those that service the food and healthcare sectors, for example, are exceptionally busy. Indeed, governments are intervening in ways unimaginable since, in many countries, the Second World War. At this time, I know it’s difficult to look beyond the next few weeks, but it is important to look forwards, albeit with a little care and sensitivity.

"Resilience is key and business models based around services are more conducive to achieving this..."

Economic activity is essential and it must recover. Undoubtedly, there will be many government initiatives to kick-start the economy, but how do we rebuild the manufacturing industry to be more resilient to future shocks, whether these shocks are health-related, trade-related, or indeed from the adverse effects of climate change. Quite clearly, the same as before is not sufficient. We have a unique opportunity to move industry forward and adopt business models that are better-aligned with the new world we will enter.

The 1900s and early 2000s were dominated by production-consumption business models, exemplified by mass production, Henry Ford and the consumer society – make, sell, dump. Feeding a growing world population, ruthless in its consumption of resources, servicing hungry global markets and all too often insensitive to the impact on the environment. This was not sustainable, and now many sectors have ground to a halt.

While mass production of course is still alive across some sectors - food and medicine to name a few - in other sectors this lockdown has shown that we do not need cars, airports and shopping centres to the extent we used them. As such, there is a great opportunity for services, delivered remotely and consumed locally, which help to build the quality of our lives without the need for consumption. If industry can build new business models on this basis, we will also create a truly resilient economy.

So, I believe that resilience is key and business models based around services are more conducive to achieving this. But what could such services look like in practice? In my next blog, I will reflect on some of the businesses that are making great progress in this space.

Further Reading:

- Read more articles by Tim Baines @ https://www.fieldservicenews.com/timbaines

- Read more on servitization @ https://www.fieldservicenews.com/servitization

- Read more about Covid-19 in service @ https://www.fieldservicenews.com/covid-19

- Read more about the Advanced Services Group @ https://www.advancedservicesgroup.co.uk

- Read more about the World Servitization Conference @ https://www.advancedservicesgroup.co.uk/wsc2020

May 12, 2020 • News • Noventum • Outcome based services • HSO • Servitization and Advanced Services • Customer Satisfaction and Expectations • EMEA

New research into the digital service trends of large manufacturers shows they are lacking the necessary IT infrastructures and are struggling to meet the expectations of customers in the servitization era.

New research into the digital service trends of large manufacturers shows they are lacking the necessary IT infrastructures and are struggling to meet the expectations of customers in the servitization era.

The research ,Drivers for Digital Growth in Service, was carried out by Noventum in collaboration with HSO and Microsoft and canvassed product manufacturers and technical services companies via electronic surveys and personal interviews.

Struggles with Servitization

The study comes as the influence of servitization - the sale of an outcome, rather than a one-off purchase - has prompted a move away from traditional one-off large product investments to pay-per-use and subscription models bringing a new set of customer expectations.

Customers now expect their suppliers to assist in other business goals, such as increased production and even influencing innovation and operations. To help them achieve this, the report finds, firms must adopt new business models to deliver outcome-based, data-driven services for their clients.

However, while the study showed 80% of companies are planning to deliver or are currently delivering customer business related services, 40% admitted that their current IT framework was not robust enough to fully support these new business models.

The results suggest that firms need to adopt a digital services strategy, encompassing the entire organisation in order to deliver a successful and services-based business.

The research was conducted at the beginning of 2020 before the Covid-19 outbreak and in an introduction to the report Noventum acknowledged the impact the pandemic could have on service business growth, while suggesting it could prompt a positive change in focus leading to new service-led business models. “...for the companies who have been negatively impacted by Covid-19,” the statement said, “it will be vital to adopt the new ways of working that have been learnt during the crisis and to put in place growth strategies that will ensure the survival and sustainability of the business.”

Further Reading:

- Read the full Executive Report from the research here.

- Read more about Servitization here @ https://www.fieldservicenews.com/servitization

- To find out more about Noventum click here.

- To find out more about HSO click here.

May 01, 2020 • News • Professor Tim Baines • Servitization • Servitization Conference • Servitization and Advanced Services

A webinar hosted by Professor Tim Baines previewing September's World Servitization Conference will feature manufacturers exhibiting at the event and hosted on the 5th May 2020

A webinar hosted by Professor Tim Baines previewing September's World Servitization Conference will feature manufacturers exhibiting at the event and hosted on the 5th May 2020

The webinar, which takes place on Tuesday 5 March at 2pm (BST), serves as a digital preview to the forthcoming World Servitization Conference and will feature some of the manufacturers who will be exhibiting at the re-arranged event which now takes place in September - its original date in May having to be moved due to the Corona Virus pandemic.

The Increasing Importance of Servitization

The World Servitization Conference is in its first iteration of the a new event but already has an excellent pedigree being a natural extension of the Spring Servitization Conference which Field Service News has been a long standing media partner.

Run out of Aston University and hosted by the Advanced Services Group the global nature of this event in 2020 is testament to the increasing significance of servitization within industry - something that many are anticipating will be further increased by the impact of the Covid-19 pandemic.

The guest line-up includes:

- Chris Dodd, Managing Director, Assisted Living & Healthcare at Legrand UK & Ireland;

- Alec Anderson, Founder and Managing Director at Koolmill Systems;

- Lee Cassidy, Chief Executive Officer,Tactile Technology and

- Tim Hughes, Managing Director at CHH Conex.

As well as looking forward to September's conference, the webinar will look at manufacturing's relationship with servitization and how it might be affected in post-pandemic world.

You can register for the webinar here.

The World Servitization Conference takes place from 14 to 16 September at the NEC in Birmingham, UK. For more information on the event including details on how to register click here.

Apr 09, 2020 • future of field service • Lucenre University • Servitization • Shaun West • The View from Academia • Servitization and Advanced Services

Dr. Shaun West, of Lucerne University, explains why increasingly it seems that we have made the mistake of designing services with the machine in mind and us mere humans are developing a habit of just getting in the way...

Dr. Shaun West, of Lucerne University, explains why increasingly it seems that we have made the mistake of designing services with the machine in mind and us mere humans are developing a habit of just getting in the way...

I don’t like to be treated as a cog in a larger wheel and so why do we often design systems that treat us as if we were a cog in a complex system? This has been to me often a contradiction we see in the modern world where services are more and more standardized so that we feel we are there to service the machine.

The Importance of Service Design

My recent trip through Heathrow was very much in that vain – services (often hidden services) have been dehumanized that the experience for all actors involved is very poor.

Agency within the system at Heathrow has been lost for all actors leading you to consider that sheep might have a better experience, but at least the system is cost-effective and compliant. But service science and through service design, we don’t have to design the future world like this - we can and must do better.

We are trying to look at things in a more human-centric approach with our Smart Twin’s project where, with ten partners, we are building digital twins for different use cases. Within a number of the cases, the interactions with the digital assistant are really important as they are supporting decision-making processes.

In other cases, we’re considering how to delegate important tasks to the digital assistant and expecting them to return for new instructions when problems start to build. This is a very different position from asking Siri to find the music I’ve been listening too (Nylon Strung by Underworld if you were interested) or to tell my heating system at home to change the set-point to 19°C from 14°C.

This returns us to the thought that “we need to remember that the human is part of the system rather than subservient to the system”. Given that many of us are in the more technical environment, it is worth looking at how we used to treat machines – we gave them care and attention, we looked after them and we listened to them.

In effect, we treated them as if they were human in many aspects. This was part of the logic that we initially used with the development of the Avatar model. (See figure 1 below). To keep the truck working for me I have to look after it and treat it with respect, if I don’t it will stop doing what I expect of it.

The model shows graphically what you need to do for it and what it will do for you – over the life-cycle you can see the whole range of services that it needs to consume to deliver for you. My coffee machine behaves just like this – if I don’t fulfil my side of the bargain it delivers me poor coffee.

When digitalization takes place we automate jobs so, therefore, people just resist the change. How true is this really? It depends… robotic or digital service assistants can be deployed.

The ‘self-service kiosk’ service assistants can, in product dominate logic, appear to be a major step forward on the service. It becomes possible to have one “service operative” whose real job appears to tell me how I should be interacting with their new solution rather than allow redeployment of staff to improve the overall customer journey and experience.

In a case I know well, the digital assistant does this by taking away tasks that the current service desk operators are poor at performing and allowing them to focus on supporting the customer with real issues – the objective of the service desk.

Here the service desk didn’t want to go back to the old way of working. Interestingly, they are now happier in their work and doing a better job.

The common theme here is to focus on all people and machines with respect and understand their basic needs and requirements, as well as what you're expecting from them when building digital solutions.

Agency is important for people; this places us in ‘control’ and allows us to have some control and understanding of what is happening. It stops us from feeling like being a small cog in a large complex wheel. Agency also brings co-creation of value, again important as the literature confirms that lasting relationships are built on co-creation of value and joint decision making between many actors.

Such relationships also create social and emotional value during service engagements and somehow we need to learn to do this effectively with digital helpers, assistants, and advisors.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Leave a Reply