ARCHIVE FOR THE ‘parts-pricing-and-logistics’ CATEGORY

Jul 17, 2019 • Fleet Technology • News • fleet • lastmile • BT • Parts Pricing and Logistics

The first BT Field Engineering Forum, sponsored by Kuehne+Nagel and held at London's BT Tower on 17 June, covered a wide range of topics on how the sector can move forward.

The host, BBC newsreader Huw Edwards, brought together industry experts to discuss the rapid evolution of technology and how innovations such as self-driving cars, drones, blockchain – and even BT’s own Final Mile solution – can help organisations to improve performance and efficiency.

A key theme was customer service and how the supply chain is responding to a significant shift towards an environment where the customer is central. Keynote speaker and author Sean Culey explored the disruptive technological models that are driving this change, and what businesses must do to deliver the experience that customers now demand.

Throughout the day, speakers and panellists demonstrated the impact of change upon major market sectors such as retail, or specific organisations such as the NHS and the Ministry of Defence.

Crucially, each speaker had practical, proven solutions to these challenges, which they shared with over 100 delegates from across the UK supply chain.

Topics ranged from perceptive fulfilment – using data to pre-empt customer buying decisions – or the use of personalised procurement portals for faster, more efficient operations.

The event also gave BT the chance to demonstrate the power of its Final Mile solution for field engineers. Final Mile is a nationwide network of secure lockers and boxes, used as intermediary stock locations by organisations with large field engineering teams. By storing parts at strategic sites along engineers’ routes, businesses can reduce driving hours to serve customers faster, remove cost and minimise environmental impact.

Stephen Maddison, Managing Director of Final Mile, explained why the Field Engineering Forum was so important. “Not so long ago, organisations only reviewed their supply chain every three years or so," he said. Today, given the pace of change and the exciting new technologies available, businesses need to keep their finger on the pulse continuously.That’s why we created the Field Engineering Forum – a place where industry leaders can tackle these issues head-on, share best practice and forge new partnerships. The supply chain is the bloodstream of the economy, so it’s vital it’s in a healthy state. We’re delighted with the quality of debate and are looking to repeat this event next year.”

Jul 08, 2019 • Features • Parcel Holders • Parts Pricing and Logistics

Ed Fraser, Managing Director at Parcel Holders responds to a Field Service News article on spare parts being the "black sheep" of the sector and wonders what role the supply chain will play in parts logistics...

Ed Fraser, Managing Director at Parcel Holders responds to a Field Service News article on spare parts being the "black sheep" of the sector and wonders what role the supply chain will play in parts logistics...

Following on from Kris Oldland's informed piece about parts management labelled the ‘black sheep’ of the service industry, I’d like to reflect on this constantly shifting sector of the service industry, discuss what’s available (and most often used), and offer some solutions.

As MD of a company which was set up to solve problems associated with getting parts to engineers, I can sympathise with the issues faced by parts managers - there are just so many ways to manage parts, and to get them where they need to be. Maybe you’ve just got to grips with one method when your engineers or boss start suggesting something else entirely! We know it can take a while for us mere humans to catch up with today’s constant change in technological innovation.

Let’s face it, technology has made much of the world and how we interact with it, almost unrecognisable to that of 20, even ten years ago. Some of us even remember flicking on a light switch to activate the tungsten element in a spherical bulb! Halogen bulbs, mini fluorescent tubes, long-lasting energy efficient LEDs… now, if we have Alexa, we don’t even need to lift a finger to illuminate a room. The way we socialise, watch TV, drink coffee, light, heat and cool our spaces, and pay for it all, presents us with a vast arena of change and choice.

But is change just due to technological innovation? Well, I would argue it has just as much to do with development in laws surrounding regulation.

Remember those dirty words: CFC gases? Those ozone-depleting nasties? Well, happily of course, they’ve been replaced with more enviro-friendly refrigerant gas. Renewables: wood pellet heaters, solar-electric systems, ground source and air source heat pumps are increasing in popularity. Your client wants the latest ‘green’ thing, it makes them look and feel good. But are your engineers up to installing, maintaining and fixing it? That’s the real challenge, getting the parts to them to do these jobs shouldn’t be.

Now, if your answer to improving service is to increase van stock, then you may have missed the point slightly. Sure, if you’re completely virtually integrated and your engineers are employed to fix one specific brand of machine, then van stock may make a lot of sense. But, for companies looking to win new business where part of the deal is maintaining a portfolio of equipment from a broad and expanding range of manufacturers, then van stock can easily become obsolete. It’s a burden on your service rather than an asset.

It's worth asking whether metrics show if doubling the van stock you can confidently predict doubling first time fix rates. If the answer is no, then this would indicate increasing vanstock is putting your business on a path to Malthus’s l law of diminishing returns. And with continual change in the marketplace, this method of managing parts is only going to get harder and more costly. Nonetheless, common sense will tell us there are certain things that the field tech shouldn’t turn up to a job without. But the more we stock the more we are depending on knowing the future and the further we get from the ‘just in time’ work philosophy which is considered a large factor in the meteoric growth of Japan’s economy.

I would argue that the way forward is better phone diagnosis and a faster supply chain. Sourcing parts and negotiating terms with suppliers can be a profession in itself! But if you want to keep this in-house then perhaps parts managers should spend their time sourcing supplies that can meet your business demand rather than stocking up on ‘general’ components that are increasingly unlikely to be needed.

"I would argue that the way forward is better phone diagnosis and a faster supply chain..."

In light of this, many field service businesses are looking to pass back their stock of inventory to primary suppliers. But what they may not realise is that these suppliers are equally reticent to order smaller and smaller batches of parts they may never ship. As such, suppliers are increasingly drop-shipping parts direct, and in doing so, not just saving themselves the threat of investing in static inventory but also saving on the extra logistics of the part travelling to their warehouses, plus the time it takes to stock the inventory only to subsequently pick and package the part once again for re-shipment.

It looks like this trend inevitably leads to more and more complex supply chains that are increasingly hard to manage. All of which makes the ‘holy grail’ of first time fixes ever more elusive.

In addition, sourcing the right part is a very different ball game to getting it into the hands of the engineer that needs it. Most field service businesses make all their revenue charging for the parts and service their engineers provide to their clients. But I’d argue that product complexity and increases in regulation mean that the scope of equipment an engineer could have at one time ‘tried their hand at’, has become ever more restricted. This, together with the natural desire to win new business means engineers increasingly work over wider territories. If you’re going to have them return to base to collect parts then during that time on the road, their skills (which you’re paying for) are redundant as they assume the work of expensive same day couriers.

OK, so I’ve thrown out stocked vans and driving to base/depots. What now?

If parts managers want engineers generating income, then they don’t want them sitting at home waiting for parts to be delivered. Sending parts direct to clients sites? It works in some sectors, but the bigger the site, the more this tends to be fraught with problems as parts are mislaid and jobs are delayed, as recipients on front desks fail to report parts’ arrivals. (This method is impractical of course in the domestic market with homes empty during working hours.)

Logistics businesses have seized the opportunity to offer premium solutions for the field service sectors with in-night delivery, forward stocking locations and locker boxes. But, far from simplifying the delivery process, they invariably require the part to travel though their delivery network, protracting an ever lengthening supply chain.

So, what if the supply chain could be turned on its head? What if we take inventory management out of the equation altogether? This at least seems to be making life easier for parts managers. Some are now cutting out the parts journey from supplier to van / home / site / locker box. Instead they are sending parts direct from suppliers and their suppliers, straight to engineers using alternative methods like PUDOs (pick up, drop off points) which are ‘open all hours’ and in convenient locations, within a few miles of engineers’ homes.

Field Service business can rest assured, innovations and change isn’t restricted to physical products. It’s equally providing greater insight into the supply chain than ever previously achieved and minimising the path and time taken for engineers to receive the parts they need. But perhaps in the midst of technological advancement and future-gazing, we may just need the human touch more than ever.

Click here for more information about PUDOs.

Jun 28, 2019 • Features • bybox • Parts Pricing and Logistics

Claudine Mosseri, General Manager, ByBox reflects on research that they have recently conducted that shows that in the face of an engineering skills shortage, efficiency in the field service sector is more important than ever...

Claudine Mosseri, General Manager, ByBox reflects on research that they have recently conducted that shows that in the face of an engineering skills shortage, efficiency in the field service sector is more important than ever...

There is a serious shortage of skilled engineers in the UK, despite the government declaring last year to be the ‘Year of Engineering’ in a bid to recruit more engineers. However, the difference between supply and demand is worsening year-on-year.

According to one Government study, businesses would need to recruit around 186,000 skilled engineers by 2024 to bridge the gap. Between 20% - 30% of all UK engineers are employed in facilities management (FM), so this is particularly concerning for the sector.

With such a dramatic shortage, facilities management companies have to make sure the engineers they do have are making the best possible use of their time; working efficiently and effectively. But this is far from the truth.

ByBox’s research of the major FM service providers reveals that engineers spend more time sourcing parts from wholesalers; whether it be driving to, waiting in store or on site for deliveries than they do actually fixing plant.

In an industry facing a critical skills shortage, why are we allowing highly-skilled and paid engineers to spend more time shopping than fixing?

Our research shows that the distribution of spare parts to sites is seriously flawed, often relying on the engineer to pick up the spare from the wholesaler, on the way to site having understood the problem over the phone or through using remote monitoring equipment. Or the engineer may travel to site, diagnose the issue and then drive to the wholesalers.

This problem is increased by regular payment issues when the engineers get to a wholesaler. Sometimes the supplier has put the FM or M&E company on ‘stop’ – meaning that the engineer may have to visit several suppliers before they can purchase a part.

Or the FM company’s finance team won’t allow the engineer to purchase an expensive part because the client organisation is behind with their payments. The engineer is stuck between the client and their own employer’s procurement and finance team.

All of which is demotivating and frustrating for the engineer leading to potential recruitment and retention problems for the service provider in an industry already facing a skills shortage. And it can lead to maverick purchasing by engineers which causes the supply chain further issues.

"Our research shows that the distribution of spare parts to sites is seriously flawed..."

All of these issues led FM providers to give an average satisfaction rating for engineer productivity of 6.3/10, the lowest score in our research, indicating the depth of the problem. But there is a recognition in the FM sector that things need to change.

The FM firms ByBox spoke to for the report had five key recommendations:

• The centralisation of the procurement and distribution of M&E spares;

• Greater reliability and proactivity from the supply chain to be able to source parts from one location before the day starts;

• More standardisation of assets and parts within buildings including architects, specifiers and construction firms stopping installing systems manufactured / maintained by one-man bands where any spares come from a single source supplier;

• The ability to store more critical spares in a fixed location close to site;

• Better use of CAFM systems to manage inventory at site level, improving the use of data to better forecast break fixes / predictive-based maintenance.

Through this research we have found opportunities to streamline the procurement, forecasting and distribution of spares.

The industry needs to review its inefficiencies from standardisation to improved data analysis to ensure inventory is controlled, distribution spend is reduced and engineers are fixing more, not running around shopping for spares.

Click here for your free copy of the white paper visit.

Jun 24, 2019 • Features • bybox • Parts Pricing and Logistics

That’s the message from research conducted last month with the UK’s top FM service providers and consultants. Its findings can be found in a new white paper from ByBox ‘Is the management of spare parts the last hidden cost in the FM supply chain?’

There is no standardised way of getting spare parts to engineers and most FM firms use a variety of different distribution methods depending on the site, the spare, the location and the client. As a result, engineers spend more time looking for spare parts rather than fixing plant. More stock is usually ordered than needed and is often more costly due to purchasing models. The knock-on effect further reduces tight margins and customers’ SLAs are missed incurring penalties. But, many procurement departments within FM service providers often consider the problem too tough to tackle.

“We were surprised at how decentralised the FM industry is,” remarked Stuart Miller, co-founder and CEO, ByBox.“The commonality we found across the sector was the disruption caused by engineers purchasing their own stock. This behaviour - albeit born out of necessity – not only effects engineer efficiency but the entire supply chain, budgets and relationships with other departments such as procurement and finance. Better use of data and distribution methods, will improve SKU optimisation and engineer efficiency as well as streamline internal processes and reduce overheads.”

In its white paper, ByBox shares insights about the approach FM providers are taking to spare part management. The paper delves into some of the challenges involved and offers solutions to removing these hidden costs. These include:

- Centralising procurement and distribution methods of M&E spares;

- Greater reliability and proactivity from the supply chain to be able to source parts from one location before the day starts;

- More standardisation of assets and parts within buildings including architects, specifiers andconstruction firms; stopping the installation of systems manufactured / maintained by one-man bands where any spares come from a single source supplier;

- The ability to store more critical spares in a fixed location close to or on site;

- Better use of CAFM systems to manage inventory at site level, improving the use of data to better forecast break fixes / predictive-based maintenance.

The white paper can be found by clicking here:

Jun 06, 2019 • Features • 3D printing • future of field service • Parts Pricing and Logistics

How do you deliver the right part, at the right time and at the right price? If you work in supply chain management, then you’ve probably seen and wrestled with these questions. Historically, the spare part transaction was a simple one: a customer needed a component that had failed, they phoned up the company, ordered and paid for the part. Transaction complete.

However, the sector’s shift to a servitization model rather than the traditional transactional-based framework has seen many companies cut their losses and cannibilise their components to align with SLAs.

In the era of servitization, the cost associated with asset failure is having a substantial impact on balance sheets. Income from replacement part sales is now considerably less than the loss accrued from downtime. The priority now is to get an asset back running as quickly as possible and if parts are struck out in the process, then so be it; the numbers will eventually balance out.

It means that a cost-plus approach to spare-parts is losing validity.

The price of producing a part and adding the profit on top is being usurped by a more value-based approach - that is, a cost based on the ultimate value to the customer. Or as a firm enters another vertical – as is common in service – will they align with a different approach such as a market-based strategy?

In short, making money from selling parts is no longer the revenue stream it once was. As well as modifying itself to the shifting nature of the sector it serves, spare parts must contend with other factors that are disrupting the transactional sphere it has felt so comfortable operating in such as E-commerce and 3D Printing.

E-commerce, for example, works best in a market-based strategy. Here it can snuggle up to China, where parts are getting cheaper and the quality is getting better and provide credible components. Add to this the threat of online retailers such as Amazon entering the market and the future does look rather bleak. Meanwhile, looking hungrily into the arena, biding its time and waiting for the right moment, 3D printing could be the most disruptive threat to traditional supply chain management.

Also referred to as additive manufacturing, the ability to print components could quash the issue of time-affected delivery. Atanu Chaudhuri is Associate Professor of Operations and Supply Chain Management at Aalborg University and an expert in additive manufacturing and 3D Printing.

As a recent guest on The Field Service Podcast he told me that some industries have been quick to embrace the technology while others less so. “The forerunners of the adoption of these technologies have been the aerospace and automotive sectors,” he said. “However, there are a lot of other industrial manufacturers who are exploring this but are at different stages of adoption.”

Extolling its financial virtues, Chaudhuri affirmed why 3D printing is aligned with servitization and suggests those taking the long-view of the technology will see a positive return on investment. “If you take a more life cycle perspective,” he said, “and look beyond the cost on a part-to-part comparison or look at the usage of the part over a lifetime of the product, say 15 or twenty years, suddenly you will see a huge difference. You will not be having a lot of inventory, you reduce the inventory carrying costs and maybe the environment will benefit, you will use fewer materials and suddenly the business case looks much better.”

Another challenge the sector continues to face is counterfeit parts. Non-genuine components can compromise safety, the integrity of finished goods and bring reputational damage. It’s an issue that Chris Mitchell, Business Transformation Director at Software and Services company PTC, is all too aware of. He references outcome-based models as a contributing factor to the problem as firms try to gain an advantage in the market. “With industries becoming more service-orientated and more competitive, this issue of counterfeit parts from China, Turkey and other parts of the world creeps up more and more,” he says.

"Making money from selling parts is no longer the revenue stream it once was..."

OEMs spend heavily on research ensuring the quality of their parts, utilising specialist software to engineered products in the best possible way, making the components safe and durable. It’s the finances associated with asset upkeep that forces some firms to opt for a damaging short-cut. “When looking at the cost of individual repair or maintenance event, cost pressures and short-sightedness often lead to the wrong buying decision whereby the cheap counterfeit part is used,” Mitchell explains.

Storage and warehouse logistics remain a puzzle for firms. It’s commonplace to have one centralised hub where all stock is housed making it simpler for inventory management; while a collection of smaller, local warehouses allow for greater flexibility in regards to geographical logistics but requires careful management. Taking advantage of the malaise, initiatives around smart-IoT connected storage boxes, such as those offered by BT and ByBox are proving solutions to the logistics issue.

Strategically placed parts can be collected by engineers who through cloud-based software, can check where the nearest part to them might be. The very nature of field service is also having an affect on how firms place themselves in the sector. By this, I refer to the many verticals that service operates in. It means requirements round spare parts can differ from the medical sector, for example, which will have different behaviours and expectations than, say, the oil and gas market.

This has led to companies segmenting logistics depending on their customer silos. To elaborate, one industry may require a very rapid solution, so expectations will centre on availability and quick delivery meaning the provider’s logistic channel needs to be flexible enough to meet these expectations. Conversely, another industry could be more demanding of uptime and be more price sensitive when purchasing components. Unfortunately, there remains another factor that now firms can do very little about.

At the time of writing uncertainty with Brexit continues and urgent questions round its effect on the global supply chain remain unanswered. While the knock-on effect of political decisions remains out of our hands for now, perhaps it’s time to ask a question that we may have more control over. Will the transactional model disappear completely?

Going forward, I think there will be a place for all approaches and here the diversity of markets could be an advantage. There will always be customers who want to deal on a transactional basis. SKF and GE Healthcare for example, still have long-term contracts with clients who prefer to deal in this way. These are large multi-national corporations and their continued loyalty to traditional frameworks should offer encouragement to other firms.

Spare parts and supply chain management is broad enough to accommodate and embrace change, be it new technology, political uncertainty and a shift in customer buying habits. One far-reaching question however will always remain: How do you deliver the right part, at the right time and at the right price? Amidst the changing sands of supply chain management, it’s something we should continue to ask and also take comfort from.

Jun 04, 2019 • Features • 3D printing • manufacturing • Additive Manufacturing • Parts Pricing and Logistics

An industrial products manufacturer has a large portfolio of spare parts in its portfolio. It has 10 year service contract with its customers implying that the company must be able to deliver spare parts on time for 10 years to its customers even though the product may longer be produced. Thus, the company has to maintain inventory of some of those spare parts. Such inventory costs run into millions of dollars. Many of those spare parts are produced by suppliers. Demand for those spare parts are low and unpredictable.

On Monday morning, the spare parts manager received a call from a customer in another continent “ Mr. Paul, our equipment is out of action as it cannot be started in the morning shift. My maintenance guys confirmed we need to replace a part, supplied by you and we do not have it in inventory. I am sending you the part number. Please deliver it within three days otherwise there will be heavy loss.” Mr. Paul checked the part number in the ERP and found that they also do not have in stock.

He found out who the supplier is and called him up. The supplier replied saying that they cannot make only one piece. They will need an order size of at least 20 and it will take 1 week. What will Mr. Paul do? He remembered that the Vice President (VP) of Supply Chain was talking about 3D Printing of spare parts in the last meeting. Can the part be printed? How will Mr. Paul figure that out?

He refers to the presentation by VP- Supply Chain and finds the name of a company called 3D Hubs (UPDATE: 3D Hubs is now Hubs). Mr. Paul checks out the website of 3D Hubs and found that he can upload the drawing of the parts and get an analysis for printability along with a quote. He uploaded the drawing, got the quote for delivery within three days and went to his boss.

His boss, Mr. James said “Are you crazy? How will I be able to justify that price? Also, have you noticed that they are not printing our part using our specified material? This will never work.” Mr. Paul tried to argue “This is a very strategic customer for us. If they are not satisfied and cancel the service contract, it will be a big trouble for us. We can say that they can run their equipment with it until an actual replacement spare part is produced and delivered by the supplier. I can talk to R&D about the approval for the deviation in material. It doesn’t seem to be a big change.” Mr. James said “You are taking a big risk, Paul. If you want to try, go ahead.”

In the end, everything turned out well. That part was produced using additive manufacturing (AM) and delivered on time. Paul received appreciation for his efforts. VP- Supply Chain was very happy and said to Paul. “Now, I want to evaluate our entire spare part portfolio and develop a systematic process of evaluating which of those parts can be printed and which cannot. It will be great if you can evaluate our portfolio and present in our next month’s meeting.”

Paul has 10 years of experience in spare parts but he does not know much about 3D Printing. How can we help Paul? I am sure that there are many people like Paul in large industrial manufacturers, who need similar help. Lets try to outline a steps-by-step process for selecting spare parts suitable for additive manufacturing.

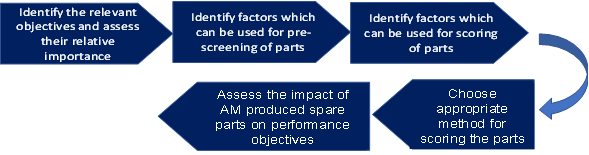

Step 1: Identify the objectives

Some potential objectives for producing spare parts using AM can be:

• Supply risk reduction;

• Lead time reduction;

• Inventory cost reduction;

• Ensuring local content;

• Minimizing loss of production;

• Reducing carbon foot print across life cycle.

Companies can decide the most relevant ones from those and provide relative importance of those using a method called analytic hierarchy process. Instead of directly assigning importance weights to each objective, experts within the company can make pairwise comparison of the objectives using a scale (for example 1-3-5-7-9) and derive the importance weights.

Step 2: Identify the factors to be used for screening the spare parts for AM suitability

Some factors, which can be used for screening the spare parts for AM suitability can be as follows: It is important to note that the company should have data on the following factors to be considered for screening.

If such data is not available or available in different IT systems or in physical form ( i.e. drawings with dimensions and material specifications), it will be difficult to include those at the screening stage.

1)Demand and demand uncertainty of the parts

Parts with low and uncertain demand are more suitable for spare parts

2) Overall part size

(Part must fit build volume of the equipment) As the equipment for different AM technologies have build size restrictions, part-size is usually a restriction, if it cannot be fitted in the build chamber. Sometimes changing the orientation of the part may be needed to fit it into the build chamber, but it might require additional support structures and may increase the overall production time. Decisions about part orientation in the build chamber can be taken only for the selected parts and not at this stage. The company can specify the upper limit of size or a range of sizes of parts, which they would like to consider

3) Materials

Not every material can be printed. Thus, parts whose specified materials can be printed can be screened when a company is starting on its journey of producing spare parts using AM. Later, alternate materials which closely match the specifications can be explored.

4) Supply lead time

Parts with long supplier lead time for conventional manufacturing can be more suitable for producing using AM as overall lead time can be reduced. A company may decide to specify either the lower limit or range of lead time, which they would like to consider.

5) Purchase price or unit cost

High priced parts, in general, can be suitable for AM but some high valued parts may be infeasible because of their size or materials etc.

6) Value of inventory across all locations

Usually parts with high inventory value can be good candidates to be produced using AM. High value of inventory can be due to high number of parts in stock or due to high prices. Sometimes, if a lot of stock is available, a company may decide not to proceed with producing such a part using AM. Some other company may decide that they would like to get rid of that stock and hence it may be worth producing those using AM. A company may also decide to include either price or inventory value as a screening factor.

Figure 1: Step-by-step approach for selecting spare parts suitable for AM

Step 3: Identify the factors to be used for scoring the spare parts for AM suitability

Some potential factors for scoring spare parts in terms of their suitability for AM can be as follows:

• Lead-time;

• Unit cost;

• Criticality in terms of influence of the part for equipment shutdown;

• Demand predictability measured as standard deviation of demand;

• Supply risk in terms of number of suppliers;

• Minimum order quantity.

The screened parts can be scored based on the above factors and how the factors are related to the objectives. Parts with long lead time, high cost, high criticality, low demand predictability, high supply risk and high minimum order quantity in the existing manufacturing process will be more suitable for AM.

Step 4: Choose appropriate method for scoring the parts

There can be multiple approaches to score the spare parts in terms of suitability to be produced using AM.

We mention some basic guidelines below:

1. Multi-criteria decision making approach (MCDM) –scoring parts on factors and linking factors to be objectives (suitable for less number of factors and less number of parts).

2. Logic decision diagrams, cluster analysis and fuzzy inference system (suitable for large number of parts, medium number of factors but strong interrelationships of factors and objectives). If the factors are dependent on each other and how they influence the objectives depends on the levels of the factors i.e. low, medium and high, logic decision diagrams can be built to score a part using different decision rules. In terms of disagreement between experts about the relationships, the relationships can be expressed as fuzzy numbers and fuzzy inference system can be used to score the parts.

3. Cluster analysis and MCDM approach for ranking of part clusters and within cluster ranking of parts (large number of diverse parts, limited to medium number of factors and independence of factors) If the factors considered are independent but the spare parts portfolio is very diverse, it will be necessary to cluster the parts, rank the clusters and then rank the parts within the clusters.

4. Bottom-up expert driven selection using a questionnaire or selection protocol (no data available or not possible to do quantitative analysis) If no data is available in digital form to score the parts, it is prudent to use the expert judgment of the service personnel or maintenance technicians. But, as those persons may not be aware of AM technologies, it is important to demonstrate to them what is possible using AM through workshops and ask them to suggest spare parts, which they find most difficult to get. Companies can also potentially run internal competitions to identify some spare parts to start with.

Step 5: Assess the impact of AM produced spare parts on performance objectives

Once some spare parts are identified, the next step is to develop business cases for the parts. But, those can be done once the appropriate technologies and equipments are identified. For that purpose, a database of all available AM equipments, the technologies they use, the materials they use, the build chamber of the equipments, the surface finish achievable need to be documented.

For the spare parts which are scored high in terms of their suitability for AM, the most appropriate technologies and equipments can also be shortlisted. Then total-cost of ownership based cost models need to be developed to understand the economic implication of producing the parts using AM. The relevant cists which need to be considered are materials, production, energy, labour as well as the savings in inventory and transportation costs over the lifecycle of usage of the parts for different demand scenarios.

Quotes from different service providers can also be used as a reference for taking the final decision. Once a company has done this exercise and identified a few feasible parts, some machine learning techniques can be used to identify the patterns amongst the most suitable parts so that the process can be automated when new parts are added to the portfolio.

May 29, 2019 • Features • copperberg • future of field service • Field Service Summit • Parts Pricing and Logistics

Would you walk into a pub that served you a warm beer the previous time? Or, go back to this fine dining restaurant with your partner if it was noisy and unclean? One word that can make or break it for the service business is ‘Experience’.

With customer satisfaction being the buzz word in the past years, now the new trending words are ‘Experience Economy’, ‘Customer Delight’, and ‘Good-feel Service’. The trend is very common in the B2C sector which has led to terms like ‘Uberized Service’, ‘Amazon like Delivery’ or ‘Disney like Experience’.

This wave of keeping customers happy and providing them with a great experience has to become a priority on the list of the majority of Field Service Directors today. With the quest to create the perfect value proposition and customer experience comes in the various challenges that these leaders in manufacturing face today.

Recently, I had a fantastic opportunity to moderate a round-table discussion along with Kris Oldland, Editor of Field Service News about the Challenges that Service Leaders Face today and the future technologies in Field Service and Spare Parts at the Spare Parts Summit Summit in Coventry, UK.

One important observation was the interlinking of issues with spare parts and field service. The service leaders faced challenges in obsolesce management, spare parts management, data collection, utilisation and analysis along with field workforce training and planning.

With the advent of digital tools, faster production and time to market, one big challenge for Service Leaders today is obsolescence management as it has become increasingly challenging to predict and prepare for the future. IoT and connected machines have made predictive maintenance easier and helped the service organisations to move into the proactive space than the reactive space. One challenge still remains with break-fix due to user mismanagement, negligence or insufficient training.

Although IoT allows companies to note some cases of misuse and offer training proactively preventing damage to the machines and need for servicing prematurely. The service leaders have accepted that there will always be break-fix with machines whether it is due to an unforeseen circumstance or a user issue. So the goal in these instances is to have enough data to be able to get a technician with the right spare parts to the location and get it fixed immediately.

"One important observation was the interlinking of issues with spare parts and field service..."

This is a shift from the older model of a technician visiting to collect information, making a fault report to get the spare parts and revisiting the customer to fix the issue which is a higher cost for the service company and loss in uptime for the customers. Tracking of spare parts and more specifically ‘Having the rights parts at the right place’ is also an issue being tackled currently by the service leaders.

Some leaders are concerned about the tracking of spare parts as they become ‘lost’ with technicians, in spare part boxes or in inventories. Technologies like RFID readers, GPS tags could play a big role in actively tracking the spare parts to make sure the parts can be delivered to the right place when required.

The manufacturing, service and aftermarket space today is in a fantastic rush for data and today is commonly referred to as the new gold or oil. Kris Oldland had an interesting take on how this gold can be dug out but will still be useless unless refined and put it in the right form. One challenge with data is also getting data from the right source.

Similar to ores to extract gold, if the content of the ore is bad, the gold will be very expensive to extract and the return on investment will be low or negative. Data has a similar proposition today. Companies have started asking, how much data is enough data and which data is good data. With better data processing, artificial intelligence and machine learning making progress, the data analysis and processing woes should be answered more effectively in the near future.

The challenges cannot be addressed with a magic wand or just ignored, but being able to address them is a progressive first step. Collaboration with the customers and getting them involved in the whole process of solving the challenges can also boost progress for the service organisations.

To sum it up according to a Forbes quote,’An experience is not an amorphous construct, it is as real an offering as any service, good or commodity.’

May 21, 2019 • News • Warehousing • Blockchain • Parts Pricing and Logistics

With this addition to its blockchain-based platform, Serve have created a new paradigm in smart logistics and complete customer satisfaction. Reducing the distance between the warehouse and end-user improves the order fulfillment experience for all participants by shortening delivery times and reducing costs. Businesses can now expand their footprint without the added infrastructure. Integrating this technology into Serve’s award-winning platform furthers its goal of becoming a global engine for commerce and last-mile logistics.

"Our mobile warehousing system distinguishes Serve in the modern, on-demand delivery and logistics industries,” says Serve’s CEO Shahan Ohanessian. “With the increased efficiency and optimization this brings to our delivery processes, businesses will be able to provide big-box capabilities and order fulfillment services to customers everywhere.”

May 14, 2019 • Features • Parts Pricing and Logistics

OK, so when it comes to your Field Service Technicians, you’ve reduced their time on the road between jobs, helped them to grow into a role of true trusted advisors and empowered them with access to all the knowledge they could need at the tap of a screen.

In fact, your already exploring how augmented reality could help you bridge the gap between experience and demand as well. Yet, a seemingly perennial problem still haunts you and your KPIs.

A problem that frustrates your customers, your technicians and you as a manager. You know where I’m going here right? The technician is on time, highly knowledgeable and determined to help, but it all falls down when he realizes he isn’t stocked with the part he needs to complete the job.

So the front line of your business, the key brand ambassadors within your company are all too often left sinking in unsatisfactory excuses as disgruntled customers lose faith in your ability to deliver on the service you promised when they signed up.

Suddenly all of that value you’d created through field service management technology investments and extensive training processes is being lost due to insufficient part availability. It’s an all too familiar challenge and one that can seriously damage a companies reputation in the short-term and it’s revenues in the long-term.

But the good news is that resolving these types of customer issues and experiences is perfectly feasible. In fact, technologies exist for this very purpose – service parts management and scheduling solutions interacting together to ensure that when your technician arrives to the right place at the right time, they have the right part to keep your customers happy and encourage repeat business.

Solutions specifically built for the service business, with all of its challenges around low-volume, ‘justin- case,’ intermittent availability, rather than for high volume, predictable, ‘just-in-time’ throughput. Service part inventory networks are complex – a part may go through central warehouses, distribution centers, regional stocking locations and secure local collection boxes along its journey to a technician’s vehicle.

Oftentimes, technicians will end up being over-stocked, causing unnecessary restocking at the warehouse. Standard parts inventory solutions are simply not designed to handle such complexity and in an area that can have such a dramatic impact on the success of your service operation, it is prudent to opt for a solution designed to be fit for purpose. In addition to this, many organizations have followed a trend initially driven by brick-and-mortar retailers, who took the brunt of the shift we’ve made as a society at large towards online shopping, which is to provide spare part stocking locations to bridge the physical gap between technicians and end customers.

In one study, The Service Council identified that over half of all service attempts fail because of not having the right part, and even when the right part is available companies are not maximizing the revenue correctly because they are not pricing correctly due to a fundamental lack of visibility into their inventory across the whole service supply chain.

"Technicians will end up being over-stocked, causing unnecessary restocking at the warehouse..."

But remember, the greater the complexity, the greater the potential for improvements in efficiency. This is particularly true of the highly complex nature of the service part supply chain. Once routing and scheduling have been optimized, further benefits can only come from other processes within the service ecosystem, and service part inventory management, with its potential to reduce costs across multiple echelons within the supply chain, can deliver quick gains. The fundamental question is ‘Why should you accept failure in your service supply chain?’. Or perhaps more crucially, ‘How much longer can you continue to do so?’

But remember, the greater the complexity, the greater the potential for improvements in efficiency. This is particularly true of the highly complex nature of the service part supply chain. Once routing and scheduling have been optimized, further benefits can only come from other processes within the service ecosystem, and service part inventory management, with its potential to reduce costs across multiple echelons within the supply chain, can deliver quick gains.

The fundamental question is ‘Why should you accept failure in your service supply chain?’. Or perhaps more crucially, ‘How much longer can you continue to do so?’ Oftentimes however, the current systems in place across the after sales service supply chain are not fit for purpose. If this is an accurate description of your own organization, I turn and say that the time for change is upon us all to make this a key area of focus within our sector. There will of course be resistance from those who believe the traditionalist approach works, those who see good enough as acceptable. If it ain’t broke, why fix it, right? But accepting mediocre service standards, is rapidly becoming a fading standard of the previous century.

Mediocre in today’s world of increasing customer expectations is, frankly, failure. And of course, failure within business is ultimately intolerable and should not be accepted by neither business leaders or their customers - and increasingly it isn’t. Indeed, there finally seems to have been a quite perceptible shift in the number of companies beginning to pay attention to the importance of good parts and inventory management.

Manufacturers around the world are waking up to the fact that the market has changed - from the volatility in the orders of durable goods, to millennials taking over the workforce, to the movement of ‘power by the hour’, there is great opportunity to be had and many organizations have identified that, in the area of parts and inventory management, there is actually a huge amount of low-hanging fruit that can see some big wins, delivered fairly quickly and painlessly.

This is changing the way businesses approach the value of parts and indeed service. It is one heck of an exciting time to be in the field service business because all of these economic, social and political changes are driving the attention onto the new era of service-centric business which has emerged across the last decade, as we embrace the emergence of the various new technologies pushing us forwards.

We are seeing futuristic concepts such as Drones, 3D Printing, Augmented Reality and Autonomous Vehicles enter the wold of field service. And whilst each of these have admittedly been on the horizon for what seems like a very, very long time as we talk of their potential and the promise of industry revolution, the fact is that these technologies are all now beginning to come to some form of maturation.

For while, talk of revolution and rapid change may sell products, conference tickets and dare I say it, even magazines - the truth is that in the world of business at least, real meaningful change always comes across a long period of smaller, incremental iterations. The fact is now that we are approaching the point where various technological, administrative and logistical kinks have been worked through and ironed out in small test cases and viability studies and most of the technologies I’ve listed are sufficiently robust that they are becoming established conversations in the mainstream of our industry.

However, the changes we are seeing in our sector are not just driven by technology alone. Sweeping demographic change within the workforce, accelerated by the aging workforce crisis being faced by companies across the globe and being exacerbated by the unprecedented differences between the incoming Millennial generation and the outgoing Baby Boomers, is of course another factor driving industry evolution forwards.

These changes are leading us into a world where we are making a shift to a much more service and outcome orientated society as a whole - something I would suggest is the result of this generational shift in tandem with the technical advances referenced above and is at the heart of why we are seeing companies turn their entire business models on their head in favor of a more customer-centric, service focused revenue models.

Servitization has gone from fringe concept to buzzword across the last few years as talk of ever decreasing SLAs and increasing First-Time- Fix rates has morphed into discussions around guarantees of uptime and the financial impact of unplanned downtime. At such a point of great industry evolution, it is essential we have our core foundations that we are to build service excellence upon, firmly in place. As an industry we seem to have our heads firmly in place when it comes to the old mantra of the getting the ‘right engineer, to the right place, at the right time.’

But without being able to get the right parts there as well it all becomes something of a moot point. Quite simply if field service organizations are going to be able to embrace the brave new world of servitization and preventative maintenance, then parts management needs to be given the same emphasis as mobile workforce management. Once we have that sorted then in terms of pushing service to the fore of industry, it’s game on.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Leave a Reply