As a keen follower of football (soccer), I liken last-mile to the striker in a football team.

The striker takes the glory, prodding home a goal when the build-up work has often been created by his team mates, who I liken to the rest of the supply chain.

As a fan, seeing a goal preceded by a complex ten person passing move, with each player contributing is a wonderful site. Yet, without the striker finishing off the move, then all the work beforehand is irrelevant.

It’s the same for last mile service delivery: admittedly there might not be a roar from a passionate 20,000 partisan crowd as afield engineer arrives on time with the parts needed to finish complete the repair, but for manufacturers, a client signing off a service call and thus completing the service-cycle is the culmination of a fantastic all round team effort.

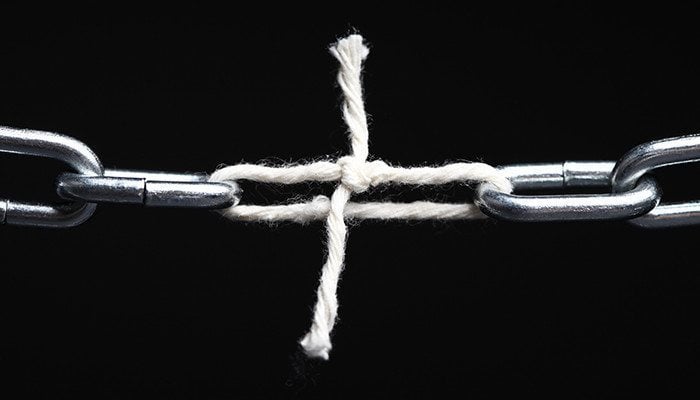

However, with an array of factors now impeding on the last mile journey - factors which are both physical and financial - firms are having to work extremely hard to ensure they continue to score goals.

Traditional Supply Chain

In 2019, the traditional spare parts supply chain is now being heavily influenced by e-commerce. For it to run efficiently it requires a level of optimisation that can handle today’s increased customer demand and expectation. To keep up, companies must turn around processes in minutes rather than hours. But what are the statistics showing expectations around delivery and how much of the world is utilising e-commerce?

Research by Shopify Plus, an enterprise e-commerce platform suggests the market is estimated at $3.3 billion and that the market will grow to $4.5 billion in 2021.

A 2017 study from Nasdaq on e-commerce and online shopping showed that around 22% of the world’s population purchases online, and that by 2040, e-commerce will account for 95% of all purchases.

The Amazon and Uber Effect

Driven by the Amazon next-day business model, along with the Uberization of service, customer standards are rising at an extraordinary rate; with customers even willing to pay to get their orders within 48 hours. It affirms the need for an efficient last mile delivery strategy to the traditional spare parts business that is the lifeblood of many aftermarket P&Ls. It is also adds additional pressure of enhanced expectations to the already challenging task of managing a field service operations with multiple moving parts

"The hard work may have been done in the production lines and warehouses, and customer contact centres, but the client cares little for the complex delivery mechanisms and logistical processes that have gone before..."

Yet it’s the final leg of the customer journey that often can get overlooked in terms of optimisation; with firms assuming that once a part leaves the carrier facility to the requested destination the cycle is complete. It’s at this point in the cycle where firms are most vulnerable to negative customer feedback.

The hard work may have been done in the production lines and warehouses, and customer contact centres, but the client cares little for the complex delivery mechanisms and logistical processes that have gone before.

All they want is to get their assets back up and running; a delay here – even by a small-time margin – will influence their experience and feedback.

Last mile Challenges

Fulfilling the last mile can present a number of challenges, such as delivery routes that are inefficient owing to traffic build-up and end-users providing incorrect data and delivery information.

The number of failed service calls that are a result of an engineer not being able to access the customer site, is still alarmingly high for many companies.

Perhaps more importantly there is a financial impact. A report by Capgemini, released in January, found last-mile delivery accounts for 41 per cent of total supply chain costs. Furthermore, when customers do commit to a same day delivery slot, a large part of the shipping fee is quickly swallowed up as firms utilise extra fuel and transport logistics to complete that request, which could just be one or two small items. Such costs are naturally transmitted to the service organisation.

To negate these issues, technology companies are identifying the need for specific last-mile solutions and are coming up with tools to assist firms, such as specific location-based solutions - with the final leg of their journeys. Speaking to Field Service News’ Editor-in-Chief Kris Oldland recently, Tim Andrew, CEO of tech outfit Localz, explained why their technology can slot into a firm’s service programme. “We’re not here to change the world for field service companies. We are not going to make you change everything you already have,” he said.

“We are here to help you quickly get big cost savings and massively improve your customer experience by simply plugging in our location-based day of service software.”

Localz boast an impressive roster of clients including DPD, Belron and British Gas but he remains clear as to what the modern customer now wants. “Customers’ don’t want to hear about a solution that is the centre of their operation; they have already invested significantly in many solutions and established efficient processes that broadly work well. Now they want to improve; they want to see how we add value to what they’ve already invested in,” he affirmed in the same interview.

The Rise of the Smart Lockers

The biggest challenge firms face in last-mile is the sheer weight of traffic on roads. This is amplified in busy built-up areas, where a recent survey by Renault found that last-mile deliveries account for around a third of all urban traffic.

"With roads expected to get busier over the coming years, and in order to keep-up with customer demand, companies will have to have to think creatively..."

With roads expected to get busier over the coming years, and in order to keep-up with customer demand, companies will have to have to think creatively on how to stay ahead of the traffic; which may not involve staying on the road.

Smart lockers enable deliveries to be consolidated at one alternate location potentially increasing first-time fix rates. Of course, not all customers will live in close proximity to a cluster of these lockers and some may not even be accessible 24 hours a day, but the technology certainly offers a viable alternative to the use of larger depots.

The Future of Service Delivery?

While Amazon continue to flirt with their drone delivery service and FedEx experiment with delivery robots, the future of last mile parts management suggests delivery via the road network may soon be moving away from the old-fashioned approaches to the service supply chain.

Conversations that I’m having with industry suggests companies’ R&D departments are already working on disruptive technologies such as the aforementioned drones as part of their long-term last mile strategy. What is certain is that what’s being offered now will not be acceptable in one or two years’ time. The impact in society of Uber and Amazon means customer expectations will continue to rise.

The last mile, as the face of service will be at the fore front of this evolution. The final stage of delivery is also the final customer touch point and it’s at this moment that firms must ensure faultless service.

It pays to have an exceptional striker who can delivery in front of goal. Keeping your last-mile forward fit, optimised and open to new ways of playing will make all the hard work that has gone on before hand worth while.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Leave a Reply