For most regional, national or global field service organisations, dealing with local regulatory compliance is simply just another part of doing business. However, when the traditional workforce models are increasingly being replaced by newer alternatives, sometimes the opportunities are presented before the regulatory obstacles are clearly defined.

Such is the case with respect to the use of freelance workers to augment the organisation’s existing mobile workforce. The use of freelance field service technicians is something that has been used to an increasing extent, by field service organisations that need to expand their existing workforce to accommodate seasonable peaks, or to address weather-related events, natural disasters, etc. – or simply to “smooth out” cyclical peaks and valleys impacting their normal routines.

The introduction of cyber-companies like Uber, Lyft and DoorDash, et al, has also contributed to the “muddied” definitions that separate full-time workers (i.e., in the United States, known as company, or W-2, employees) and contractors (i.e., 1099 employees, in the States). There are currently arguments on both sides of the issue, with the U.S. Internal Revenue Service (IRS) stating that private taxi service drivers (e.g., Uber, Lyft, others) and food delivery service workers (e.g., DoorDash, and many others) are actually “employees” of these named companies, and so on.

In fact, some States have already enacted their respective regulations concerning this growing trend of contract workers (e.g., California), with others beginning to follow their lead (e.g., New York State). For example, on 30 August, 2019, the California Senate Appropriations Committee cleared Assembly Bill 5, moving it a crucial step closer to becoming state law. Less than three weeks later, on September 18, 2019, the bill (commonly referred to as AB-5, or the Bill) passed a full Senate vote and was signed into law by Governor Gavin Newsom.

While the Bill was scheduled to become effective on 1 January, 2020, it will ultimately be enforced retroactively to the date of its original signing into law. However, there are bound to be some delays as it will likely be contested in court, primarily by those enterprises that would be most impacted, such as Uber, Lyft and DoorDash, among others in the transportation services and food delivery segments.

The bad news is that, probably at some point in the future, your local County, State/Province or country may also institute – or attempt to institute – similar legislation as was just passed in California; however, the good news is that any such regulation will most likely apply more directly to the aforementioned taxi and food delivery services than to the field service industry.

Let me explain what you need to know!

The California Bill, which we can assume will set the standard for subsequent geographic bills, is based on the findings of the California Supreme Court in its 2018 Dynamex decision to determine whether a worker is an employee, which generally makes it harder to qualify workers as Independent Contractors (i.e., ICs). According to the court’s findings, workers would thus be considered an employee by default, unless the hiring entity can demonstrate that:

- The individual is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact

- The individual performs work that is outside the usual course of the hiring entity’s business

- The individual is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed

However, field service organizations are likely to avoid the full brunt of the impact of the California Bill – or other bills like it – as “Classification as an employee is viewed as beneficial to workers, who receive various workplace protections not afforded to independent contractors, such as workers’ compensation, unemployment and disability insurance, paid sick days and family leave. Wages are also subject to withholding and various employment taxes.”

The truth is that, by and large, ICs do not receive these stated benefits or perks and, are therefore not subject to reclassification as full-time, or company, workers.

According to Jens Audenaert, General Manager, WorkMarket an ADP Company, “The passing of AB-5 does not mean that companies can no longer use freelance labor. We continue to see organizations of all sizes increase their use of freelance labor as they adapt to the evolving workforce. What laws like AB5 do mean, is that companies will need to be more thoughtful and deliberate around their processes as they engage with independent contractors, so the organization understands who it’s engaging with, and how. A Freelance Management System is a technology-based approach that is designed to keep organizations safe with respect to compliance, by providing a comprehensive automated platform and audit trail.”

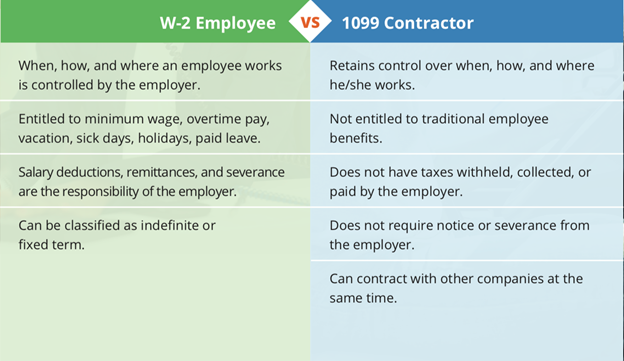

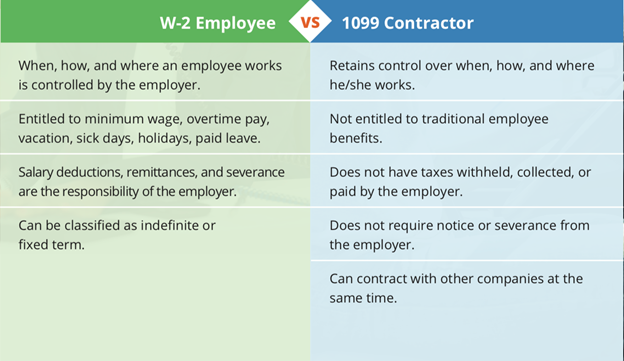

WorkMarket summarizes the following principal characteristics that ultimately distinguish Company (i.e., W-2) employees from freelance (i.e., 1099) ICs as:

Further, Best Practices guidelines targeted specifically to the Field Service Freelance Labor market focus on the following three areas:

Audit

- Terminate inactive contractor relationships within your reporting systems

- Conduct a systematic review in light of new Department of Labor (DOL) standards

Revise and Update

- For relationships that will continue, revise and update the existing agreement’s language

- Modify actual practices, if necessary, to comply with new DOL standards

Governance and Training

- Establish a formal and centralised approval, governance, and monitoring process

- Implement a regular training schedule for those involved in the approval/use of contractors

- Continue to publicize and strictly apply these processes

In summary, the best way to prepare your organization for any of the potential ramifications of regulatory compliance, whether directly associated with California AB-5, or just in general, the two key assets that you will have at your disposal (i.e., through the use of a Freelance Management System (FMS) solution such as that offered by WorkMarket), is:

- The complete automation of all of your Contractor Management activities, and

- A comprehensive Audit Trail that can provide you with all of the supportive data and information you will need should you be faced with a regulatory audit.

To read more on this topic, you can read the following Blog from WorkMarket:

11 Consequences of Misclassifying Your 1099 (i.e., Independent) Contractors.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Field Service News is published by 1927 Media Ltd, an independent publisher whose sole focus is on the field service sector. As such our entire resources are focused on helping drive the field service sector forwards and aiming to best serve our industry through honest, incisive and innovative media coverage of the global field service sector.

Leave a Reply